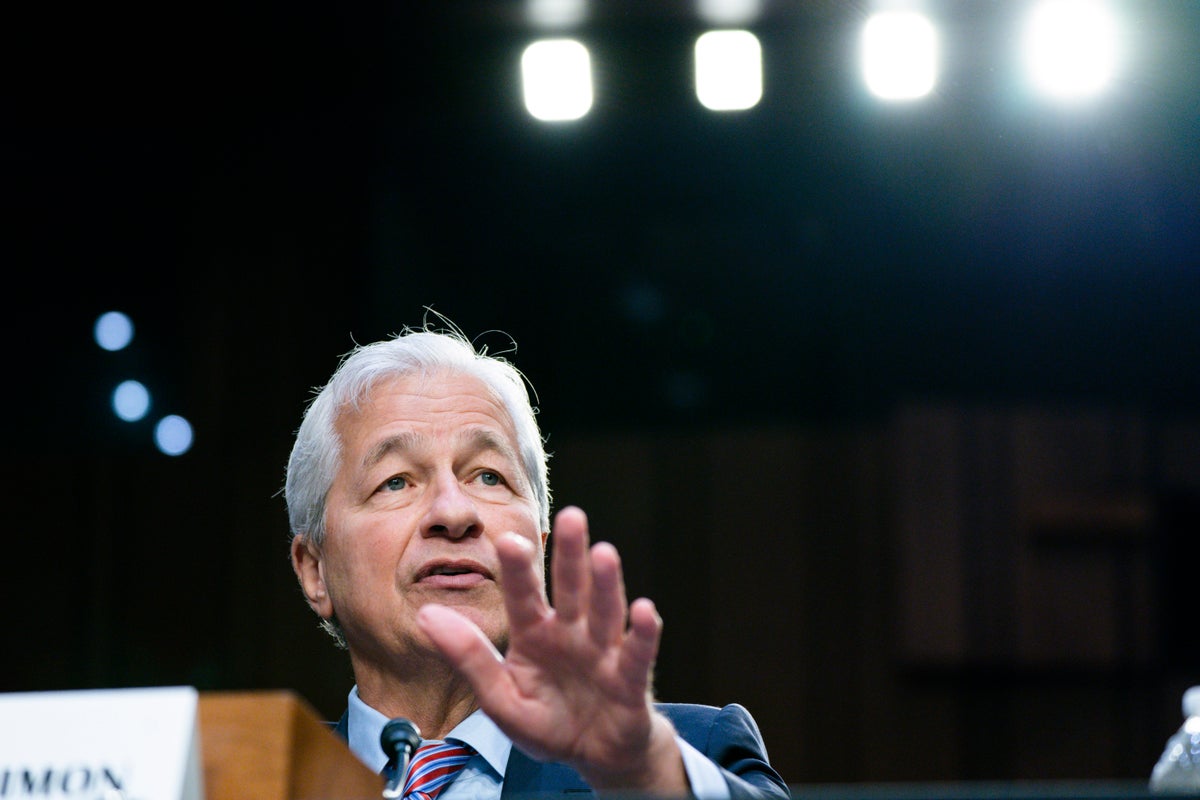

JPMorgan Chase's third quarter profit soared 35% from last year, fueled by a rapid rise in interest rates, but the bank's CEO, Jamie Dimon, issued a sobering statement about the current state of world affairs and economic instability.

“This may be the most dangerous time the world has seen in decades,” Dimon wrote in the bank's earnings statement.

Dimon laid out a laundry list of major issues: the Russia-Ukraine War, the new war between Israel and the Palestinians in Gaza, high levels of government debt and deficits, high inflation, as well as the tight labor market, where worker demands for increased wages has led to high-profile strikes in manufacturing and entertainment.

“While we hope for the best, we prepare (JPMorgan) for a broad range of outcomes so we can consistently deliver for clients no matter the environment,” he said.

Dimon often weighs in on global and economic issues that go beyond the scope of banking. He's often seen as the banker that Washington and global leaders can turn to for advice, solicited or unsolicited. His comments are likely to reverberate through Washington and Corporate America.

The earnings report showed that JPMorgan is doing extremely well despite the geopolitical and economic uncertainties.

The bank reported a profit of $13.15 billion, up from $9.74 billion in the same period a year earlier. On a per-share basis, profit rose to $4.33 a share from $3.12 a share a year earlier. The result beat analysts' forecasts, which called for a profit of $3.95 a share, according to FactSet.

Total revenues were $39.87 billion, up from $32.7 billion a year ago. That was largely driven by higher interest rates, which has allowed JPMorgan to charge customers significantly higher amounts of interest on loans compared to a year ago.