The U.S. economy added fewer-than-expected new jobs last month, data indicated Friday. with softer wage gains underscoring concerns that the Federal Reserve's reluctance to lower interest rates is choking off growth prospects.

The Bureau of Labor Statistics said Friday that a net 114,000 new jobs were created in July, below the downwardly revised total of 179,000 recorded in June and well south of this year's monthly average of around 222,000.

Economists were looking for a headline total of around 175,000 new hires in the July report with a headline unemployment rate of 4.1%.

Average hourly earnings rose 0.2% from June levels, a tally just inside Wall Street forecasts, and were up 3.6% on an annual basis, the slowest pace of growth since May 2021.

The headline unemployment rate edged higher to 4.3%, the highest since October 2021, while the labor force participation rate, meanwhile, nudged higher to 62.7%.

image source: Getty Images

"Has the Fed made a policy mistake? The labour market’s slowdown is now materializing with more clarity," said Seema Shah, chief global strategist at Principal Asset Management.

"Job gains have dropped below the 150,000 threshold that would be considered consistent with a solid economy," she added. "The rise in the participation rate is certainly good news and dulls the recession signal (but even so) a September rate cut is in the bag and the Fed will be hoping that they haven’t, once again, been too slow to act."

U.S. stocks extended their recent heavy declines following the data release, with the S&P 500 last marked 141 points lower, or 2.6%, heading into the midday session, while the Dow Jones Industrial Average fell 900 points.

The Nasdaq, meanwhile, fell 523 points, 3.05%, pulling the tech-focused benchmark into correction territory.

Benchmark 10-year Treasury note yields plunged 14 basis points to 3.793% following the data release, the lowest since December, and were last marked at 3.827%.

Rate-sensitive 2-year notes fell 20 basis points to 3.901%, the lowest in more than a year, before stabilizing at 3.915%.

Related: The Fed's biggest problem isn't inflation anymore

Data on Thursday showed weekly jobless claims jumped to the highest levels in nearly a year over the period ended July 27, the Labor Department said, with around 250,000 Americans filing their first paperwork for unemployment benefits.

The running total of continued claims, meanwhile, which lag the headline measure by a week, hit 1.88 million, the highest level since 2021.

Hiring is also slowing sharply, according to a closely tracked report from Challenger Gray. Employers have said they plan to add 3,676 workers in July, taking the year-to-date total to 73,596, the lowest in more than a decade.

Job cuts are also edging higher, with the highest July tally in four years and the third-highest year-to-date total since 2009, Challenger Gray reported.

"Was the data dependent Fed too late to act again? The market is saying just that," said Jay Woods, chief global strategist at Freedom Capital Markets.

"The trends in inflation were heading in the right direction, but the softening of the labor market never seemed to get the focus when discussing their dual mandate," he added. "This week that narrative changed and the market is leading that discussion."

More Economic Analysis:

- June jobs report bolsters bets on an autumn Fed interest rate cut

- Biden debate flop boosts Trump, but economy may be tougher opponent

- First-half market gains come with a dash of investor unease

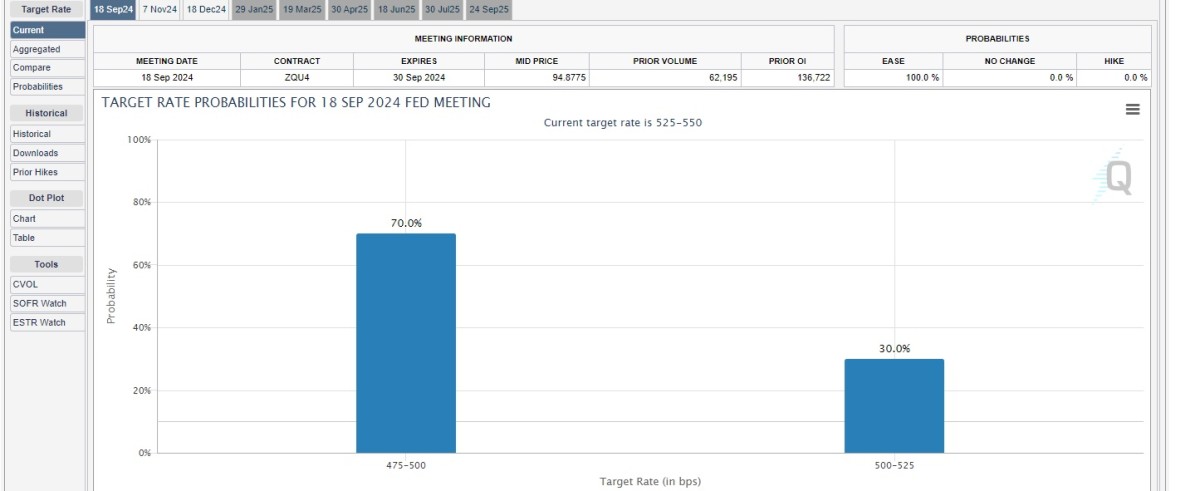

CME Group's FedWatch, meanwhile, pegs the odds of a 50 basis point reduction in September at around 70%, up from just 30% prior to the data release, with two more cuts priced in over the final two meetings of the year.

The Atlanta Fed's GDPNow forecasting tool suggests a third-quarter advance of 2.5%, down from its prior estimate of 2.8% on July 26.

Related: Veteran fund manager sees world of pain coming for stocks