Shares of Johnson & Johnson (JNJ) are trading higher on Tuesday, up about 4% and hitting all-time highs in the process. The move comes after the company reported earnings before the open.

Earnings came in ahead of expectations, while revenue slightly missed analysts’ estimates. Further, J&J gave its dividend a 6.6% boost, now yielding almost 2.5%.

As reported previously at TheStreet, Johnson and Johnson also “lowered its full-year profit forecast, and suspended its guidance for vaccine sales amid what it called a global surplus and waning demand.”

Despite this, investors are gobbling up the stock, which is good news for the bulls.

While the rest of the market has been struggling — with the S&P 500 down in six of the past seven sessions — J&J has not. Investors have viewed the stock as a flight-to-safety trade amid the ongoing volatility.

Bulls hope the upward trajectory can continue, but what do the charts say?

Trading Johnson & Johnson Stock

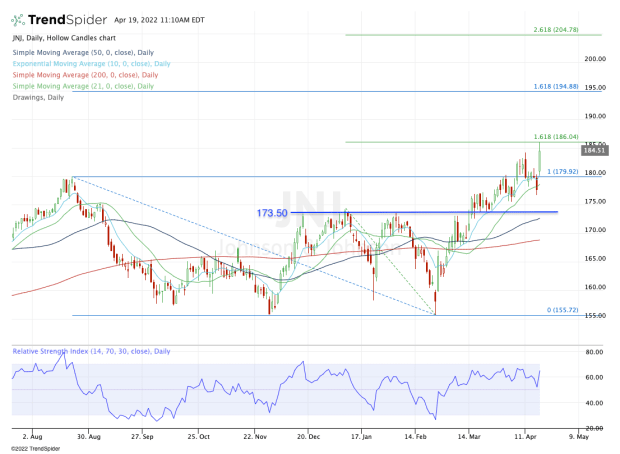

Chart courtesy of TrendSpider.com

Shares of Johnson & Johnson stock have been trading quite well, riding a strong uptrend that began in late February.

Most stocks cannot make that claim, as many retested the February low in mid-March. In many cases, the stocks actually broke to new lows. Not J&J, though.

On Monday — the day before earnings — the stock had its first test of the 21-day moving average since March 4. With today’s rally, shares are powering higher off that level and climbing to the 161.8% extension of the 2022 range.

If Johnson & Johnson stock can hold up, ideally above last week’s high of $184.20, then it keeps today’s high near $186 in play.

Longer term, that could open the door to the 161.8% extension from the much larger range, stretching from this year’s low to last year’s high in August. That extension comes into play near $195 and would be followed by a potential push toward $200.

On the downside, bulls do not want to see Johnson & Johnson stock fall below $180. A break of this level — resistance from August — likely puts the 10-day and 21-day moving averages in jeopardy.

Below all of these measures and it’s possible that the stock revisits the $173.50 breakout area and/or the 50-day moving average.

Long story short: Above $186 creates the potential for more upside. Below $180 and the 21-day moving average could put the low- to mid-$170s in play.