Retail stocks have had a rough ride over the past nine months after peaking in February.

A combination of factors have led to falling profits, weaker earnings and loss of interest from investors who have driven the SPDR S&P Retail ETF XRT down nearly 20% since its February 2023 peak.

Related: Tesla hits 5-month low, down 20% from Q3 earnings, amid fading EV demand

The holiday season is the most important quarter for most retailers as shoppers flock to stores to pick up gifts for friends and family. But the success of the holiday quarter is very reliant on the health of the overall economy, and there are signs that Americans could be tightening their belts instead of letting them loose following their Thanksgiving feasts.

Household liquidity in the U.S. has fallen from its peak of $3.4 trillion — thanks to pandemic stimulus packages and changed spending habits — to $1 trillion now, according to a recent JPMorgan note which predicts that American's savings "should largely be exhausted by 2024. Importantly, even as of 2Q23, nearly all the inflation adjusted excess cash sits with the relatively affluent (top 20%).

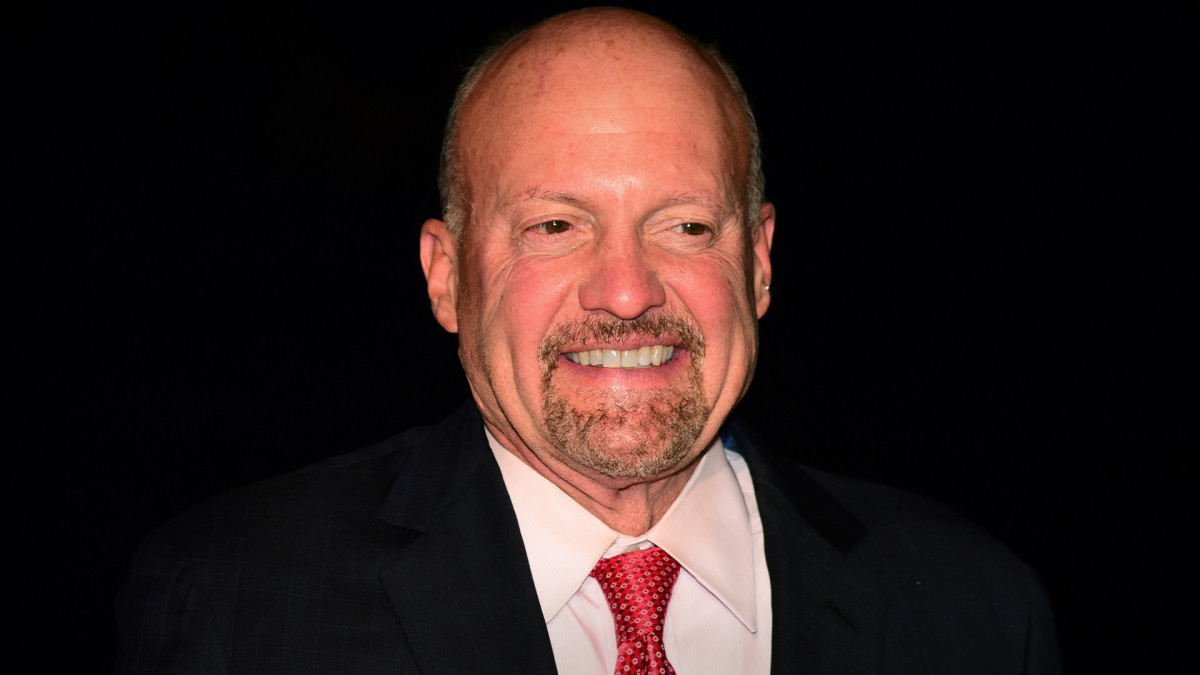

CNBC's Jim Cramer believes this data solves the mystery of why retailers, minus a select few like Amazon AMZN, Costco COST and others have struggled to gain any momentum since February.

This is the "cushion" but remember wages are higher and inflation is not running as hot so there still is a 2019 like scenario... But it is why all the T&E and retailers save Costco, TJX, WMT and AMZN can't lift . Great chart https://t.co/TCR2X6VGad

— Jim Cramer (@jimcramer) October 31, 2023

The U.S. personal savings rate reached a record high of 32% in April 2020 after averaging just 8.5% between 1959 and 2023, according to Trading Economics. Savings began to fall back into historical ranges before government stimulus like PPP loans caused another spike, but personal savings for Americans have been below the 10-year average for nearly 12 months, according to U.S. Bureau of Economic Analysis data.

Meanwhile, U.S. consumer spending reached an all-time high of $15.494 billion in the third quarter of 2023.

U.S. stocks edged lower in early Tuesday trading, with major indices on pace for the worst monthly performance of the year as high interest rates, mounting geopolitical risks and softer-than-expected earnings from mega-cap tech stocks hold down gains.

Investors found some relief from the recent surge in Treasury bond yields late Monday, however, with the moves spilling over into the Tuesday session, following a smaller-than-expected $776 billion borrowing target issued by the Treasury.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.

.png?w=600)