To hear Jensen Huang describe what he sees ahead for artificial intelligence and Nvidia (NVDA) is something so vast that computing and how we use it will never be the same.

Huang, the founder and CEO of the chip maker that was among the hottest stocks in 2023, gave the keynote address Monday to open Nvidia's GTC 2024 conference.

Huang focused on what he insisted was the coming transformative influence that his company's Blackwell program of chips and related systems that will have on technology and artificial intelligence at the first level and the entire economy beyond.

An excited audience and big plans

The audience at the SAP Center in San Jose, Calif., was enthusiastic. The four-day event, that's been called the Woodstock of AI, was expected to draw some 300,000 attendees live or online.

Huang focused on Nvidia's new generation of chips and the two factors that make AI work:

- The training (or programming) to enable the semiconductors to receive data, recognize and organize it and send it back out to a client in usable form.

- The brute computing power to make it all happen.

Nvidia's influence on artificial intelligence is already substantial thanks to its H100 GPU chips and related products, which power most AI applications now.

Making chips so powerful they can think

The Blackwell platform, expected to be available toward the end of 2024, will use a new series of chips, the B200 family, combined with new components and software to get the most out of the chips.

The goal is to let a user pack more training onto chips so they and the components built around them can recognize data more quickly.

As important, the chips are supposed to access more inference — the capacity to know how analyze the data to produce usable conclusions to queries and questions.

Related: Analysts revamp Eli Lilly stock price target on weight-loss drugs

Blackwell is supposed to offer 4 times the capacity of Nividia's wildly popular A100 chip to program the training aspects in the chips themselves and 30 times the inference output.

Add more of these chips into the system, and you can gather more data and translate it into more usable information almost instantaneously.

Who would use the new chips

To that end, Nvidia is developing other equally fast components into the platform system so that the information flows in and out swiftly and, as important, smoothly, all the while using a lot less power.

Shutterstock

Which means, if you're building a self-driving car, you can theoretically load more data into the chips helping to drive the vehicle so that it performs more safely and reliably.

So, automakers, already hard-at-work at developing safe and reliable self-driving vehicles, would be very interested in the potential of the units.

Other uses include systems that can help warehouses operate more efficiently.

Surgeries, using equipment being developed using Nvidia chips by the MedTech business of Johnson & Johnson (JNJ) , could be done with fewer medical errors.

More AI Stocks:

- Analyst reveals new Broadcom stock price target tied to AI

- AI stock soars on new guidance (it's not Nvidia!)

- Nvidia CEO Huang weighs in on huge AI opportunity

Corporations like German software maker SAP SE (SAPGF) could help its core customers — big companies with massive, cumbersome amounts of financial, sales and human resources — do their jobs more efficiently.

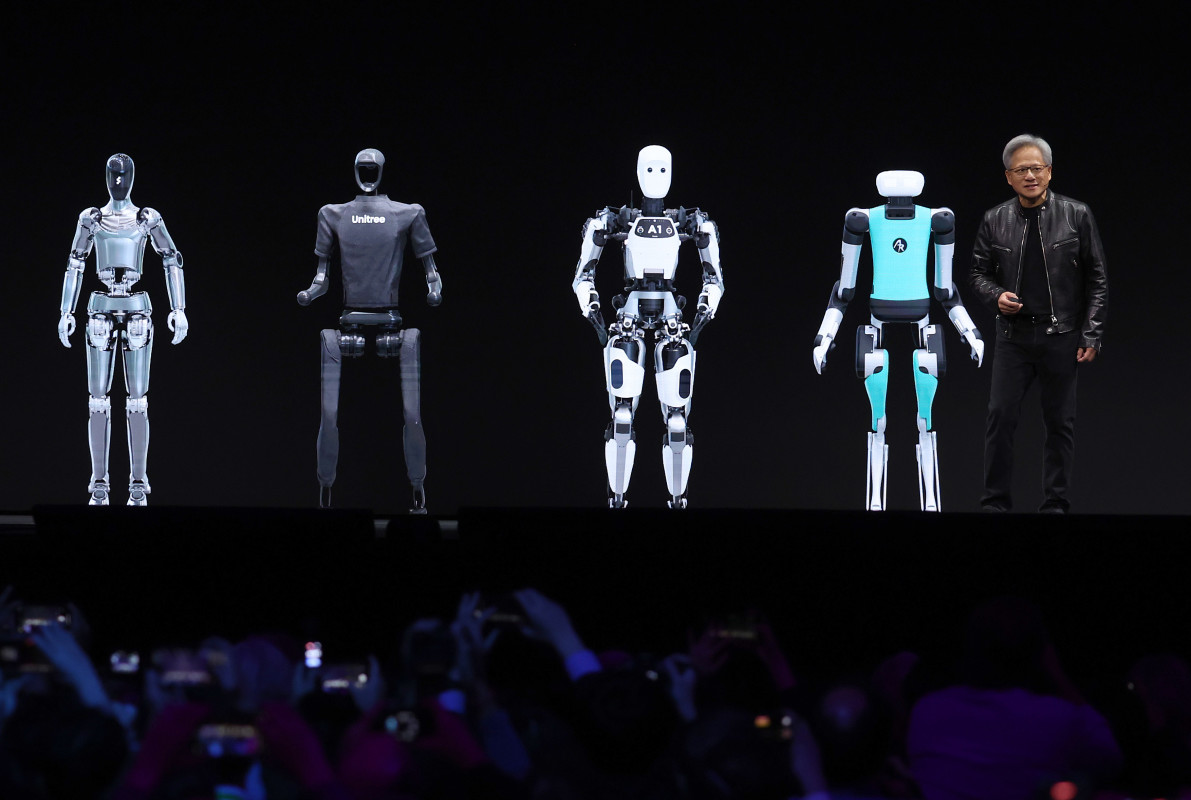

Robots could be built to mimic more closely human activities and thereby take over common tasks many of don't want to do.

The two-hour presentation to the crowd of tech developers and business executives, including Michael Dell of Dell Technologies (DELL) ended with a big round of applause. (Dell's company is a key player in data-center technology.)

The stock opened up as much as 5.2% after Monday's open but slid to $885.55, up just 0.7%. It fell 1.8% after hours to $869.

The shares hit an all-time intraday high of $974 on March 7 but have fallen 9.2%. since. They're still up 78.6% this year alone, after rising 239% in 2023.

The desultory performance may because investors may be worried about increasing competition in the AI business. Chip giant Advanced Micro Devices (AMD) and Google-parent Alphabet (GOOG) are among the many tech companies now working on AI products.

The price might have been affected by market interest in the Federal Reserve's interest-rate decision due Wednesday.

Related: Veteran fund manager picks favorite stocks for 2024