To say that the action in Japan's stock market this year has been a wild ride would be an understatement.

The Nikkei 225, Japan's benchmark index, was up close to 27% for the year at its high in July … and then August happened. Stock prices collapsed on August 5, dropping 12% on the day – the largest single-session drop since Black Monday – and bringing the total decline from the July top to 27%.

Then, on August 6, the Nikkei enjoyed its biggest one-day gain since 2008, and it's been inching higher ever since.

So, what on earth happened to Japanese stocks?

And more importantly, what should we do about it as investors?

Why did Japan's stock market crash?

To get an understanding of what roiled Japan's stock market, let's head back to the "fear-of-missing-out" (FOMO) days of the pandemic in America.

In early 2020, the Federal Reserve lowered interest rates to zero and then proceeded to hoover up $5 trillion in bonds in one of the largest quantitative easing programs in history. The combination of ultra-low rates and excessive stimulus by the Fed created an environment of abundant liquidity and a low opportunity cost for risk-taking. Investors had every incentive to gamble.

We know what happened next. The Fed's aggressive monetary policy injected massive liquidity into the financial system. This excess liquidity flowed into the stock market, driving up asset prices. Additionally, government stimulus checks provided direct financial support to individuals, some of which was invested in the stock market.

As stock prices soared, especially in high-growth sectors like technology, retail investors were driven by FOMO. Seeing the rapid gains made by others, they rushed to invest, further inflating asset prices. This feedback loop led to a euphoric market environment where valuations detached from fundamentals.

The FOMO rally came to an abrupt end in 2022. Once the Federal Reserve stopped injecting liquidity into the financial system and raised interest rates, the party was over, and we entered a bear market.

And here's where we turn to Japan.

The Bank of Japan never followed the Fed's lead in tightening monetary policy, keeping Japanese rates pegged at absurdly low levels. Up until March, the benchmark rate was actually negative at -0.1%. And even after March's "historic" rate hike – the first in 17 years – the target range for interest rate was only 0.0% to 0.1%.

So, Japanese investors had every incentive to pull their cash out of the bank and put it literally anywhere else. As was the case in the U.S. during the 2020-2021 FOMO market, a lot of Japanese cash made its way into the Japan's stock market, pushing prices higher.

The carry trade goes sideways

Not all of the cash stayed in Japan, though. Some made its way overseas via the "carry trade." Both Japanese and foreign investors alike had the opportunity to borrow free money in yen and then turn around and invest it in higher-yielding currencies like the U.S. dollar.

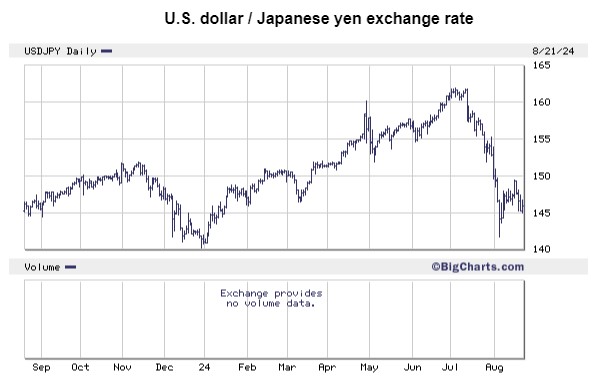

Their actions created a virtual cycle. The constant selling pressure on the yen and buying pressure on the dollar helped to push the dollar sharply higher relative to the yen. So, the investors playing the carry trade made money two ways. First, on the higher yielding assets and second on the currency move.

But why settle for a 5% money market rate when you can really add some sizzle with American tech stocks? The same dynamic applied. No matter how much money an American stakeholder made in Nvidia (NVDA) and the other Magnificent 7 stocks, a Japanese investor made more due to the constant depreciation of the yen.

And then it all went into reverse.

Fed Chair Jerome Powell indicated that a September rate cut might be on the table around the same time the Bank of Japan started to talk a good game about raising interest rates further.

This was enough to prompt a partial unwinding of the carry trade. The dollar dropped by about 12% relative to the yen in July and early August, which is a massive move in a short period for a developed world currency.

This sudden strength in the yen was destabilizing and culminated in the volatility storm we saw in early August, which sent the Cboe Volatility Index (VIX) – the volatility measure known popularly as the "fear gauge" – on its largest one-day spike ever.

What can investors do about Japan's stock market volatility?

Japan is a world away and there are not a lot of Americans that are invested in the land of the rising sun. But markets are interconnected, and liquidity sloshes across borders. If the yen continues to strengthen relative to the dollar – and this is likely if the Fed moves forward with lowering interest rates – then we're going to see a continued unwinding of the carry trade with all of the volatility that implies.

For most investors, there is actually little that can be done. Speculating on the yen's move is not going to be practical for the typical investor with a 401(k) plan or an IRA just looking to earn a reasonable return.

But the volatility storm we saw in early August should be a wake up call to review your portfolio and be sure you're taking an appropriate level of risk. After the run we've enjoyed in the market this year, it might make sense to rebalance, take a little risk off the table, and shift a little more of your portfolio into bonds and cash.