/Zimmer%20Biomet%20Holdings%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

Zimmer Biomet Holdings, Inc. (ZBH) is a leading global medical device company specializing in orthopedic solutions. With a market cap of $22 billion, Zimmer Biomet operates in over 25 countries and sells products in over 100 countries worldwide.

Companies worth $10 billion or more are generally described as "large-cap stocks," Zimmer Biomet fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the medical devices industry. With a strong presence in reconstructive surgery, sports medicine, and robotic-assisted procedures, Zimmer Biomet designs and manufactures innovative implants, surgical instruments, and digital healthcare technologies.

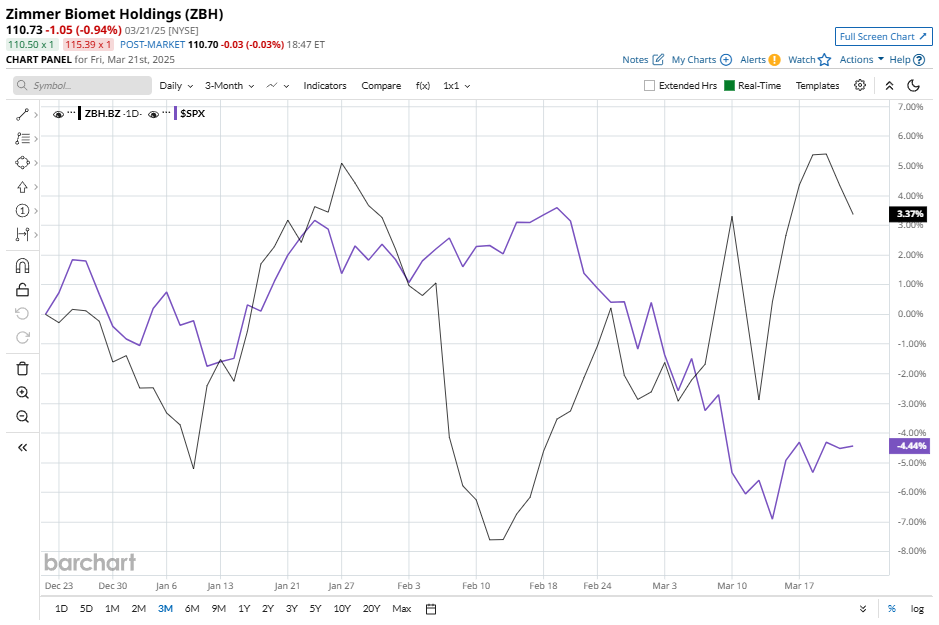

But, Zimmer Biomet has slipped 17.3% from its 52-week high of $133.90 achieved on Mar. 28 last year. Nevertheless, the stock has gained 3.4% over the past three months, outpacing the broader S&P 500 Index ($SPX), which declined 4.4% during the same period.

ZBH has surged 4.1% over the past six months, surpassing SPX’s marginal fall. However, the stock’s 12.9% decline over the past year lags behind SPXs 8.1% returns.

To confirm the recent bullish trend, ZBH has been trading above its 200-day and 50-day moving average since mid-March.

On Feb. 6, Zimmer Biomet reported its fourth-quarter and full-year 2024 financial results. The company achieved net sales of $2.023 billion for the quarter, marking a 4.3% increase over the same period in the prior year. Adjusted EPS was $2.31, slightly surpassing analysts' expectations by one cent.

Despite these positive figures, Zimmer Biomet issued a cautious outlook for 2025, forecasting adjusted EPS between $8.15 and $8.35, below Wall Street's anticipated $8.56. This conservative guidance reflects anticipated challenges, including currency headwinds and the integration of the recent Paragon 28 acquisition, which is expected to impact earnings by approximately ten cents negatively. Following the announcement, Zimmer Biomet's shares declined by 5.1% as investors reacted to the company's tempered future projections.

Zimmer Biomet has outperformed its peer Medtronic plc’s (MDT) 1.2% decline over the past six months but has trailed MDT’s 8.3% rally over the past 52 weeks.

However, analysts remain optimistic about the stock’s prospects. ZBH has a consensus “Moderate Buy” rating among the 28 analysts covering it. The mean price target of $121.12 represents a 9.4% premium to current price levels.