/Expeditors%20International%20Of%20Washington%2C%20Inc_%20logo%20on%20screen-by%20madamF%20via%20Shutterstock.jpg)

Expeditors International of Washington, Inc. (EXPD), headquartered in Seattle, Washington, provides logistics services. Valued at $15.9 billion by market cap, the company provides air and ocean freight forwarding, vendor consolidation, customs clearance, marine insurance, distribution, and other international logistics services.

Shares of this leading non-asset-based third-party logistics provider have underperformed the broader market over the past year. EXPD has declined 9.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 22.3%. In 2025, EXPD stock is up 2.6%, compared to the SPX’s 4% rise on a YTD basis.

Narrowing the focus, EXPD’s underperformance is also apparent compared to the ProShares Supply Chain Logistics ETF (SUPL). The exchange-traded fund has declined about 3.8% over the past year. Moreover, the ETF’s 3.3% gains on a YTD basis outshine the stock’s returns over the same time frame.

EXPD's stock has struggled to keep pace with the market, as the company navigates challenges posed by volatile freight rates, limited air and ocean capacity, and geopolitical tensions that are eroding profit margins.

Today, on Feb. 18, EXPD reported its Q4 results. Its EPS increased 54.1% year over year to $1.68. The company’s revenue stood at $3 billion, up 29.7% year over year.

For the current fiscal year, ended in December 2024, analysts expect EXPD’s EPS to grow 9.2% to $5.47 on a diluted basis. The company’s earnings surprise history is mixed. It beat or matched the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

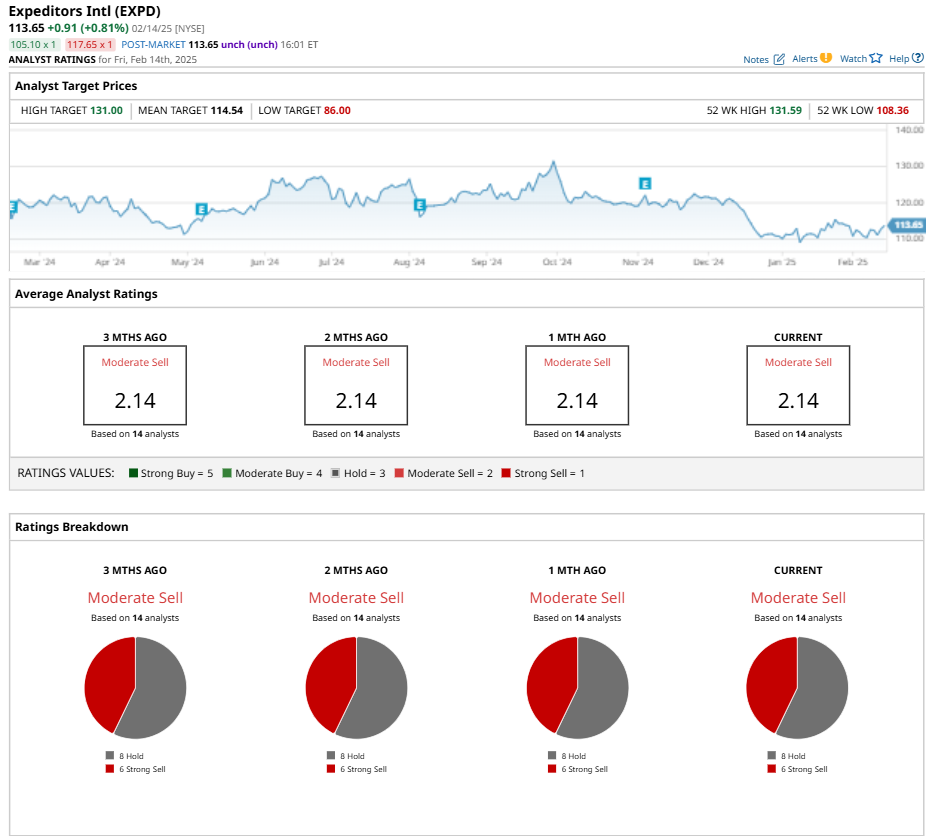

Among the 14 analysts covering EXPD stock, the consensus is a “Moderate Sell.” That’s based on eight “Strong Buy” ratings, and six “Strong Sells.”

The configuration has been consistent over the past three months.

On Jan. 23, Stifel kept a “Hold” rating on EXPD and lowered the price target to $117, implying a potential upside of 2.9% from current levels.

The mean price target of $114.54 represents a marginal premium to EXPD’s current price levels. The Street-high price target of $131 suggests an upside potential of 15.3%.