Blink Charging (BLNK), a prominent provider of electric vehicle (EV) charging equipment and services, has had a turbulent year.

Essentially, Blink designs and operates EV charging stations that allow vehicle owners to charge their cars at home, work, or in public areas. Its full range of charging products includes Level 2 AC chargers, DC fast chargers, and a platform for real-time monitoring, payments, and energy management. From a rapidly declining share price to receiving a delisting notice from the Nasdaq Exchange at the start of the month due to a delayed Form 10-K filing, the path has been rocky for the company in 2025.

Specifically, Blink failed to file its annual Form 10-K for the fiscal year ending Dec. 31, 2024. Such a notice typically raises concerns, as delisting can significantly reduce liquidity and investor confidence. Finally, on April 9, the company filed its Form 10-K, alleviating initial fears of a Nasdaq delisting. This raises the question of whether Blink Charging stock is a “buy” now. Let’s find out.

Delisting Fears Ease, but Challenges Remain

Blink rapidly expanded over the last few years, resulting in a remarkable increase in revenue. Notably, from just $6.2 million in 2020, the company’s revenue reached $140.6 million by 2023. However, in 2024, revenue dipped by 10.2% year-over-year to $126.2 million. This was largely driven by a 25% decrease in its product revenue for the year.

Management expects service revenues, which helped offset the product decline, to rise further in 2025. Product revenue is expected to rebound by the second half of the year.

Blink continues to burn cash at an unsustainable rate. The company continues to invest heavily in R&D, sales, and global expansion, leading to sustained losses. For the full year 2024, the company posted an adjusted net loss of $0.61 per share, narrower than a loss of $1.42 in 2023. The company ended the year with $55 million in liquid marketable securities and no cash debt. The global shift toward electric vehicles is undeniable, but the EV charging space is becoming increasingly crowded. Companies like ChargePoint Holdings (CHPT), EVgo (EVGO), and Tesla (TSLA), which are either better capitalized or more advanced in infrastructure deployment, are putting additional pressure on Blink. The company must reduce cash burn, improve gross margins, and continue moving toward profitability to maintain its position in the EV sector.

Analysts predict revenue to increase slightly by 0.16% in 2025, followed by a 32.6% increase in 2026. Losses could narrow down to $0.48 per share in 2025, and narrow further to $0.32 in 2026. As Blink is unprofitable, price-earnings ratios are not applicable for valuation purposes. The stock’s valuation of 0.6x forward sales appears cheap, but it also reflects skepticism about the company’s ability to generate sustainable earnings.

Is BLNK Stock a Buy, Hold, or Sell on Wall Street?

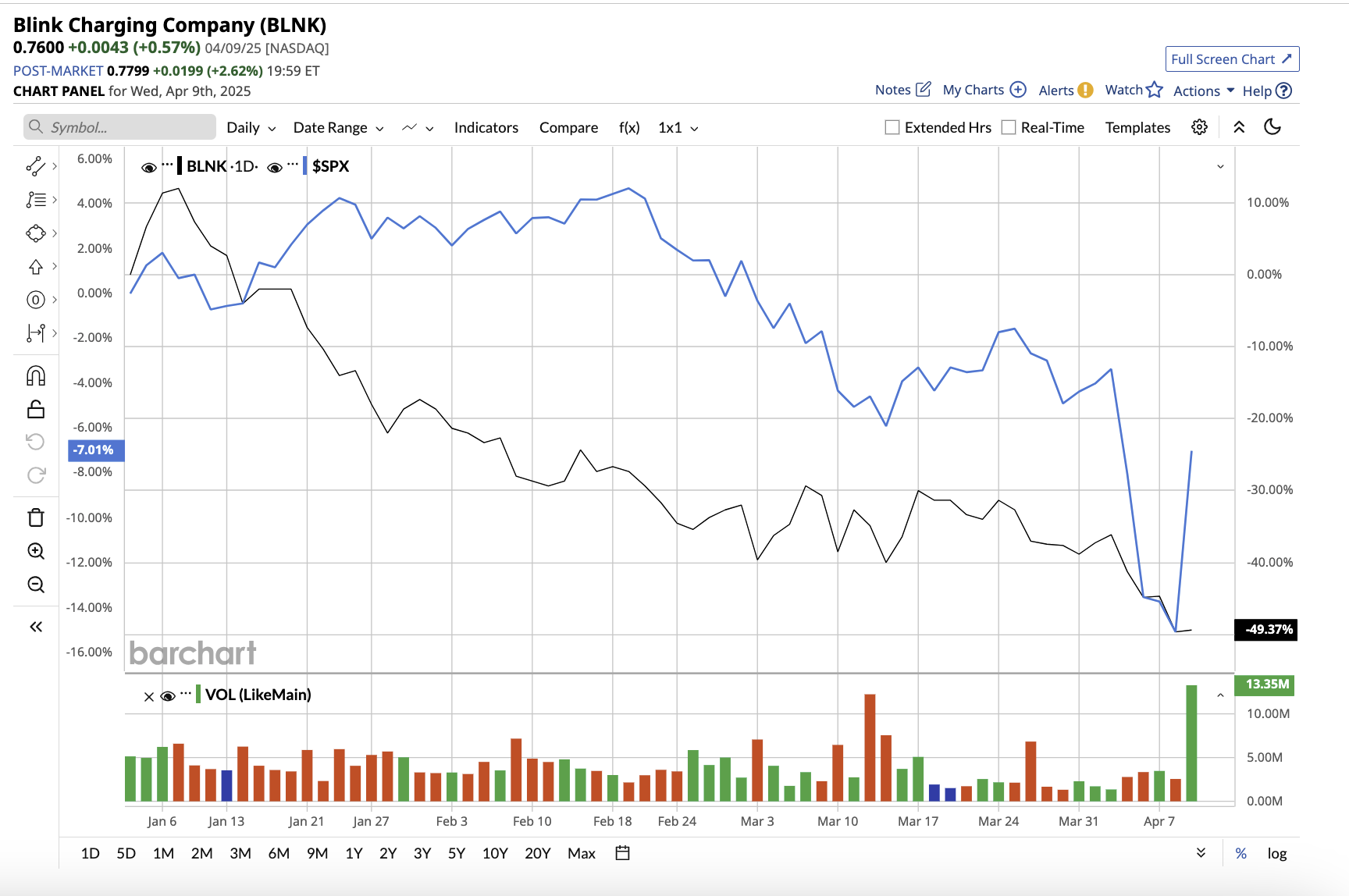

Blink Charging shares have fallen to alarming lows, trading at around $0.70 per share, far below their peak during the EV boom.

So far this year, the stock is down 49.6%. Nonetheless, Wall Street expects the stock to rise by 298% based on an average target price of $2.79.

Furthermore, its high price estimate of $8 implies a 1,042% upside potential from current levels. On Wall Street, the stock is an overall “Moderate Buy.” Of the eight analysts covering the stock, three rate it a “Strong Buy,” and five rate it a “Hold.”

The Bottom Line on BLNK Stock

Although the easing of delisting fears provides some short-term relief, Blink, as a penny stock, remains highly volatile. Its financial health and market competition make it a highly risky play for conservative investors. While Wall Street remains cautiously optimistic, I believe it is wise to steer clear of this EV stock.