The stock market has been on a tear lately, with the S&P 500 up 11.8% from the October lows.

For the Dow’s part, the index is up more than 4,200 points from the low, or 14.75%.

In fact, so far in this rally the Dow Jones Industrial Average has been the best performing U.S. stock index of the four major indexes. Aside from the two mentioned above, the group includes the Russell 2000 and Nasdaq Composite.

The Dow gets a lot of attention, mainly for its large point swings. After all, “The Dow Plunges 1,000 Points!” seems a lot more serious than “The S&P 500 Drops 115 Points” — even though they both equate to a 3% decline (from current levels).

Regardless of why the Dow gets so much attention, the fact is that it’s the best-performing index at the moment.

Trading the Dow

Chart courtesy of TrendSpider.com

While the chart above is a look at the index, investors can’t buy the Dow index outright. But they can trade the SPDR Dow Jones Industrial Average ETF Trust (DIA).

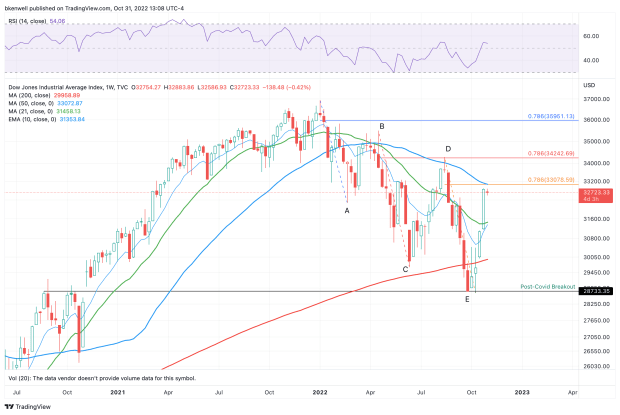

I see a five-wave correction on the weekly chart, which resulted in a bit of an overshoot below the 200-week moving average. But the Dow found its footing at the prior 2020 breakout level near 28,700 and barely made new lows in October (unlike the S&P 500 and Nasdaq, which fell hard).

There was some relative strength on the downside earlier in the month, and there's been relative strength on the upside — with four straight weekly gains to boot — but the Dow isn’t out of the woods yet.

Notice on the chart above that the Dow has retraced roughly 75% of its losses on the previous two declines this year. You’ll also see that the 50-week moving average has been resistance for most of 2022.

Well, the Dow is now coming into both of those areas, as the 50-week moving average is also near the 78.6% retracement at 33,075.

This suggests caution, but also presents opportunity.

It would likely be healthiest for the Dow to find this area as resistance, then find support on the pullback and give bulls a higher low to work with. Without threading the needle too finely: It would be ideal to find support around 31,500 — where we find the 10-week and 21-week moving averages.

While there is short-term risk in the current setup, there’s also opportunity. If the Dow can clear these upside hurdles, it could open the door up to the 34,000 area.

That being said, the main driver of the Dow and the market is likely to be the Fed. If on Wednesday the Fed opens the door to pausing on rate hikes, it could continue to push stocks higher. If we get a repeat of the Jackson Hole rhetoric, lower prices may be in store.