Stocks closed on a high note this Friday. This puts a bullish exclamation mark on the first half of the year!

That is now...but what happens later is a bit more of a mystery.

Yes, the current trend could continue. Or perhaps there will be reason for more caution in the months ahead.

Let’s spend some time today to consider what happens in the 2nd half of the year so we can craft the best trading plan to carve profits from the market.

Market Commentary

The most complete way for me to share my stock market outlook and trading plan is by watching the presentation I just gave for the MoneyShow that covers the following topics:

- Review of...How Did We Get Here?

- Bear Case

- Bull Case

- And the Winner Is??? (Spoiler: Bear case more likely)

- Trading Plan with Specific Trades Like...

Assuming you watched the video, let me add some additional color commentary.

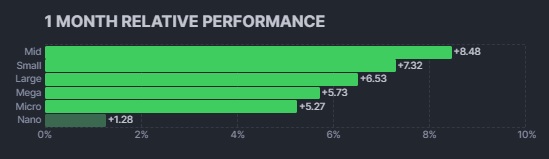

That starts by admitting that the recent price action is straight up bullish. Even previously noted problems with lack of market breadth are improving as gains are finally making their way beyond the tech mega caps in the S&P 500 (SPY) to other stocks including small and mid caps.

Unfortunately, on the fundamental front I still see things as mostly bearish. The key being the likelihood of a future recession forming which would beget lower corporate earnings and thus lower stock prices.

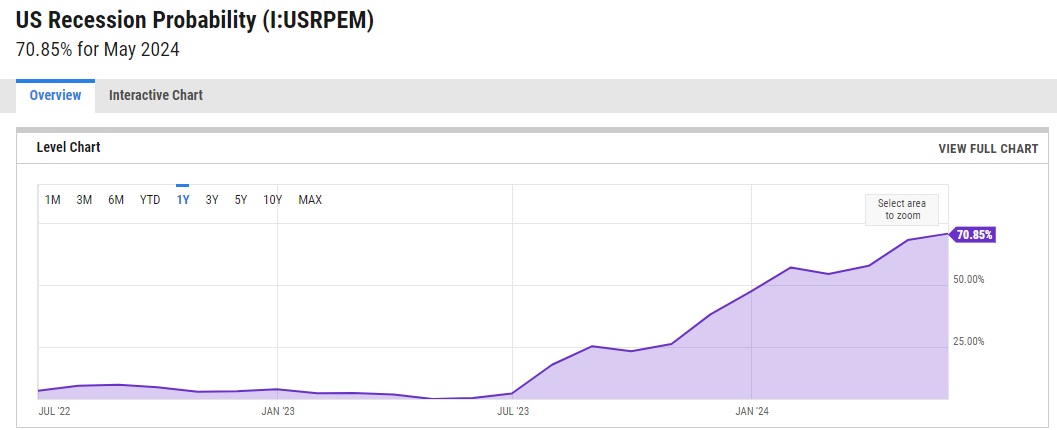

Using the popular recession probability measure where folks compare the inversion between the 3 month & 10 year Treasuries, that now looks like this at just over 70% probability of recession by May 2024:

So how can stocks be up this much as the future probability of recession darkens?

This fits in with the “Boy Who Cried Wolf” version of the investment story. Just replace “Wolf” with “Recession”.

Investors are tired of hearing about the probability of recession as it keeps NOT happening. At this stage they will not react UNTIL that recession/wolf is on their doorstep with blood dripping from its fangs. THEN investors will sell stocks in earnest. Until that time, it seems to be...”Party on Garth” for investors.

You may have heard a snippet today that the Core PCE inflation reading was slightly better than expected. Since this is the Fed’s favorite inflation measure it was considered the main catalyst for stocks flying higher once again.

Now the facts...

+4.6% year over year inflation is indeed better than the 4.7% reading from last month. But unless I am mistaken, it is nowhere close to the 2% target inflation rate required by the Fed.

Further, the month over month reading came in exactly as expected at +0.3% which still points to the current pace of increase between +3.6% and 4%. Again, still too hot.

This explains why the odds of a rate hike at the next Fed meeting on 7/26 is now up to 87% likelihood vs. 72% a week ago and up from 53% a month ago. Meaning this inflation reading does not make anyone think the Fed will stop putting their foot on the neck of the economy with future rate hikes.

Please remember that on Wednesday, Chairman Powell noted once again that 2 more rate hikes are on the menu. This was accompanied by the usual sound bites about more work to do...and higher rates for longer...and please get off your crack pipe if you think that we will lower rates this year (OK...that last part was me, not Powell ;-)

There is a lot of key economic reports this coming week like ISM Manufacturing, ISM Service and Government Employment. However, unless they SCREAM RECESSION, then I suspect investors will remain blissfully ignorant.

No...I am not saying the bull market will keep advancing non-stop from here. I am saying it is not ready for a real sell off until proof of a recession is seemingly irrefutable.

Note that often the end of a quarter ends with a bang followed by a whimper. That is why I am not chasing this market. We have enough in the market too participate in upside while not extending our necks to far lest our heads get chopped off.

I still think we have a mild case of irrational exuberance which should give way to a modest pullback and trading range to start July. This would be the logical choice as investors await more clues to point out the odds of recession and whether that pushes us more bullish...or back into our bearish caves.

But...who says the market is logical? ;-)

For now, a balanced portfolio closer to 50% invested feels the most appropriate given the facts in hand. We will continue to monitor the situation and make adjustments as appropriate. Just don’t be too late to react to that recessionary wolf when it starts moving your way.

What To Do Next?

Discover my full market outlook and trading plan for the rest of 2023. It’s all available in my latest presentation:

2nd Half of 2023 Stock Market Outlook >

Just in case you are curious, let me pull back the curtain a little wider on the main contents:

- Review of...How Did We Get Here?

- Bear Case

- Bull Case

- And the Winner Is??? (Spoiler: Bear case more likely)

- Trading Plan with Specific Trades Like...

- Top 10 Small Cap Stocks

- 4 Inverse ETFs

- And Much More!

If these ideas appeal to you, then please click below to access this vital presentation now:

2nd Half of 2023 Stock Market Outlook >

Wishing you a world of investment success!

SPY shares were trading at $443.25 per share on Friday afternoon, up $5.14 (+1.17%). Year-to-date, SPY has gained 16.78%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

Is the Bear Market TRULY Dead? StockNews.com