/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Elon Musk has no shortage of ambitions, with involvement in everything from self-driving cars to his new role in the federal government. However, there are two projects that he is particularly passionate about: populating Mars and Optimus, Tesla’s (TSLA) humanoid robot.

And in a recent interview with Fox News, Musk shared how he plans to bring the two together by confirming that SpaceX’s Starship will depart for Mars at the end of 2026 with Optimus on board.

But what does all this mean for Tesla stock investors who have been burnt by a 42% drop in the share price in 2025?

About Tesla Stock

With Musk at the helm, Tesla currently commands a market capitalization of $758.6 billion.

The company has been a true wealth creator, with shares up more than 585% over the past five years. Plus, the company has grown its revenue at a compound annual growth rate (CAGR) of 32% over the same time period.

And although Tesla missed revenue and earnings expectations for the fourth quarter of 2024, the company still delivered year-over-year growth. Revenue was up 2% to $25.71 billion while earnings rose 3% to $0.73.

The company generated $4.8 billion in net cash from operating activities in Q4, exceeding the prior year’s $4.4 billion, although full-year free cash flow saw a slight decline to $2.03 billion.

Notably, with the Dojo Supercomputer and Tesla’s recent foray into ride-hailing in California expected to drive significant growth for the company, how does Optimus fit in? And what does the latest Mars news mean? Let’s have a closer look.

Musk Convinced About Optimus

Elon Musk envisions Tesla’s Optimus humanoid robot as a game-changer, with a revenue potential surpassing $10 trillion — an outlook that underscores the sheer scale of the opportunity ahead. Musk has stated that once annual manufacturing reaches 1 million units, the cost per unit will likely drop below $20,000. In line with this vision, as stated in my previous article, Tesla plans to roll out several thousand Optimus robots this year, with a significant ramp-up in production thereafter. Initially, these robots will be deployed within Tesla’s operations, improving efficiencies across various departments and processes.

Optimus is designed to integrate seamlessly into existing workflows without requiring major overhauls. Tesla is leveraging imitation learning through teleoperation, motion capture, and VR-based demonstrations, allowing the robots to intuitively perform tasks traditionally executed by humans, from household chores to industrial machine operation. This same AI framework underpins Tesla’s autonomous driving system, ensuring Optimus can interpret and interact with its environment dynamically.

Already in operation within Tesla’s factories, Optimus is continuously refining its capabilities through a data-driven learning process similar to Tesla’s Full Self-Driving (FSD) software. This positions Tesla at the forefront of AI-driven automation, with applications that extend far beyond the automotive sector.

Industry forecasts further reinforce the long-term potential. Morgan Stanley projects a humanoid robot population of 40,000 by 2030, expanding to 63 million by 2050, while Citigroup anticipates exponential growth, with over 1 billion robots in use by 2035 and as many as 4 billion by 2050. Given Tesla’s early-mover advantage, the company is well-positioned to capitalize on this rapidly expanding market.

Supporting this optimistic outlook, Bank of America analyst John Murphy sees Optimus benefiting from Tesla’s broader advancements in autonomous technology. He expects the maturation of Tesla’s robotaxi initiatives to accelerate Optimus’s capabilities, facilitating increased production beyond 2026 and ultimately reducing unit costs, further strengthening Tesla’s competitive edge in AI-powered robotics.

Analyst Opinions on TSLA Stock

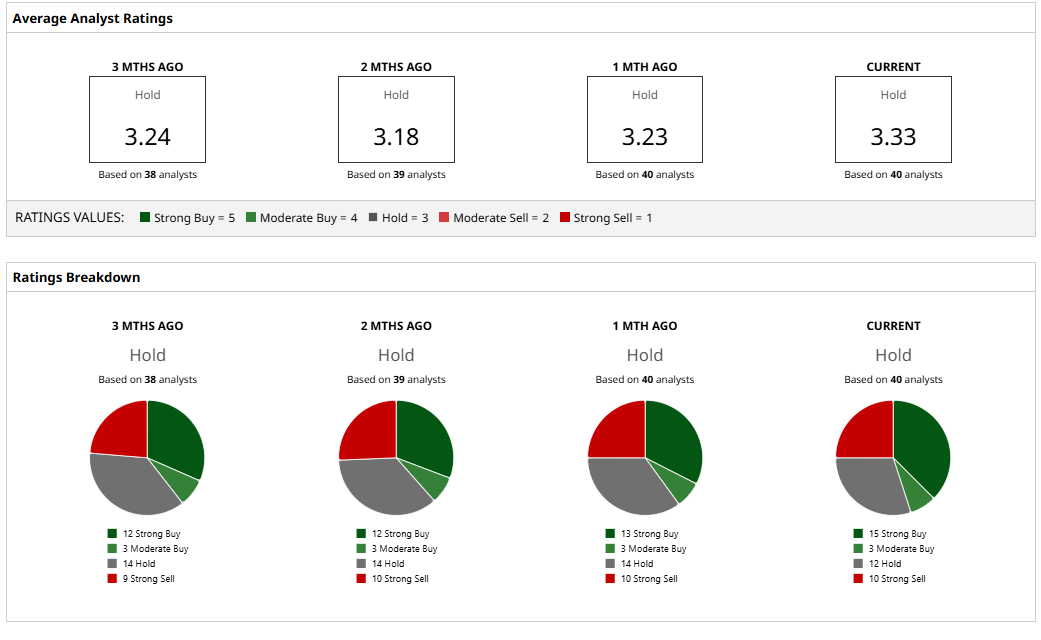

Taking all of this into account, analysts have deemed Tesla stock a “Hold” with a mean target price of $343.67. This denotes upside potential of about 46% from current levels. Out of 40 analysts covering the stock, 15 have a “Strong Buy” rating, three have a “Moderate Buy” rating, 12 have a “Hold” rating, and 10 have a “Strong Sell” rating.