/Qorvo%20Inc%20logo%20on%20phone%20on%20work%20station-by%20MacroEcon%20via%20Shutterstock.jpg)

Greensboro, North Carolina-based Qorvo, Inc. (QRVO) provides core technologies and radio frequency (RF) solutions for mobile, infrastructure, aerospace, and defense applications. With a market cap of $6.8 billion, Qorvo operates through High-Performance Analog (HPA), Connectivity and Sensors Group (CSG), and Advanced Cellular Group (ACG) segments.

Companies worth $2 billion or more are generally described as "mid-cap stocks," Qorvo fits right into that category, with its market cap exceeding this threshold, reflecting its notable size and influence in the semiconductor space.

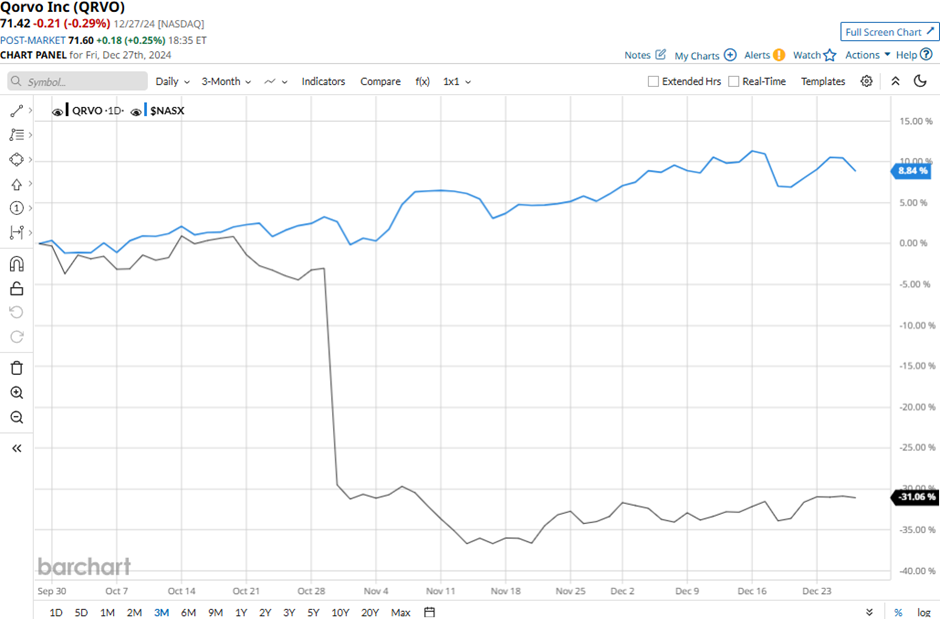

Despite its notable strengths, Qorvo has fallen to a lofty perch. QRVO stock has tanked 45.5% from its 52-week high of $130.99, reached on Jul. 16. QRVO has declined nearly 31.1% over the past three months, substantially underperforming the Nasdaq Composite’s ($NASX) 8.8% gains during the same time frame.

Over the longer term, Qorvo’s performance looks even grimmer. QRVO has plummeted 36.5% over the past six months and 37.7% over the past 52 weeks, compared to NASX’s 10.4% gains over the past six months and 30.6% surge over the past year.

To confirm the bearish trend, QRVO has consistently traded below its 50-day moving average since the start of August and below its 200-day moving average since early September.

Qorvo stock prices plunged by a massive 27.3% in the trading session after the release of its Q3 results on Oct. 29. The company reported a 5.2% year-over-year decline in revenues to $1 billion and a 21.3% drop in adjusted EPS to $1.88. Although its topline and earnings exceeded Wall Street’s expectations by modest margins, the company reduced its revenues and earnings guidance for the second half of 2025 which unsettled investor confidence.

A significant portion of the smartphone industry is observing a move from mid-tier to entry-level Android 5G devices which has affected Qorvo’s financials due to unfavorable mix. Furthermore, the company expects this trend to persist in the future which will continue to dampen Qorvo’s topline and profitability margins. This caused the company to lower its guidance, leading several analysts to downgrade the stock following the earnings release.

Qorvo has substantially underperformed its peer MaxLinear, Inc.’s (MXL) 2.4% gains over the past six months and a 17.7% decline over the past year.

Among the 23 analysts covering the QRVO stock, the consensus rating is a “Hold.” Its mean price target of $91.84 represents a 28.6% premium to current price levels.