/NVR%20Inc_%20building%20sign%20by-%20DCStockPhotography%20via%20Shutterstock.jpg)

Reston, Virginia-based NVR, Inc. (NVR) operates as a homebuilder in the U.S. Valued at $21.8 billion by market cap, the company builds single-family detached homes, town homes, and condominium buildings under the Ryan Homes, NVHomes, and other trade names. NVR provides a number of mortgage related services to its homebuilding customers and to other customers through its mortgage banking operations.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and NVR perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the residential construction industry. NVR’s strategic lot acquisition approach through LPAs and joint ventures has led to control of 135,800 lots, setting the company up for continued growth. These investments in joint ventures showcase a forward-thinking approach to resource management and expansion.

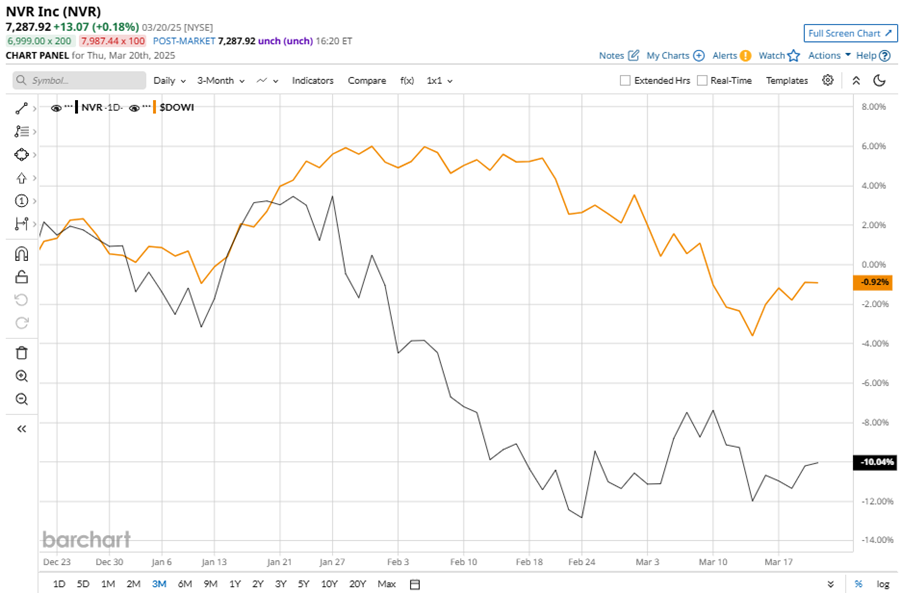

Despite its notable strength, NVR slipped 26.9% from its 52-week high of $9,964.77, achieved on Oct. 18, 2024. Over the past three months, NVR stock declined 12%, underperforming the Dow Jones Industrials Average’s ($DOWI) 2.1% losses during the same time frame.

In the longer term, shares of NVR dipped 10.9% on a YTD basis and fell 8.4% over the past 52 weeks, underperforming DOWI’s YTD 1.4% losses and 6.2% returns over the last year.

To confirm the bearish trend, NVR has been trading below its 200-day moving average since mid-December, 2024. The stock is trading below its 50-day moving average since late October, 2024, with slight fluctuations.

On Jan. 28, NVR shares closed down more than 3% after reporting its Q4 results. Its EPS of $139.93 beat Wall Street expectations of $126.41. The company’s revenue was $2.8 billion, beating Wall Street forecasts of $2.7 billion.

In the competitive arena of residential construction, D.R. Horton, Inc. (DHI) has taken the lead over NVR, showing resilience with a 6.2% downtick on a YTD basis but lagged behind the stock with a 17.3% dip over the past 52 weeks.

Wall Street analysts are cautious on NVR’s prospects. The stock has a consensus “Hold” rating from the seven analysts covering it, and the mean price target of $8917.50 suggests a potential upside of 22.4% from current price levels.