Valued at a market cap of $15.4 billion, NiSource Inc. (NI) is an energy holding company. The Merrillville, Indiana-based company provides natural gas and electricity to millions of customers across several states in the U.S., focusing on regulated distribution and generation operations.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and NiSource fits this criterion perfectly, exceeding the mark. NiSource is renowned for its extensive natural gas distribution network, which spans nearly 60,000 miles and serves millions of customers across multiple states while also committing to a significant transition towards renewable energy sources and reducing carbon emissions.

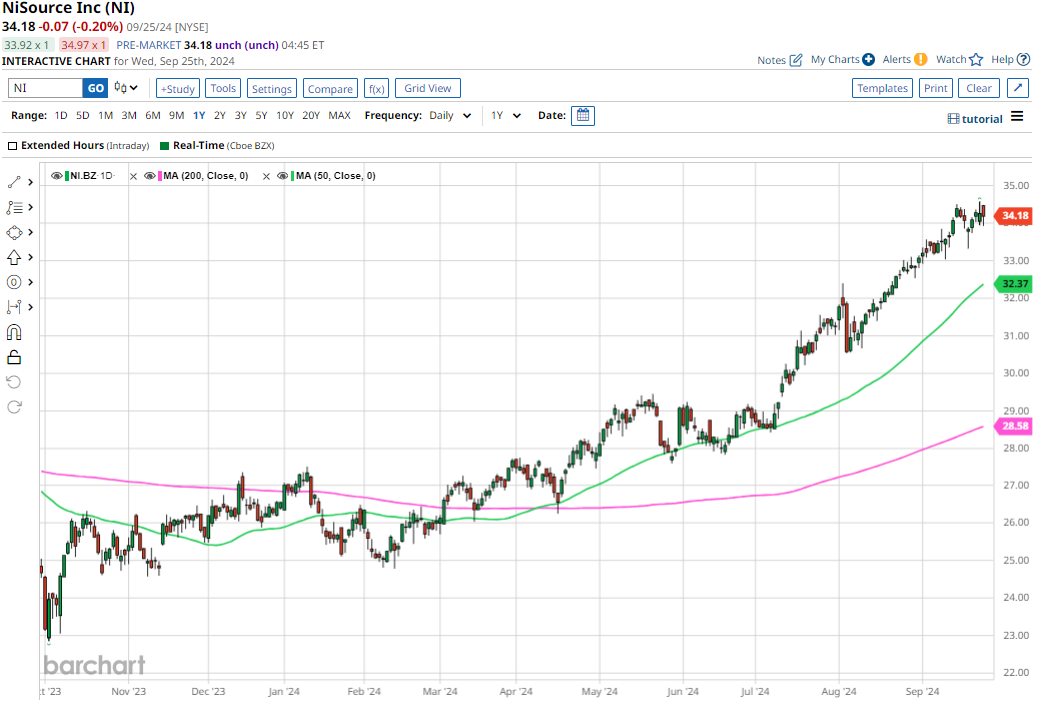

The energy holding company pulled back 1.1% from its 52-week high of $34.56. Shares of NI are up 18.6% over the past three months, outperforming the broader S&P 500 Index's ($SPX) 4.6% rise in the same period.

Longer term, on a YTD basis, shares of NiSource have surged 28.7%, outpacing SPX's nearly 20% increase. However, NiSource has risen 28% over the past 52 weeks, lagging behind SPX's 31.9% return.

Yet, NI has been in a bullish trend, trading above its 20-day and 50-day moving averages since March.

NiSource has outperformed in 2024 due to strong growth in its electric operations in northwest Indiana, cost-saving measures, and its ongoing transition away from coal. Moreover, the stock rose marginally on Aug. 7 due to better-than-expected Q2 adjusted earnings of $0.21 per share, driven by lower operating costs that helped offset weaker gas sales. A significant reduction in operating expenses, aided by falling U.S. natural gas futures, contributed to the positive earnings surprise.

The stock’s rival, Duke Energy Corporation (DUK), has seen a 24.5% rise over the past 52 weeks and a 19.8% gain on a YTD basis, lagging behind NI's performances in both periods.

Due to NI’s outperformance relative to SPX in 2024, analysts are bullish about the stock's prospects. The stock has a consensus rating of “Strong Buy” from the 12 analysts covering it, and it is currently trading slightly below the mean price target of $34.59.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.