Nio, Inc (NYSE:NIO) was trading about 3% higher on Friday, etching out two possible bullish patterns on the daily chart.

On Wednesday, Credit Suisse analyst Bin Wang maintained an Outperform rating on the Chinese EV manufacturer and slapped a whopping $83 price target on the stock, citing his expectation Nio’s sales volume climbs to 150,000 units this year after it begins delivering the ET7 sedan on March 28.

Images of Nio’s second sedan –the ET5— rolling off its production line were shared by the company on Monday. Nio expects to begin delivering the model in September.

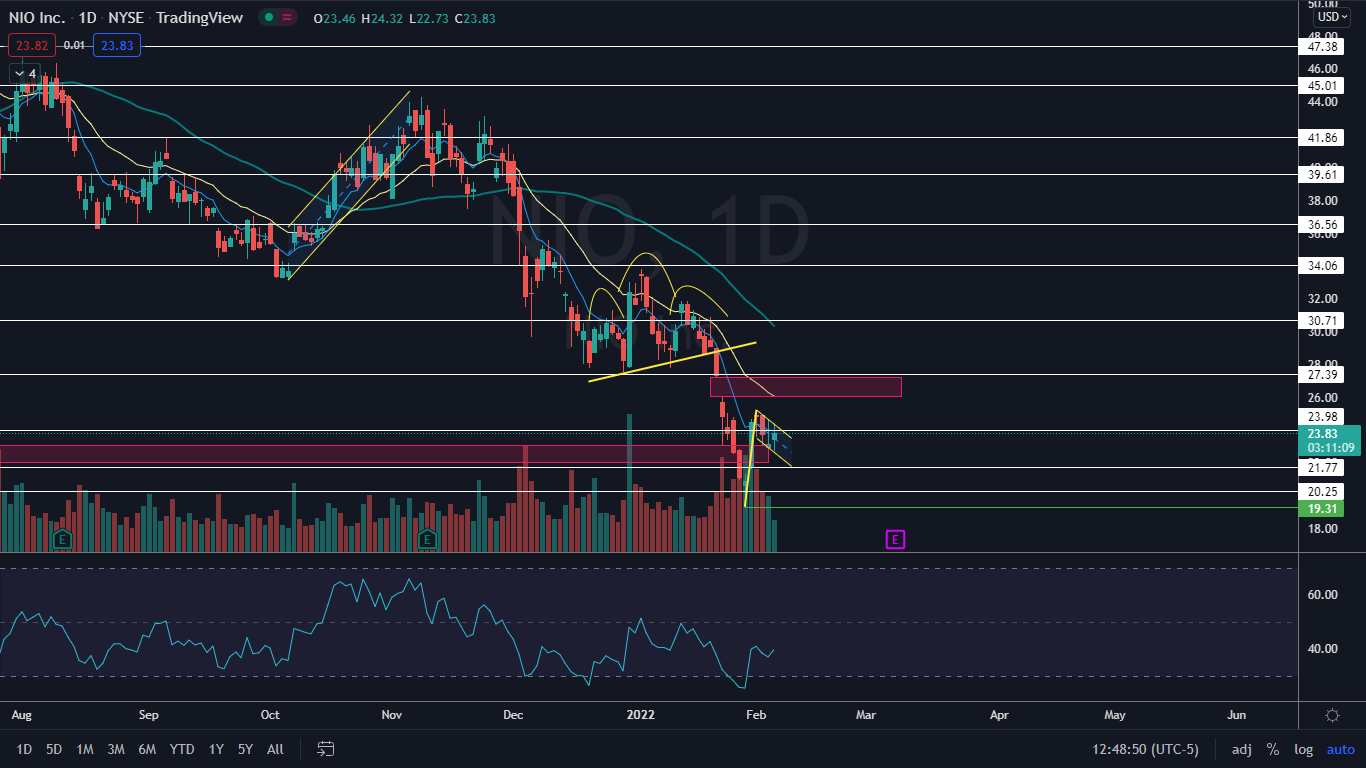

Nio’s had a rough 13 months, plummeting about 71% from its Jan. 11, 2021, all-time high of $66.99 to a 52-week low of $19.31 on Jan. 28 of this year. If the market cooperates and Nio’s bullish patterns are recognized, however, a big move to the upside may be in the cards.

See Also: How to Buy Nio Stock Right Now

The Nio Chart: On Friday, Nio was printing a bullish inside bar pattern on the daily chart within a bull flag pattern the stock has been forming since Jan. 28, with the pole created between that date and Feb. 1 and the flag forming over the trading days that have followed. Traders and investors can watch for the stock to break up from both patterns late Friday or on Monday.

If Nio breaks up bullishly from the flag pattern the measured move, calculated by determining the length of the pole as a percentage is 30%, which indicates the stock could soar up toward the $30 mark.

The break from the pattern is likely to come on Monday because on Friday Nio was trading on lower-than-average volume, which indicates the stock is consolidating before making a move. As of the early afternoon, just 31.2 million shares had exchanged hands compared to the 10-day average of 74.81 million.

On Jan. 26 and Jan. 27, Nio closed a lower gap on its chart but it has a higher gap that has not yet been closed between $25.98 and $27.22. Gaps on charts fill about 90% of the time, which indicates Nio will eventually rise up to trade within the area.

Nio is trading slightly above the eight-day exponential moving average (EMA) but below the 21-day, which indicates bullish indecision. Bullish traders may want to wait to see if Nio can regain the 21-day EMA before entering into a position.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

- Bulls willing to take more risk want to see Nio break up bullishly from the flag formation on higher-than-average volume on smaller timeframes, which would likely allow the stock to more easily regain the 21-day EMA and fill the gap. The stock has resistance above at $23.98 and $27.39.

- Bears want to see big bearish volume come in and drop Nio down through the bottom descending trendline of the flag formation, which will negate the pattern. Nio has support below at $21.77 and $20.25.