/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

Alphabet (GOOGL), Google’s parent company, has announced the acquisition of Wiz, a rapidly growing cloud security startup, for $32 billion in an all-cash transaction. While this is a hefty price tag, cybersecurity is a fast-growing industry, and the potential returns could be substantial if Google successfully integrates Wiz into its ecosystem. This move is a significant step forward in Alphabet’s ongoing expansion into cybersecurity, which is becoming increasingly important as cloud computing continues to dominate the digital landscape.

Alphabet’s stock has fallen 11.4% year-to-date, fueled by fears of a potential recession. Let’s look at how the Wiz acquisition affects Google’s business and whether it improves the long-term investment case for Alphabet stock.

Why Did Google Acquire Wiz?

With major enterprises and technology companies increasingly relying on cloud infrastructure, security is critical. This is why the demand for cybersecurity firms has grown. Wiz is a cloud security startup that launched in 2020. It provides a platform for cloud-native application protection (CNAPP), allowing organizations to identify and mitigate security threats in cloud environments.

Alphabet’s Google Cloud division has been fiercely competing with Amazon Web Services (AWS) and Microsoft Azure for market share. AWS currently dominates the cloud market with a 30% share, followed by Microsoft (MSFT) Azure (21%), and Google Cloud (12%). While Google Cloud has lagged behind, this acquisition may make it a more viable option for businesses concerned about cyber threats. Companies are more likely to migrate to Google Cloud if they believe their data is secure. Furthermore, Wiz’s existing customer base and revenue streams could benefit Google’s financial performance.

How Is Google Cloud Performing?

While Google Search contributes significantly to Alphabet’s revenue, Cloud is another key growth driver, thanks to its AI-powered offerings, robust infrastructure, and strategic customer partnerships. Google Cloud, which accounted for 12.3% of total revenue, reported a 30% year-over-year revenue increase to $12 billion in Q4. Full-year revenue hit $43.3 billion. In comparison, AWS generated $107.6 billion in revenue in 2024, a 19% increase over the previous year. Microsoft Cloud revenue, led by Azure, increased 23% to $135 billion in its fiscal 2024. In 2024, Alphabet’s total revenue increased by 13.8% to $350 billion, while earnings increased by 38.6% to $8.04 per share.

During Alphabet’s Q4 earnings call, CEO Sundar Pichai emphasized the strength of Google Cloud’s infrastructure. The company broke ground on 11 new cloud regions and data centers in various locations across the U.S., as well as seven new subsea cable projects to improve global connectivity. Google’s data centers have also seen significant efficiency gains, delivering nearly four times more computing power per unit of electricity than five years ago. This efficiency, combined with cost and performance benefits, has made Google Cloud a more appealing platform for businesses looking for AI-powered solutions. Google has also expanded its collaboration with Nvidia (NVDA), becoming the first cloud provider to offer the much-anticipated Blackwell platform. The CEO also highlighted how the rapid adoption of Google’s generative AI models — Gemini Flash, Gemini 2.0, Imagen 3, and Veo — has fueled the segment's growth.

Beyond AI development, Google Cloud has expanded its presence in AI-powered databases, data analytics, and cybersecurity. Adding Wiz’s solutions could increase Google Cloud adoption and enable Google to charge a premium for enhanced security features. Despite the aggressive expansion, Alphabet maintains a sturdy balance sheet. It had $96 billion in cash and marketable securities at the end of the quarter, alongside a free cash flow of $72.8 billion.

Is GOOGL Stock a Buy, Hold, or Sell on Wall Street?

Following the acquisition announcement, BMO Capital analyst Brian Pitz reaffirmed an “Outperform” rating on GOOGL stock, with a $230 price target. Pitz emphasized the deal’s strategic importance, citing its potential to accelerate AI innovation and strengthen Google’s competitive advantage in cloud security. Furthermore, the acquisition could increase user trust in Google Search and YouTube’s AI tools. While the antitrust landscape remains uncertain, Pitz believes the deal is likely to be approved due to its clear strategic benefits.

Separately, Canaccord Genuity analyst Maria Ripps also maintained a “Buy” rating with a price target of $225. Ripps believes that while Wiz’s valuation is high, its rapid growth and advanced security capabilities will drive long-term cloud expansion, making the acquisition a game-changer for Google’s cloud strategy.

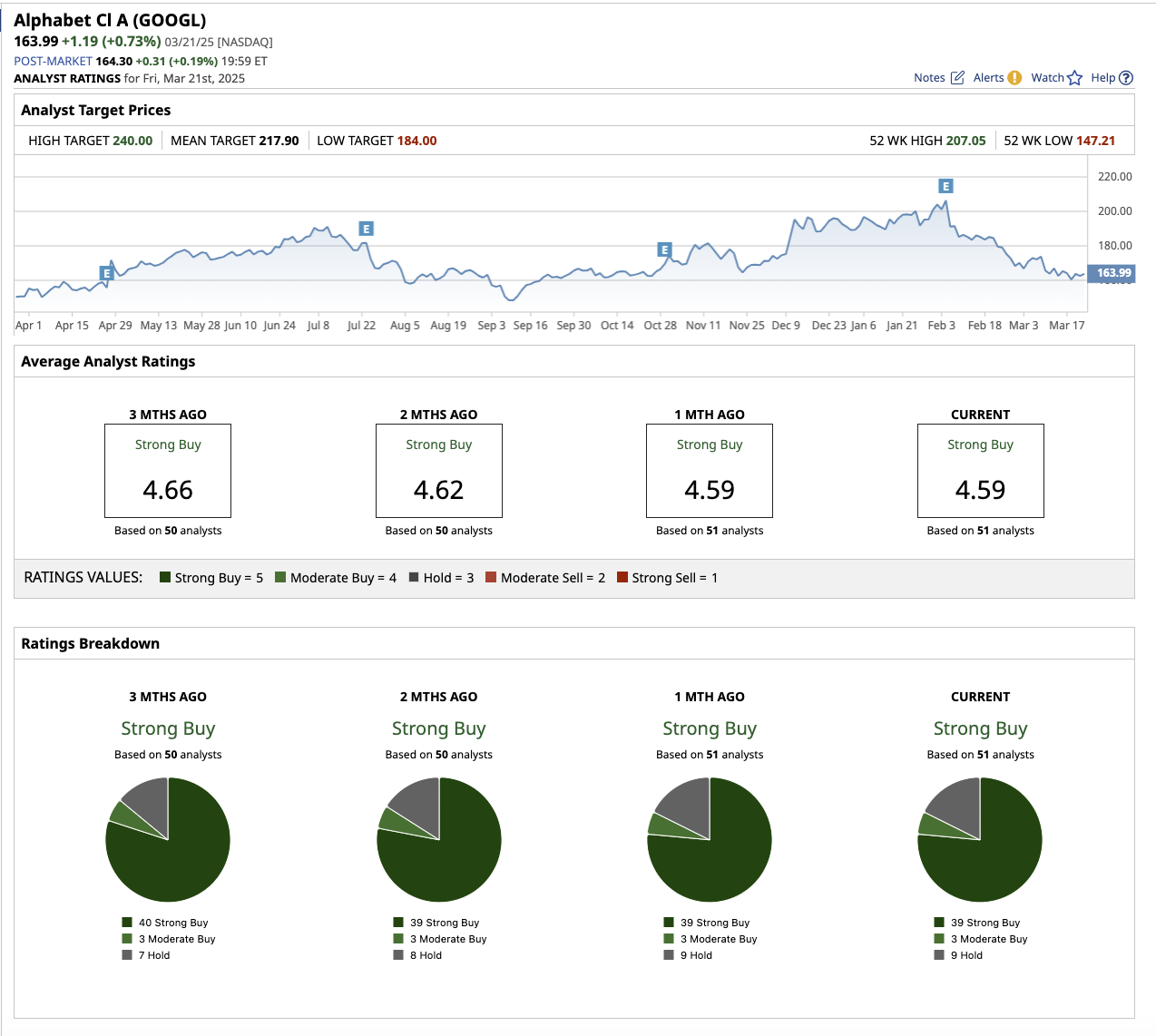

Overall, on Wall Street, GOOGL stock is a “Strong Buy.” Of the 51 analysts covering the stock, 39 rate it a “Strong Buy,” three say it is a “Moderate Buy,” and nine rate it a “Hold.” The average target price of $217.90 implies the stock can rise by 30% from current levels. Plus, its high price estimate of $240 suggests the stock has an upside potential of 44% over the next 12 months.

The Key Takeaway

Google Cloud’s AI-powered offerings and infrastructure investments make it one of the top three players in enterprise cloud computing. As businesses continue to prioritize AI-powered solutions, Google Cloud is poised for long-term growth in 2025 and beyond. The Wiz acquisition strengthens Google Cloud’s security capabilities, making it a more appealing option for enterprises. The global cybersecurity industry is expected to generate $271.9 billion by 2029. GOOGL stock remains a “Strong Buy” for long-term investors, thanks to its expansion into cybersecurity, which has strengthened its competitive position.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.