KEY POINTS

- Germany has dumped more than half of its Bitcoin holdings, as per the latest data

- King said it's "safe to say Bitcoin is failing" the German government's liquidity test

- Aljarrah agreed that the asset is "artificially inflated" and is due to rise then crash again

- Many Bitcoiners came to the token's defense as $BTC reclaimed $58,000 early Wednesday

The German government's continuing sell-off of its seized Bitcoin stash has rocked the crypto community to the core, with some blaming the said activity for the price downtrend the world's first decentralized digital asset suffered in recent weeks.

While some crypto experts and analysts have been working to keep a balance in market sentiment, some financial experts have different perspectives, and their contrary views has triggered a debate among Bitcoiners.

How much has the German government dumped so far?

Before it started selling off its $BTC treasury, the government had over 50,000 Bitcoins seized from a movie piracy site. The stash was worth around $3 billion, and based on Arkham Intelligence data that shows government's wallet now only has around $1.3 billion worth of the digital currency. As such, Germany already dumped more than half of its $BTC holdings.

Germany isn't just dumping for cash

Jacob King, the founder of financial newsletter WhaleWire, took to X (formerly Twitter) Tuesday to share his take on the German government's dump that has led to increasing fear in the crypto community.

The German government isn’t just selling their seized #Bitcoin to get a few extra billion dollars in the bank. That’s pocket change for them.

— Jacob King (@JacobKinge) July 8, 2024

This is a test. They want to evaluate the financial stability and security of Bitcoin by testing how much “real” demand there is. Hint:…

"The German government isn't just selling their seized Bitcoin to get a few extra billion dollars in the bank. That's pocket change for them. This is a test. They want to evaluate the financial stability and security of Bitcoin by testing how much 'real' demand there is," he said.

He went on to note that the world's top digital asset by market value has already plunged nearly 25% "when they've barely begun." King said nearly 48% of orders are being rejected "because there's not enough buyers." Based on the said figures, King said it's now "safe to say Bitcoin is failing the test."

Bitcoin is 'artificially inflated'?

King further argued that the popular digital currency is just "being propped up by fraudulent Chinese exchanges and stable coins."

Versan Aljarrah, the founder of independent investment advisory firm Black Swan Capitalist, couldn't agree more. He said the cryptocurrency is "artificially inflated by stable coin liquidity," and it's "not negative talk" but "a fact" relying on data.

It’s actually true, you are correct, Bitcoin is artificially inflated by stable coin liquidity which is pumps it higher every 4 years. We’ve done a very deep analysis by simply layering charts and primarily following the money, anyone who looks will be able to see this as clear…

— Vandell | Black Swan Capitalist (@vandell33) July 9, 2024

Aljarrah advised holders of the coin to enjoy the ride and come up with an "exit strategy" and a cash-out plan when the digital asset climbs to a new all-time high since the coin will ultimately "crash again" when insiders and crypto whales "use retail peasant investors as liquidity."

Bitcoin test debate ensues

Matthew Kratter, a prominent Bitcoin hodler – a coin holder who holds the asset long-term, regardless of market sentiment – called out King for being a "Tether ($USDT) truther" and "FUD (fear, uncertainty and doubt) spreader." For Kratter, the German government has other, more serious problems to resolve instead of testing Bitcoin liquidity.

Jacob is clearly a Tether truther, FUD spreader, and general idiot. German government has much bigger problems on their hands than testing BTC liquidity

— Matthew R. Kratter (@mattkratter) July 9, 2024

The International Monetary Fund (IMF) said in a late March report that "Germany is struggling," being the only Group of 7 (G7) nation to suffer an economy shrink in 2023. It is due to become the slowest-growing economy in the group again this year, the IMF projected.

Many Bitcoiners went on to challenge the numbers provided by King, but he has yet to respond to questions that doubted if he had data to back his statements. Other users believe the digital coin hasn't really failed the liquidity test as seriously as King deems so.

Because you have some type of evidence to back your statement right?

— Defi_Dawg 🩸🩸🩸 (@StillDefi99) July 9, 2024

Where do you see 48% of orders are getting rejected? Lol

— Matt Mercurio (@onthegamble) July 9, 2024

I think it didn't fail that much.

— Our Crypto Talk (@ourcryptotalk) July 9, 2024

$42k would have been on if there was no demand amidst these sellings

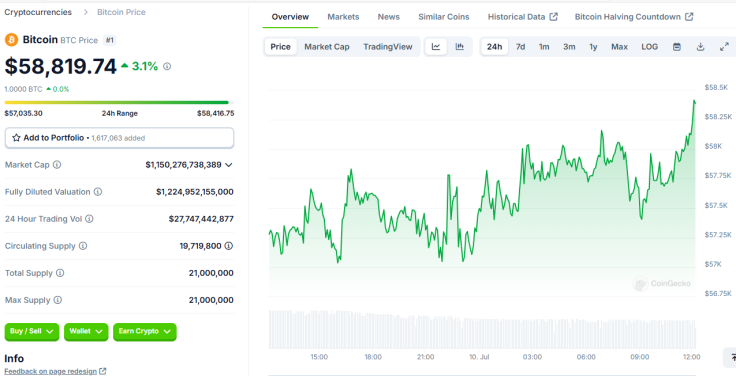

Bitcoin reclaims 58K

Interestingly, the debate around Bitcoin's liquidity comes as the digital asset continues to be in the green following last week's pressure. $BTC prices climbed above $58,000 late Tuesday. As of early Wednesday, the coin is trading between $58,600 and $58,800, according to CoinGecko data. It has been up by over 2% in the last 24 hours.