Shares of Best Buy (BBY) look good on Thursday, up about 7.5% on the day. However, the stock looked even better earlier in the session when it was up more than 12%.

The rally comes after the company reported better-than-expected earnings, although the fade from the session high comes amid increasing volatility in the current news-driven environment.

Of course, the fade also comes from an important technical area on the chart (more on that in a second).

Best Buy beat on earnings, missed on revenue, announced a $5 billion buyback plan and raised its dividend by 26%. Under that circumstance, I can see why the stock is rallying.

It follows the better-than-expected results from Target (TGT) earlier this week as well, while that stock has held up pretty well following the rally. In other words, there has been good news in the industry.

Now the question becomes, can Best Buy continue higher or will the market-wide volatility be too much to handle?

Trading Best Buy Stock

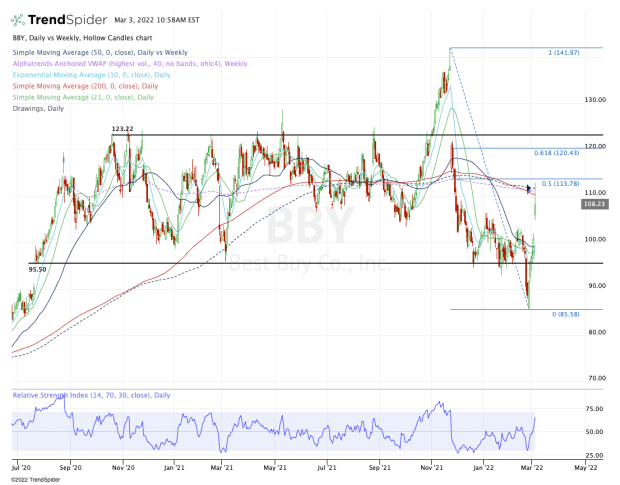

Chart courtesy of TrendSpider.com

Earlier this morning, Best Buy stock was pushing above $112, a significant move given the number of key measures between $110 and $112.

Specifically, Best Buy was pushing above the 200-day and 50-week moving averages, as well as the weekly VWAP measure.

If the stock could clear this area, it would put the 50% retracement in play near $113.75 and allow the bulls to harness control.

Not that they can’t gain control now, but clearing such a significant area on the chart would have really given investors a vote of confidence. Now we must keep an eye on that upside area.

A push back through it, as well as $114, opens the door to the 61.8% retracement of the entire range, up near $120. That will also bring resistance into the discussion between $123 and $124.

On the downside, keep an eye on today’s low, which is currently at $104.86. A move below $104.75 could open the door down to the gap-fill level near $102, followed by the $100 mark.

Below that and we’re dealing with prior support near $95. Keep in mind, a full unwind of the stock could ultimately put last month’s low back in play near $85.

However, because the company reported a pretty solid earnings report, my gut would lean away from this type of extreme outcome. If it happens, we’ll likely have bigger problems on our hands than Best Buy.