AT&T (T) is rallying on Thursday, up more than 4% after reporting earnings. For long-time shareholders, it’s been quite a nice reprieve over the last few weeks.

The stock rode higher earlier this month once the company completed its spinoff of Warner Bros Discovery (WBD). After consolidating over the past week, shares are on the run again.

Today’s rally comes after the company was able to deliver a top- and bottom-line earnings beat.

When Netflix (NFLX) reported earnings a few days ago, it reported a dip in its subscribers. This had investors worried about streaming losing steam. AT&T proved that theory wrong.

The HBO and HBO Max unit added 12.8 million new subs versus the same quarter last year and 3 million in the most recent quarter.

So far, the report seems to be giving the stock a nice jolt to the upside. With a low valuation and a 5.5% dividend yield, are the technicals about to start working in AT&T’s favor as well?

Trading AT&T Stock

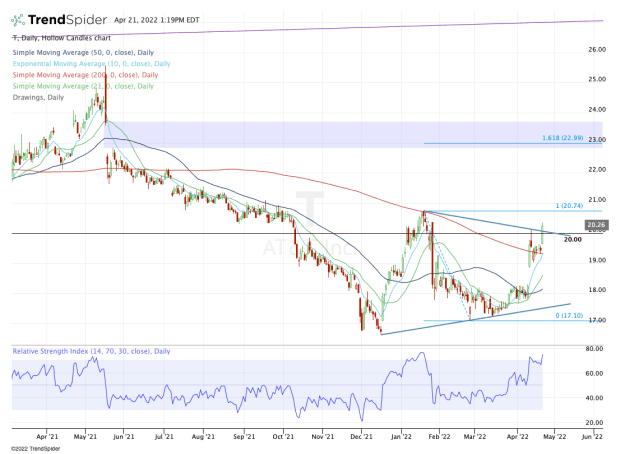

Chart courtesy of TrendSpider.com

Despite a market-wide reversal in the main US stock indices, AT&T stock is pushing higher. Shares are going weekly-up over last week’s high of $20.12. Notably, it’s also thrusting the stock above the key $20 level.

Assuming the stock can close above this level, it will have investors looking at the 2022 high at $20.74.

AT&T has been a terrible laggard over the years. However, could it be a leader in this current environment where defense stocks are leading? For instance, Verizon (VZ) — which reports earnings tomorrow — has held up quite well this year.

If AT&T can maintain momentum and clear $21, it’s not out of the question that the stock could eventually climb toward $23. There we find the 161.8% extension and a major gap from last May.

If the stock goes on to fill that gap, it will send AT&T up to $23.58.

On the downside, bulls should use caution if the stock can't stay above $20. That wouldn’t necessarily mean the end for AT&T stock, but it would keep the $19.25 level in play.

If it were to lose this level — and thus the 10-day and 200-day moving averages — it would open the door to the 21-day and the gap-fill level down at $18.30.

For now though, the relative strength that AT&T’s displaying is encouraging. Let’s not fight the trend until it ends.