When it comes to the tower market, American Tower AMT is an 800 pound gorilla.

It, Crown Castle CCI, and SBA Communications SBAC together command 88% market share of America’s 112,000 cellular towers. And while the global market is a bit more fragmented, American Tower’s portfolio of 221,000 tower sites is nothing to sneeze at.

The world has a global thirst for Smartphones and mobile data. Telecom companies like AT&T T and Verizon VZ want the monthly plans with subscribers, but they don’t want to spend the hefty capital required to build the towers. So they hire American Tower to build and operate them, who then leases the space to multiple tenants to house the equipment required for transmission. The leasing deals can last for years if not decades, and they typically have built-in pricing escalators. All tower operators generally enjoy mid-single-digit billings growth and 90%+ tenant retention rates.

American Tower is no different, posting 4% billings growth and 14% overall revenue growth (much of this coming from new towers constructed or acquired). This is a market where the big get bigger, and the need for capital efficiency lead to a market oligopoly controlled by three domestic players.

Do you want your portfolio to outperform the market? Our lead advisors uncover the top 7 opportunities in the stock market each month for our members. Click here to try 7investing for $1.

American Tower’s Capital Allocation is Key

In my initial report, I noted the key for investing in American Tower would be how efficiently it deployed its gushing cash flows into projects that provided future returns. It’s a cash-compounding machine, who uses its cash internally for growth and then shares the rest as a tax-advantaged dividend.

American Tower has typically allocated its adjusted funds from operations (“AFFO”; similar to operating cash flow) in the following ways:

- 50% is paid out as a cash distribution. As a Real Estate Investment Trust (REIT), AMT must pay out 90% of its pre-tax operating income as distributions in order to benefit from favorable tax treatment.

- 25% is used for internal capital expenditures. This is what it uses to build new towers in areas that don’t yet have coverage.

- 25% is used for acquisitions, to buy and then operate towers from others.

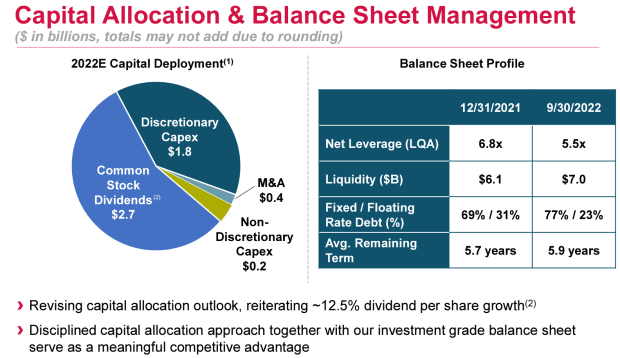

American Tower funds those activities using leverage, since the project returns outpace the costs of borrowing debt. The company’s Net Leverage Ratio — its Net Debt Position divided by its Adjusted EBITDA — has traditionally been between 3x – 5x.

At the end of 2021, AMT’s Net Leverage Ratio peaked at 6.8x, though it’s recently come down a bit to 5.5x (in the most recent quarter). The company is stepping on the accelerator for global expansion, which provides opportunity but also introduces new risks.

The Opportunities and Challenges of Investing in India

One country that American Tower has its sights on is India, whose growing middle class is embracing cell phones. In 2017, American Tower acquired 20,000 tower sites in India from local telecom operator Vodafone Idea (VIL) and then gave it preferential rights for future contracts. Expansion into India has continued for the past five years. American Tower recently added 1,200 new sites there during its most recent third quarter; which accounted for 75% of the 1,600 new sites it added globally.

Yet while the growth promises of India are intriguing, VIL is having some serious capitalization problems. Due to heavy debt loads and regulated rate caps, VIL hasn’t had sufficient cash on-hand to pay back loans from the Indian government or to pay American Tower’s leasing agreements. VIL is exploring strategic options, which has included converting past due amounts into corporate equity ownership by India and/or by American Tower. It’s not exactly a good sign when your largest partner in a region is so cash-strapped that it has to offer you an ownership stake in order to make due on its accounts payable.

The relationship with India’s government is also a challenging one. In 2019, India increased the license fees and spectrum usage charges it imposed on its largest carriers (including VIL), which required them to renegotiate their leasing rates with American Tower.

The 7investing Key Takeaway

The challenges in India are a great reminder that American Tower’s international expansion opens it up to a world of new opportunities; yet it will also introduce new challenges that will require flexibility. The company recently signed a Master License Agreement with Airtel Africa AAFRF, who also has ambitions of growing quickly across the continent. American Tower’s Africa organic tenant billings grew 6.8% in the third quarter — which was the fastest-growing region behind only Latin America. The company is committing to build low-carbon towers for Airtel’s newest 5G cellular offerings in Nigeria, Kenya, Uganda and the Niger region.

American Tower saw its funds from operations contract 1% in the quarter, mostly due to the merger of T-Mobile and Sprint several years ago that is finally getting around to the consolidation of certain towers and contracts. Yet its revenue and billings growth remains strong, its 61.5% adjusted EBITDA margin remains fantastic, and the 12% boost to its dividend is showing no sign of slowing down.

Here is a look at how its capital allocation looked in Q3 2022:

- $684 million to paying the dividend (62% of AFFO)

- $459 million for capital expenditures — primarily in India (41%)

- $141 million for acquisitions — the largest being a $34 million urban data center in Miami (12%)

The cost of those activities exceeded its $1.1 billion of AFFO, though American Tower did raise $2 billion in a summer equity offering to more than cover the slight quarterly debit.

I’ll be keeping an eye on its debt load, while also respecting that 77% of it is at fixed rates (i.e. won’t be impacted by rising rate environment). We’ll see how things work out in India and whether it uses some of its cash flow to reduce debt in the coming quarters.

About the author: Simon Erickson is the founder and CEO of 7investing. He is one of the stock market’s most forward-looking investors, focused on identifying disruptive innovation and finding developing trends before others may even be aware of them.

Simon previously worked for seven years at The Motley Fool, where he most recently served as the lead advisor of Motley Fool Explorer. In this role, Simon ran an investment newsletter that profiled innovative trends, personally directed more than $1 million of funds into a real-money investment account, and managed a team of 22 people. Explorer was recognized as one of TMF’s fastest-growing and highest customer retention newsletters.