Shares of Alphabet (GOOGL) (GOOG) started Friday off under pressure, following a disappointing earnings report on Thursday evening.

Not too far into the session though and you’d hardly notice the dip. At last check, Alphabet stock was almost flat on the day, up considerably from its near-5% loss at the open.

In fact, it was a tough open for other FAANG holdings too. Apple (AAPL) and Amazon (AMZN) were both on the decline due to earnings.

The robust jobs report before the open didn’t help. While a strong labor report eases fears of a recession, it increases the fear of higher interest rates from the Federal Reserve.

As for Alphabet specifically, the company delivered a top- and bottom-line miss. While that created morning weakness, the buyers have since stepped in. The question is, can they continue to elevate Alphabet stock?

Trading Alphabet Stock on Earnings

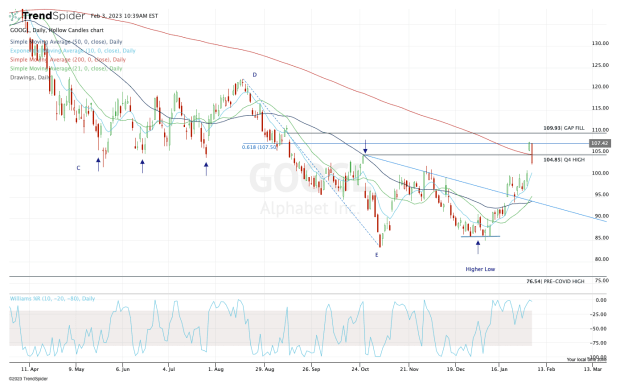

Chart courtesy of TrendSpider.com

Unless it’s a truly horrendous quarter, Wall Street continues to give a pass to companies reporting earnings right now. We’ve seen this trend for weeks now and that action shouldn’t go unnoticed.

For bulls’ sake, it actually would have been a good thing to see a test of the $100 level on this morning's dip. Instead, Alphabet only dipped to $102.58.

Had it tested $100 though, we would have gotten a test of recent resistance and active support via the 10-day moving average, while filling the earnings gap.

Now pushing higher though, one area stands out: $107.50 to $107.85. The former is the 61.8% retracement, while the latter is the pre-earnings high.

If the stock can clear that area, it will show clear control by the bulls.

In that case, it opens the door up toward $110, where there’s a gap-fill from September. Above that puts the 78.6% retracement in play near $113, followed by resistance near $120.

This statement goes for Alphabet stock, but also goes for most stocks right now: Alphabet stock is trading much, much better. Wether we are in the midst of a bear market or just endured it, it doesn’t matter right now — the bulls have control. There are plenty of overhead resistance zones and it will likely not be a march straight back to the highs, but things are getting much better.

.jpg?w=600)