If you are trying to decide between an IRA vs. 401(k), count yourself lucky. Not everyone's employer offers 401(k)s, and many working people feel too cash-strapped to contribute to a retirement account. And that's a shame — because these popular accounts act as powerful, tax-advantaged ways to save toward retirement. Given common concerns about the Social Security trust fund, which is projected to run out of money as early as 2033, IRAs and 401(k)s are even more crucial for a secure retirement.

While they share many characteristics, there are also key distinctions to be aware of when comparing an IRA vs. 401(k). For example, many 401(k) plans offer an employer match up to a certain amount, while IRAs lack this feature. If you understand these similarities and differences, you can compare them to determine the best way to save based on your circumstances and goals.

IRA vs. 401(k) — or both?

Here's the good news: you don’t have to choose between an IRA or a 401(k). It’s perfectly fine to use both. After comparing the features of each plan, you may elect to save a portion of your paycheck in a 401(k) but contribute additional money to an IRA. Or you may decide to contribute the maximum amount to each.

Do you have access to a plan?

The first difference lies in who may be eligible for each type of plan.

401(k)s are employer-provided. To open a 401(k), you need to work for an employer that sponsors one and qualify for participation based on their criteria. Generally, if you are at least 21 and have worked with that employer for at least a year, then you qualify.

IRA stands for an individual retirement account. That “individual” part means you can open one independently, unrelated to your employer. However, you can only contribute to an IRA with earned income, such as wages, salaries, tips, bonuses, commissions, and self-employment income.

If you are married, consider opening a spousal IRA if you or your spouse qualifies.

If you are self-employed, you still have choices. For example, you might opt for a SEP IRA or a solo 401(k).

Contribution limits

Every year, the IRS sets contribution limits for IRA and 401(k) accounts, usually with some changes to account for inflation.

IRAs. You can contribute a maximum of $7,000 in 2025. Catch-up contributions for taxpayers 50 and older are limited to $1,000, for a total contribution of $8,000. These numbers are unchanged from 2024.

401(k)s. Eligible savers can contribute $23,500 to these accounts in 2025, up from $23,000 in 2024. Savers between 50 and 59, or over 63, may make catch-up contributions of $7,500 2025 for a total contribution limit of $31,500 in 2025.

There's exciting news for those aged 60-63 in 2025. The "super catch-up" provision allows them to contribute an additional $11,250 instead of $7,500 allowing then to contribute $34,750 in total for 2025.

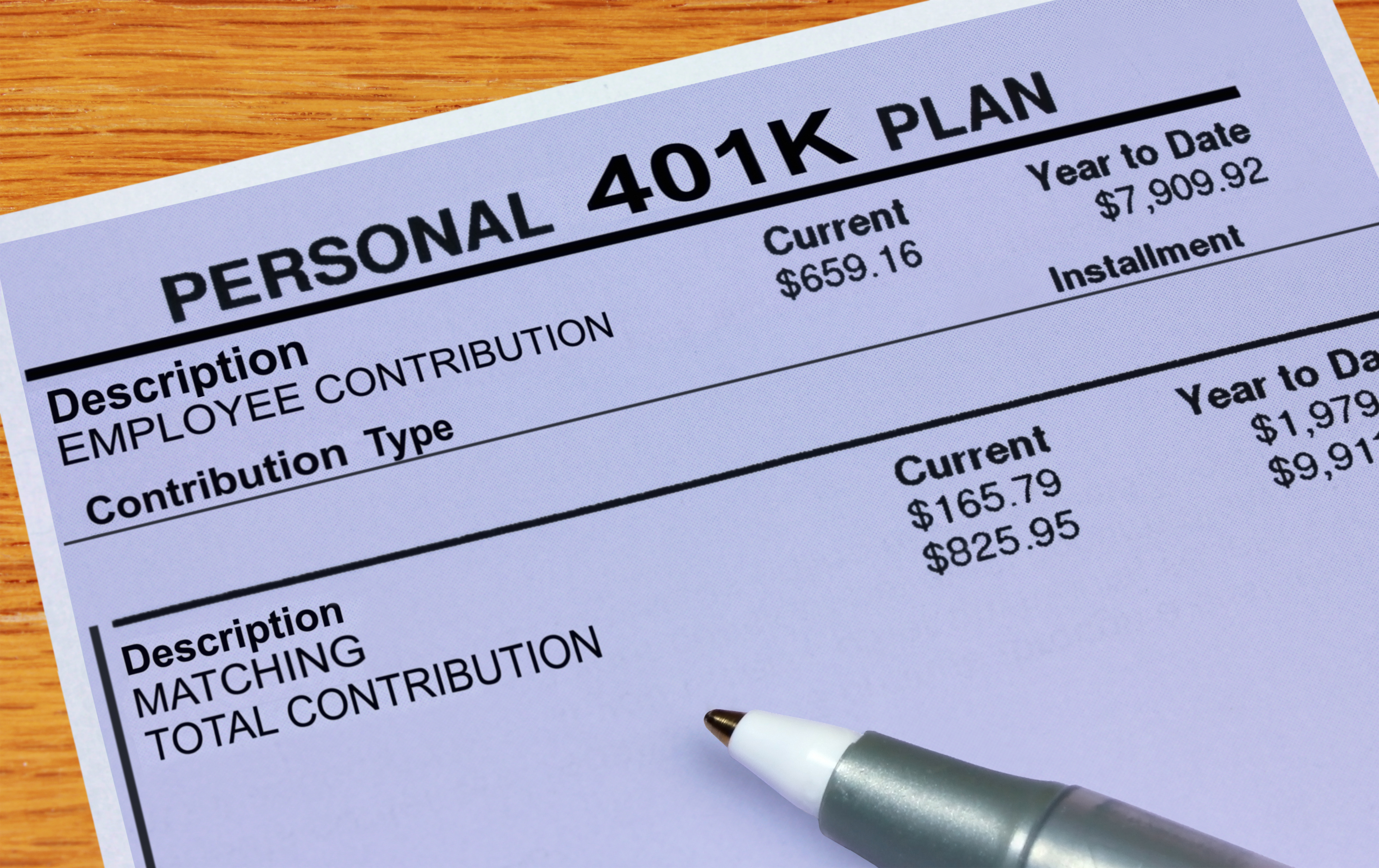

Matching contributions

Employers can also contribute to your 401(k) account through matching contributions, and many do. This additional money provides a powerful boost to your savings; with careful planning, you might even become a 401(k) millionaire. So, when available, it is usually best to prioritize saving in your 401(k) until you receive every matching dollar you can. Each employer has their own matching formula, but all follow the same general format in which they match a portion of your contributions up to a maximum percentage of your salary.

For example, your employer may provide a 50% match up to 10% of your salary. Assume you make $100,000. For every dollar you contribute up to $10,000, your employer will contribute an additional 50 cents. So you could receive an extra $5,000 per year just for saving. After 25 years, that would amount to an additional $365,000, assuming your account earns 8% annually.

There's no match option with an IRA. However, two fintech firms are offering to match IRA contributions. Robinhood promises to match 1% of IRA contributions for regular customers and up to 3% for those who pay an additional annual fee as "Gold" members. SoFi offers a 1% match for IRA rollovers and contributions. However, before you open an IRA with these companies, ensure they have the investments you'd like to put in your IRA and check for fees and limitations. You may be better able to build IRA wealth through smart investment choices than a match.

Tax deductions

One of the main advantages of retirement accounts is the tax benefits they provide. This includes the ability to deduct your contributions and defer paying income tax until withdrawal.

However, if your employer offers a retirement plan, you may not be able to deduct your IRA contributions depending on your income (as determined by your modified adjusted gross income (MAGI) and filing status.

You can always get the tax benefit of your traditional 401(k) contributions regardless of your income. Income tax rates are progressive, so higher earners benefit more from deductions. Consider your income and deductibility of contributions if you are covered by a 401k.

Roth IRA vs Roth 401(k): Income Limits

Another income limit that can hinder your IRA savings is the Roth IRA income limit. Roth IRAs have the potential to be very valuable, but you can only contribute to a Roth IRA if your income falls below certain thresholds.

However, many 401(k) plans also provide Roth options. Your income does not affect your Roth 401(k) contributions. As long as you work for an employer that offers one, you can contribute to a Roth 401(k) regardless of how much money you make.

Early withdrawals

If you withdraw from a tax-deferred retirement account (traditional IRAs or 401Ks) before you reach 59-½, you usually are subject to a 10% penalty on top of regular income tax. However, with a traditional 401(k), you may be able to take advantage of the rule of 55. If written into your plan’s documents, it provides an exception to the early withdrawal penalty if you retire at 55 or later. This rule does not apply to IRA withdrawals.

You may withdraw penalty-free from Roth IRA and 401(k) accounts if you withdraw from the amount you contributed, not on investment gains. This extra layer of flexibility means you can fall back on a Roth account in an emergency.

The rules for early withdrawal from IRAs and 401(k)s are complex. If you are tempted to go this route, run your plan by a financial planner or tax adviser to ensure you won't be penalized.

Investment options

Your investment choices inside a 401(k) will be limited, typically to a specific list of mutual funds. Depending on the choices available, you may not be able to create the portfolio you’d like within a 401(k). With an IRA you’ll often have access to a much wider range of investments to include stocks, bonds, mutual funds, and ETFs. You can also add Treasury bonds, bills and notes to an IRA.