Apple (AAPL) stock is off the low of the day but is still off more than 2% following a downbeat iPhone report.

The Bloomberg report says that iPhone demand is not as strong as some investors may have hoped and that plans to boost production are now off the table.

The stock’s decline makes for an interesting market dynamic and comes amid a stock market and bond market rally — one that’s occurring without Apple.

Earlier this month I called Apple one of the “last stocks standing” as the bear market continued to drag equities lower.

Amid the selloff — including a portion where the S&P 500 declined in six straight sessions — Apple mostly held up pretty well.

Trading Apple Stock

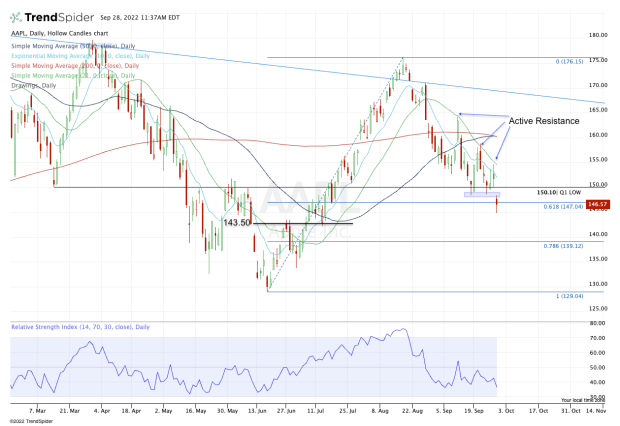

Chart courtesy of TrendSpider.com

While megacap tech peers like Microsoft (MSFT) and Alphabet (GOOGL) (GOOG) earlier this year were relative-strength leaders, these two stocks recently made new 52-week lows.

That really just left Apple — and to some degree Tesla (TSLA).

As of yesterday’s close, Apple stock was still up 17.5% from its 2022 low, an impressive feat given that the S&P 500 made new lows yesterday.

On Tuesday, Apple stock rallied toward active resistance via the 21-day moving average. The bulls’ hope for today’s decline would have been for it to find support near $148.

As illustrated above, the $148 area marks the low for the past two weeks.

If Apple stock can reclaim and close above this area, it’s a win for the bulls, even though they still have a lot of work to do -- meaning that Apple stock is still below $150, as well as active resistance via the 10-day and 21-day moving averages.

Should Apple stock stay below $148, as well as the 61.8% retracement near $147, then that keeps more downside in play.

Specifically, it could put the $143 to $144 area on the table, followed by the 78.6% retracement near $139.

A break of all these levels could put the low- to mid-$130s back in play. If that happens, it’s hard to imagine that the S&P 500 or Nasdaq will be holding up very well.