(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

Tuesday stocks were up and the investment media (CNBC and the like) are sharing details on why that is the case. And why you should consider being bullish.

Note that Monday stocks fell and those same media outlets put out scary headlines telling you why to be bearish.

The investment media does not care about accuracy. Nor about helping you invest better. They just want maximum eyeballs on their information to sell advertising space.

This means there is no accuracy...no consistency...no value!!!

What should you do instead?

Read on below for the answer...

Market Commentary

No doubt the FOMO rally today seemed very tempting to participate in. It just kept rolling higher minute by minute because in general computer driven traders are momentum based and they just piled in on top of each other.

Unfortunately, today’s gains have very little to do with the long term picture...which remains bearish.

Simply nothing has happened to make anyone in their right mind think that the bear market is over as inflation is a deadly economic disease that is still far too virulent. On top of that you have a Fed that is gung ho in squashing inflation by means of aggressive rate hikes that most certainly will dampen an already weakened economy (-1.6% in Q1 and Q2 GDPNow estimate at -1.5%).

This process is far from over. Which is why economic decline is far from over. Which is why share price decline is far from over.

This is a very short version of the much more in-depth discussion I had on this topic during the July 11th Platinum Members webinar (watch it here now >)

Note that I originally felt that this bear market would end sometime in the 2nd half of the year making it a shorter than the average 13 month bear market. (Measured from previous peak to bear market bottom).

That outcome may still be possible. Unfortunately this past month lingering above the recent bottom is starting to have me pondering that this may be more of elongated bear market like we endured from 2000-2003.

The great similarity is that in both scenarios stock valuations got a bit stretched for the overall market. Especially true for the most exciting growth stocks that rallied to great heights only to plummet back down to earth.

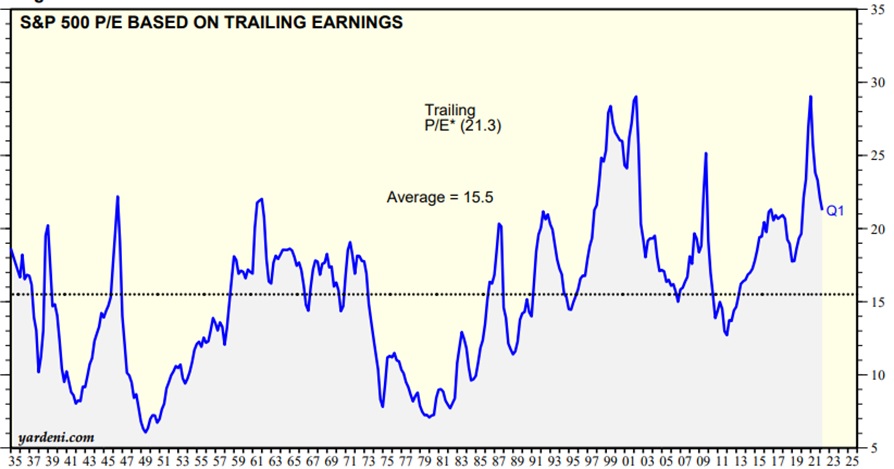

I know some of you are thinking that valuations were much more extreme during the tech bubble of the late 1990’s and thus not a good comparison. However, when you see the S&P 500 (SPY) chart below you will see that the overall PE of the market was quite similar showing that valuations got too stretched across the board.

I have shown this valuation slide on webinars in the past much to everyone’s shock just how eerily similar the peak PE in early 2022 was versus the tech bubble back in 2000. And yes, we have come down from that peak...but still well above the long term average PE of 15.5 which we should go below at the bear market bottom.

Now that we appreciate the similarity in the heights of valuation we now can appreciate how the path of the current market may mirror what we saw back in 2000 to 2003. That being a long winding road with many drops...followed by many false rallies until final bottom was found about 3 years later in the spring of 2003.

So for as much as I have talked about the modern market moving faster than in the past...mostly because of the rise of computer based trading...maybe this one is the long slow burn like 2000-2003.

No this is not the base case right now. Still think it will work out quicker than that. However, it is interesting to contemplate the possibility as each bear market has its own unique properties. Just opening eyes to the possibilities and thus increasing everyone’s patience for the gains in our inverse ETF positions not immediately filling up like a jackpot.

Reity, is it possible the bear market is over?

Yes it is possible. But it is HIGHLY unlikely for the reasons already stated.

Again, my 7/11 webinar presentation goes into detail about the nature of bear market bottoms. And how many drops/rallies/drops cycles it takes til final bottom is found. So, there is truly nothing special to me about today’s bounce.

Now add to it that we are coming out of a bit of a stock valuation bubble thanks to the low rate TINA (There Is No Alternative....to stock investing environment of the past few years). And just like the last time we had to deal with excessive valuation levels from 2000 to 2003, it may take longer to let ALL THE AIR out of the bubble.

This knowledge gives me the necessary patience to not get pulled into these suckers rallies at first blush. But, yes, there is a limit to that patience as indeed the bear market bottoming process is different every time and there is always the possibility that the next bull market has emerged.

In my book I would not seriously contemplate that bottom has been found til we test the 100 day moving average for the S&P 500 (SPY) which currently rests at 4,148. The interesting thing about this spot is that it corresponds with where stocks bounced to in early May after the first time we dropped into bear market territory.

Breaking above that 100 day moving average level in combination with any serious signs of moderating inflation and I could be tempted to get back to being bullish. Or at least a much more balanced portfolio than the straight up shorting of the market that we are doing now.

It’s funny. During a bull market, investors have tremendous patience to wait through all kinds of pullbacks and corrections for the next leg higher.

Yet during the bear market...there is virtually no patience to be found. Kind of hypocritical when you think about it as they are both long term processes that take a while to work their way to completion.

This tells us to be students of history. To appreciate the economic cycle has not been fully played out to the downside which would include earnings decline and job loss.

When those shoes drop...and they will...then investors will quickly give up any false bullish aspirations. This will produce wave after wave of downside. And just when it seems like there is absolutely no hope...that is bottom...and that is when the next bull market will emerge.

When you appreciate these lessons from history it is hard to make any serious statement that we have already found bottom and that this is ripe soil to grow the next long term bull market. We need more downside for that to happen. And that means we need more time.

Be patient my friends. This may take a lot longer than previously believed. But still says that our bearish portfolio strategy is still on the right side of history.

What To Do Next?

Right now there are 6 positions in my hand picked portfolio that will not only protect you from a forthcoming bear market, but also lead to ample gains as stocks head lower.

Like the ample gain our members enjoyed in June as the market finally tumbled into bear market territory.

This unique strategy perfectly fits the mission of my Reitmeister Total Return service. That being to provide positive returns…even in the face of a roaring bear market.

Come discover what my 40 years of investing experience can do you for you.

Plus get access to my full portfolio of 6 timely trades to not just survive...but thrive in this brutal bear market environment that is far from over.

Wishing you a world of investment success!

SPY shares . Year-to-date, SPY has declined -16.80%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

Investors: Do You Have the Patience to Weather THIS Bear Market? StockNews.com