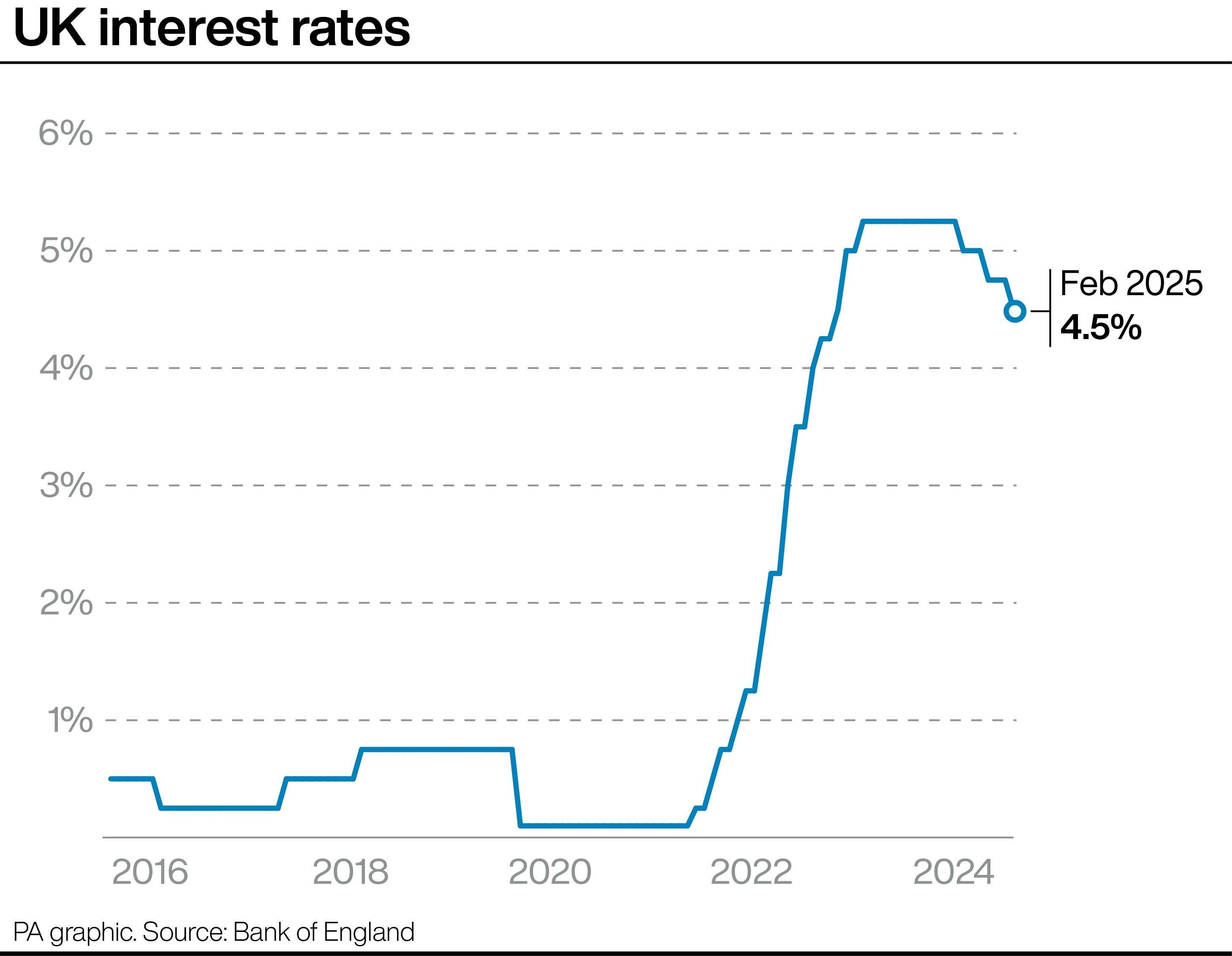

The Bank of England has cut interest rates to 4.5 per cent, but painted a gloomy picture for the UK economy by halving its growth forecast for this year and predicting a surge in inflation.

Policymakers voted for a quarter-point reduction, after similar cuts in August and November last year, bringing the base interest rate to its lowest level in more than 18 months.

But after the base rate rose as high as 5.25 per cent in late 2023, there is an indication it will continue to fall.

However, the Bank also warned that more people would be out of work, as firms swallow higher taxes and wage increases announced at the October Budget.

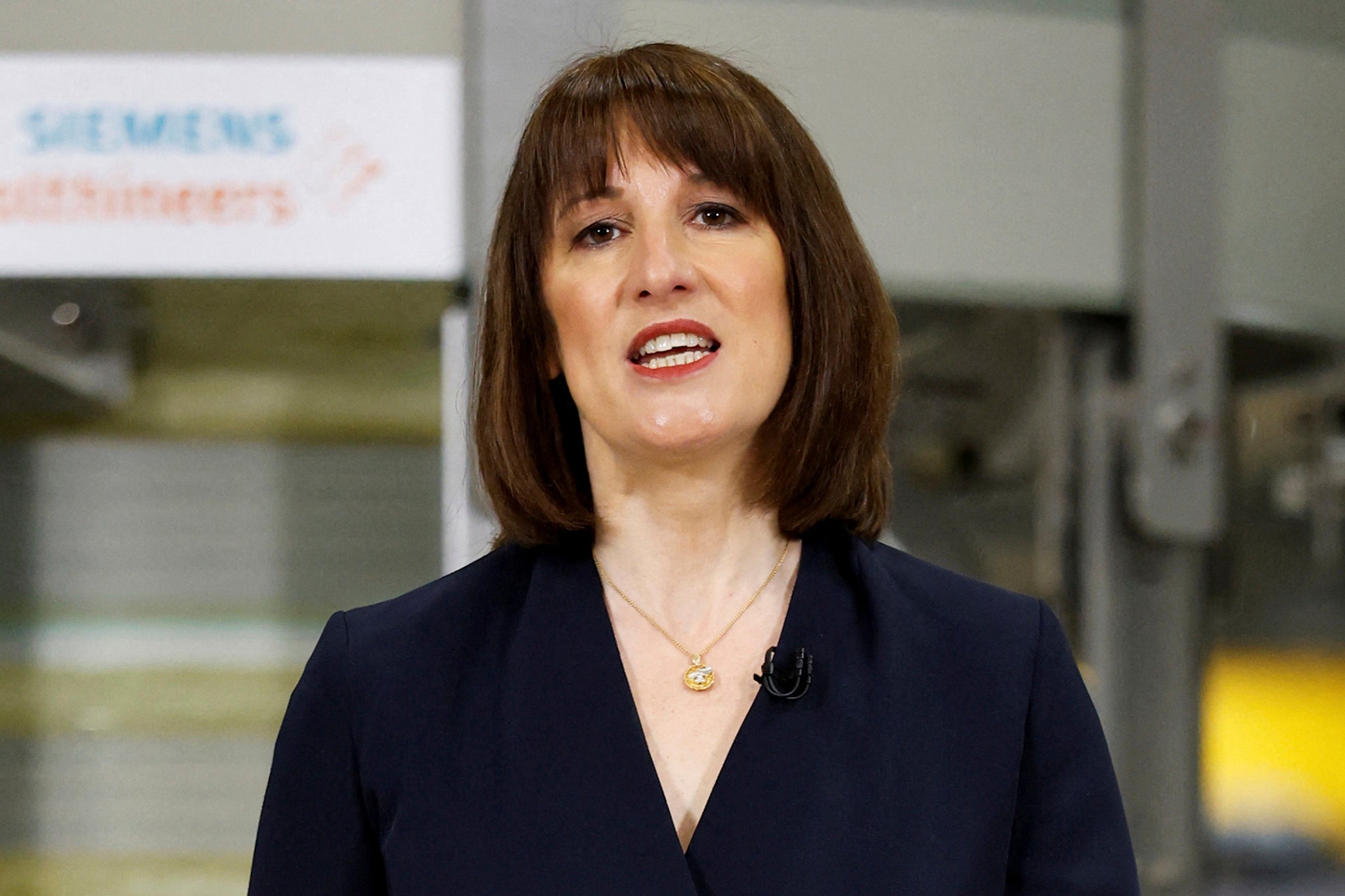

And it piled more pressure on Labour and chancellor Rachel Reeves by forecasting a steep drop in economic growth this year and saying interest rates would rise by more than expected.

The UK economy is only set to grow 0.75 per cent this year, down from a previous estimate of 1.5 per cent, before accelerating again in 2026 and 2027.

Inflation is rising faster than expected, and is now forecast to hit a peak of 3.7 per cent in late summer.

Key points

- Bank of England cuts inflation rates to 4.5 percent

- Bank of England downgrades growth forecast in blow to Reeves

- Interest rates: What does a 0.25% cut mean for your mortgage, savings and bills?

- Why does the Bank of England change interest rates?

Top Labour backer turns on party over Reeves’ ‘crippling’ Budget

17:54 , Jane DaltonRecap: The chancellor isn’t having a good week. One of Labour’s top business backers turned on Rachel Reeves, warning her Budget would cripple businesses and lead to swathes of job losses:

Top Labour backer turns on party over Reeves’ ‘crippling’ Budget

Besieged Reeves hit by even-worse-than-expected economic growth forecast

17:22 , Jane Dalton

Besieged Reeves boosted by Bank rate cut but hit by downgraded growth expectations

‘Much-needed confidence boost’ for home buyers

16:55 , Jane Dalton

‘Much-needed confidence boost’ for home buyers as mortgage rates fall

Opinion: You’ll need a bigger rabbit to pull out of your hat, chancellor

16:29 , Jane DaltonThe fear of stagflation – high rates, high inflation and low growth – was all over the Bank’s minutes, writes James Moore:

You’re going to need a bigger rabbit to pull out of your hat, chancellor

Savers could face surprise tax bill

16:05 , Jane Dalton

Some savers might be about to get a tax bill - how much interest can you earn?

Prime minister says people will be better off

15:40 , Jane DaltonSir Keir Starmer said people would have more money in their pockets as he welcomed the decision to cut interest rates.

The Prime Minister said: "I think it's important to look at what's happened. The interest rate has come down, that's the third drop in interest rates since July.

"That's good news because for many people watching this it means they will have more money in their pockets.

"Wages are going up higher than inflation, so again people feel better off. The minimum wage has gone up."

He added: "We are absolutely determined we are going to grow the economy, and I don't mean a line on a graph, I mean people feeling better off."

What the cut means for mortgage applications already in or accepted

15:10 , Jane DaltonBorrowers midway through a new application or about to refinance with the same lender may have some wiggle room:

Interest rates fall to 4.5 per cent – will your mortgage get cheaper?

More rate cuts forecast

14:44 , Jane DaltonOne economist predicts more base-rate cuts this year.

Frances Haque, chief economist at Santander UK, said: "Our forecasts are still pointing to a further three cuts this year - with the next to come in May, allowing the Bank of England to strike a balance between containing inflation, while boosting economic growth, and with that, supporting household confidence and the mortgage market."

Will your mortgage be cheaper?

14:16 , Jane Dalton

Interest rates fall to 4.5 per cent – will your mortgage get cheaper?

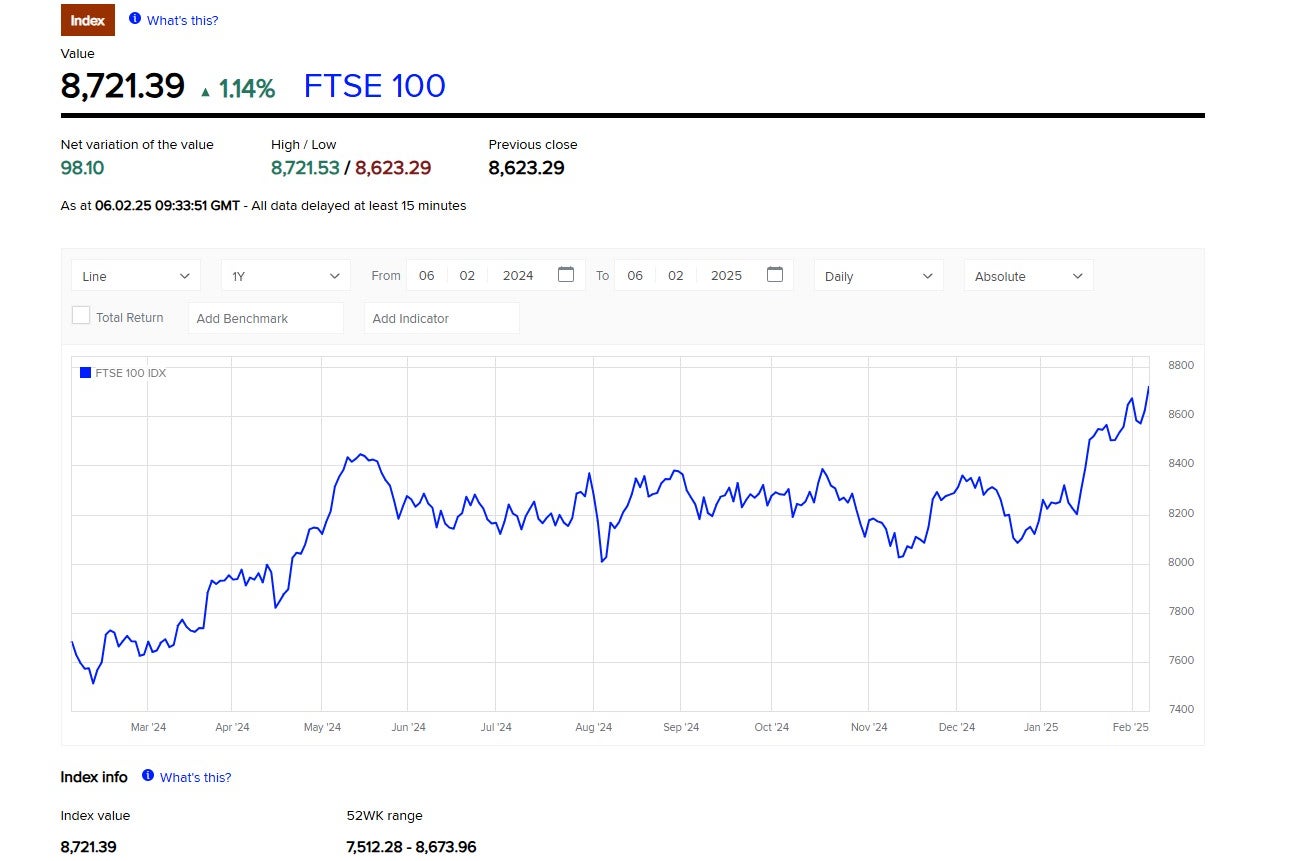

The FTSE-100 surged to an all-time high, even before the Bank announced its base-rate cut.

The index opened 0.8 per cent up on Thursday at 8,695.24.

Market analyst at Trade Nation David Morrison said: “The FTSE -100 has enjoyed a strong bullish run since before Christmas. Three weeks ago it broke out of a relatively tight trading range that had been building since May last year.”

Interest rates fall to 4.5 per cent – will your mortgage get cheaper?

13:40 , Holly EvansThe Bank of England (BoE) has cut interest rates - a big boost for some homeowners, as it directly impacts their repayments on mortgages.

But not for everyone, not necessarily immediately and certainly not all the time in the same way. It also affects savers, borrowers and pretty much everyone else, of course, but mortgages are an exceptional cost.

For a full year now, the base rate has been at four per cent or higher; having been at one per cent or lower for over a decade, it meant the fast rise through 2022 to 2024 saw people paying far higher amounts on mortgages than they had been used to previously.

Read the full article here:

Interest rates fall to 4.5 per cent – will your mortgage get cheaper?

US tariffs and potential trade war could impact growth

13:17 , Holly EvansAndrew Bailey has indicated that recently announced US tariffs, and a potential trade war linked to this, could slow down growth across the wider global economy.

The Governor of the Bank of England said: “If there were to be tariffs that contributed to a fragmentation of the world economy, that would be negative for growth for the world economy. I hope that doesn’t happen, but that could happen.

“The impacts on inflation are much more ambiguous.

“It depends on the reaction of other countries to the tariffs, whether that leads to a redirection of trade and what impact that has on exchange rates.

“You can’t have a clear and unambiguous forecast of what it means for inflation, but we will of course follow it very carefully.”

Bank of England 'moving too slowly', say think tank IPPR

13:15 , Joe MiddletonThe Bank of England is "moving too slowly" on cutting interest rates, the Institute for Public Policy Research (IPPR) has said.

Carsten Jung, principal research fellow and head of macroeconomics at IPPR, said: "The recent economic weakness in the UK is primarily driven by too high interest rates.

"While many commentators focus on project-by-project discussions that individually have small effects, the elephant in the room is high rates. Today's rate cut was therefore much needed, but the Bank is still moving too slowly.

"We are in the last mile of returning to normal rates of inflation. While the energy price shock is still rippling through the system, recent measures of underlying inflation show we are back to historical averages.

"By keeping rates high the Bank has been perhaps understandably cautious, but their current stance looks increasingly zealous."

Governor a 'strong supporter' of Reeves long-term growth plans

12:59 , Holly EvansAndrew Bailey said he is a supporter of the Chancellor’s long-term growth plans announced last week but that it would take time for the strategy to come through in its economic growth projections.

He said: “I am a very strong supporter of the growth agenda of this Government and what the previous government had.

“Growth rate in the UK has been low since the financial crisis – addressing those questions is critical, so I very strongly agree with the Chancellor.

“Structural policies take time to come through.

“As we are looking at a two to three year horizon, you wouldn’t expect that to come through quickly.

“But that does not mean it doesn’t matter and won’t have a positive impact.”

Global uncertainty poses risk to inflation

12:54 , Holly EvansGovernor Andrew Bailey said there was a “greater uncertainty in the current environment” and that it was important to take a careful approach to cutting interest rates.

He said there was also “global uncertainty” and said: “We are all witnessing it from day to day. There is heightened uncertainty. It is two sided.”

This is in the wake of Donald Trump’s tariffs on China, Mexico and Canada, and his threat to impose them on the EU and potentially the UK.

Mr Bailey also added there had been an increase in labour supply but no change in GDP which had impacted productivity.

Consumers more price conscious and holding back on spending

12:48 , Holly EvansGovernor of the Bank of England Andrew Bailey said: “Metrics of business and consumer confidence have deteriorated over recent months, and contacts of the Bank’s agents report that consumers are more price conscious and holding back on spending.

“This is consistent with a slowdown in demand.

“Equally, the disinflation process has been slow too and both services price inflation and pay growth remain at elevated levels.”

Road ahead will have bumps, says Bank of England governor

12:41 , Holly EvansGovernor of the Bank of England Andrew Bailey has said there will be “bumps” in the road to bring down inflation.

He said: “We expect to be able to cut the Bank rate further as the disinflation process continues.

“But we will have to judge meeting by meeting how far and how fast.

“We live in an uncertain world and the road ahead will have bumps.

“We expect inflation to increase this year, to a peak of about 3.7 per cent before returning to the 2 per cent targets. We will set the Bank rate to ensure that it does so sustainably.”

Trades Union Congress urges Bank to 'keep moving' with cuts

12:37 , Holly EvansThe head of the Trades Union Congress (TUC) urged the Bank of England to “keep moving” with further cuts to interest rates to support households and businesses.

TUC general secretary Paul Nowak said: “This rate cut is badly needed to help lift the economy out of stagnation.

“The Bank must now keep moving with further cuts to support households and businesses in the months ahead.

“Lower borrowing costs will ease pressures on households, helping families with their weekly budgets and leaving them with more to spend. And it will make it more affordable for businesses to invest and grow.”

Pound falls after interest rates decision

12:35 , Holly EvansThe pound weakened following the decision to cut rates to 4.5 per cent after the Bank of England revealed that two of its nine policymakers had voted for a bigger 50 basis point cut to 4.25 per cent.

Sterling fell 1 per cent to 1.238 US dollars and was 0.5 per cent lower at 1.195 euros.

Unemployment is set to rise to a peak of 4.75 per cent

12:33 , Holly EvansDespite the cut to near-term growth forecasts, the Bank said the economy would grow faster than expected in the longer term, with a growth rate of 1.5 per cent for 2026 and 2027, both up 0.25 percentage points compared with the last forecast.

Policymakers also said unemployment is set to rise to a peak of 4.75 per cent, up from previous forecasts of 4.5 per cent, adding that rising national insurance contributions (NICs) for employers posed “a risk” of more people being out of work.

It comes after several large firms including Sainsbury’s cut jobs in the first weeks of 2025, with the supermarket saying some of the losses were linked to the increase in NICs.

The cut to the base rate was not a unanimous decision, with two of the nine members voting to cut rates even further to 4.25 per cent, while the remaining seven voted for a quarter point cut.

The Bank said it had not factored the potential effects of Donald Trump’s trade tariffs on its forecasts, adding that it “remains unclear what the overall landscape for US and other global tariffs will ultimately look like”.

Analysis: Interest rate cut is boost for Reeves, but the devil is in the detail

12:30 , Archie MitchellOn the surface, Thursday’s Bank of England interest rate cut is a boost for Rachel Reeves after a bruising four months.

But as always, the devil is in the details, and the central bank has slashed its growth forecast in half in a major blow to the chancellor.

Sir Keir Starmer and Ms Reeves have made economic growth a central plank of the Labour government’s plans, but since they were elected in July the economy has been stagnant.

And, after a Budget economists have repeatedly warned will be a hammer-blow for their growth mission, the Bank said the economy will now grow by just 0.75 per cent this year.

That is down from a previous forecast of 1.5 per cent. Ms Reeves set out her stall on growth in a major speech last week, outlining fresh measures she hopes will get the economy moving. But the clock is ticking.

Labour’s path to re-election in 2029, with Reform UK on the rise, looks increasingly perilous. If the economy and living standards continue to stagnate, it could become impossible.

Cut in interest rates a boost to the housing market, says expert

12:27 , Holly EvansBen Thompson, Deputy CEO, Mortgage Advice Bureau, said: “A cut in the base rate is exactly what the housing market needed.

“This will give buyers confidence and should help ease the minds of many who are due to renew their mortgage in the coming months.

“The Bank of England has taken the first opportunity it has to cut rates, and this could mean mortgage rates begin to decline as we head into the busy spring period.

“For those looking to get onto the property ladder, now is the time to take the first steps and speak with an adviser to get mortgage ready.”

Tories say Labour's 'disastrous Budget' will likely mean fewer rate cuts

12:22 , Holly EvansThe Conservatives welcomed the cut to interest rates but said Labour’s “disastrous Budget” would likely mean fewer rate cuts this year than expected.

Shadow chancellor Mel Stride said: “This will be welcome news for many families and businesses who have been hit hard by Labour’s mismanagement. Sadly, their disastrous Budget is likely to mean fewer rate cuts this year than previously anticipated.

“Under new leadership, the Conservatives will back business and our nation of entrepreneurs to create jobs and wealth.

“That is the only way to grow our economy so everyone can have a more secure future.”

The Bank is still moving too slowly, says IPPR

12:18 , Holly EvansReacting to today’s decision by the Bank of England’s Monetary Policy Committee to cut interest rates, Carsten Jung, principal research fellow and head of macroeconomics at the Institute for Public Policy Research, said:

“The recent economic weakness in the UK is primarily driven by too high interest rates. While many commentators focus on project-by-project discussions that individually have small effects, the elephant in the room is high rates. Today’s rate cut was therefore much needed, but the Bank is still moving too slowly.

“We are in the last mile of returning to normal rates of inflation. While the energy price shock is still rippling through the system, recent measures of underlying inflation show we are back to historical averages. By keeping rates high the Bank has been perhaps understandably cautious, but their current stance looks increasingly zealous.”

Chancellor Rachel Reeves said she is 'still not satisfied with the growth rate'

12:16 , Holly EvansChancellor Rachel Reeves said the interest rate cut was “welcome news” but that she was still “not satisfied” with growth.

She said: “This interest rate cut is welcome news, helping ease the cost-of-living pressures felt by families across the country and making it easier for businesses to borrow to grow.

“However, I am still not satisfied with the growth rate. Our promise in our Plan for Change is to go further and faster to kickstart economic growth to put more money in working people’s pockets.

“That’s why we are taking on the blockers to get Britain building again, ripping up unnecessary regulatory barriers and investing in our country to rebuild roads, rail and vital infrastructure.”

Analysis: Mostly positive with half a million homeowners as the immediate winners

12:11 , Karl Matchett, Business EditorA 25 basis points cut is going to be seen as mostly positive, but as with most financial decisions there are two sides to the see-saw.

Lower interest rates can stimulate spending and investment, and of course should lead to lower repayments on borrowing costs, but it also lowers savings rates.

Add in a lot of potential inflationary pressures in the wider economic world - including potential tariffs - and the Bank of England will still be very keen to ensure inflation doesn’t go on the rise again.

The big immediate winners here will be among the more than half a million homeowners in the UK who are on ‘tracker’ mortgages, which will see repayments go down accordingly.

Two members of the MPC voted for sharper cuts

12:09 , Holly EvansThe Bank of England has reduced interest rates after seven members of the central bank’s nine-strong Monetary Policy Committee (MPC) voted to reduce the base rate from 4.75 per cent to 4.5 per cent.

Two members of the committee – Swati Dhingra and Catherine Mann – voted for a sharper reduction to 4.25 per cent.

Bank of England downgrades growth forecast in blow to Reeves

12:08 , Holly EvansUK interest rates have fallen to 4.5% after the Bank of England voted to cut borrowing costs, as it also slashed short-term growth forecasts for the economy.

The Bank’s Monetary Policy Committee (MPC) voted for a quarter-point reduction after similar cuts in August and November last year, bringing the base rate to its lowest point since June 2023.

Governor Andrew Bailey said the cut will be “welcome news to many” but that the Bank is “monitoring the UK economy and global developments very closely, and taking a gradual and careful approach to reducing rates further”.

The Bank halved its growth forecast for the UK economy to 0.75% for this year, down from previous estimates of 1.5%, before accelerating again in 2026 and 2027.

The downgrade is a blow to chancellor Rachel Reeves after Labour made growing the economy its key priority.

It also comes amid signs inflation is rising again, with forecasts pointing to a higher-than-expected peak of 3.7% later in the summer.

Interest rates: What does a 0.25% cut mean for your mortgage, savings and bills?

12:05 , Holly EvansThe Bank of England (BoE) have today announced their base rate is to be cut 25 basis points, leaving the Bank Rate - what we might simply call the interest rate - at 4.5 per cent, the lowest it has been in the UK since mid-June 2023.

Around that time, with inflation rising fast and the BoE seeking to stem it, the base rate jumped from 3.5 per cent at the start of February to 5.25 per cent by August - causing a sharp increase in mortgage repayments, a battle for savers among banks and plenty of other side effects.

Now with both inflation and interest rates (generally, slowly) on the way back down, this is the first decrease the BoE (or their Monetary Policy Committee, technically) have applied since November last year, amid an eventual government aim to stem inflation at two per cent.

Read the full analysis from Karl Matchett here:

Interest rates: What does a 0.25% cut mean for your mortgage, savings and bills?

Bank of England cuts inflation rates

12:00 , Holly EvansThe Bank of England has announced it is cutting interest rates from 4.75 per cent to 4.5 per cent, the lowest point in 18 months.

The decision could lead to cheaper borrowing costs, meaning a boost for mortgage-borrowers, but could also see lower returns on savings.

It will be a boost for Chancellor Rachel Reeves in her bid to grow the UK economy.

Challenges of higher interest rates and cost-of-living increases begin to ease, says UK Finance

11:47 , Holly EvansCharles Roe, director of mortgages at UK Finance, said: “The number of mortgages in arrears has seen a slight decrease compared to the previous quarter.

“Having peaked in (the first quarter of) 2023, arrears appear to now be on a confirmed downward trend.

“This reflects the fact that, while pressures remain, the challenges of higher interest rates and cost-of-living increases have begun to ease.

“This is good news for customers, but we know that this will not be the case across all households, and lenders will support anyone who might be struggling.

“Lenders offer a range of support to anyone worried about their finances. If you’re worried about your finances, please reach out to your lender as soon as possible to discuss the help available. Doing so won’t affect your credit score.”

What can we expect from today?

11:23 , Holly EvansIt is a busy day for the Bank of England, with markets and mortgage-lenders likely to have a careful eye on the forthcoming announcements.

At noon, the Monetary Policy Committee’s decision on interest rates will be announced, which is expected to cut interest rates to 4.5 per cent from 4.75 per cent.

It will also publish the Monetary Policy Report which will set out inflation projections and hint at what may come next for the UK economy.

The Bank’s governor Andrew Bailey is expected to speak to journalists at 12.30pm.

Home repossessions increase but mortgage arrears on ‘downward trend’

10:46 , Holly EvansThe number of homeowners having their property repossessed increased towards the end of 2024, but mortgage arrears now appear to be on a “confirmed downward trend,” according to a banking and finance industry body.

UK Finance, which released the figures, encouraged borrowers who are concerned about their ability to keep up with their payments to reach out to their lender for support.

Its figures show 1,030 homeowner-mortgaged properties were repossessed in the fourth quarter of 2024, which was 12% higher than in the previous quarter and 54% higher than the same period a year earlier.

Meanwhile, 700 buy-to-let mortgaged properties were repossessed in the fourth quarter of 2024, which was unchanged from the previous quarter and 30% higher than the same period a year earlier.

The overall proportion of mortgages in arrears remains low, UK Finance said, at 1.06% of homeowner mortgages and 0.65% of buy-to-let mortgages.

Some 92,170 homeowner mortgages were in arrears of 2.5% or more of the outstanding balance in the fourth quarter of 2024 – 2% fewer than both the previous quarter and the fourth quarter of 2023.

Construction sector sees fall for the first time in nearly a year

10:17 , Holly EvansActivity in Britain’s construction sector fell for the first time in nearly a year last month as economic uncertainty weighed on the industry, according to new figures.

The latest S&P Global construction purchasing managers’ index (PMI) showed a reading of 48.1 in January, down sharply from 53.3 in December and the first result signalling a contraction since February 2024.

Most economists had expected activity to rebound to 53.7 in January.

Any reading above the 50 threshold indicates that activity in the industry is increasing while anything below means it is shrinking.

FTSE 100 sees surge ahead of predicted interest rate cut

09:54 , Holly EvansThe FTSE 100 has risen to a record high ahead of an expected announcement from the Bank of England that interest rates will be cut.

The London Stock Exchange has surged by 1.1pc to 8,721.54 as traders bet that the Monetary Policy Committee will issue a quarter point reduction to 4.5 percent.

Record low number of businesses created across UK

09:30 , Holly EvansA record low number of businesses were created across the UK in the final quarter of last year, new figures show.

Business group the Institute of Directors warned the falling trend was “concerning” and called on the Government to “ease the significant pressures on business”.

It comes just days after economic forecasters at the EY Item Club predicted the UK economy will improve more slowly than anticipated this year, downgrading Chancellor Rachel Reeves’ hopes to rapidly boost growth.

Figures from the Office for National Statistics (ONS) show 65,450 new businesses were created across the UK in the three months to December – down 8.5% from the same quarter a year earlier and the lowest number of any quarter since records began in 2017.

Some 13 of the 16 main industrial groups saw a fall in the number of businesses created over the past year.

The most significant falls were seen in the transport and storage industry, followed by the business administration and support services sector.

Rising inflation costs to do with impact of October budget

09:05 , Holly EvansThe rise in cost inflation is partly to do with the effect of policies announced at the October Budget.

Chancellor Rachel Reeves raised national insurance contributions for companies in October.

The move was designed to give the Government more money to spend on public services like the NHS.

But some companies have complained it is pushing up costs and contributing to rising inflation.

Matthew Ryan, an analyst at finance firm Ebury, added that with economic growth stagnating but inflation rising, the Bank “will have to make a judgment call about which risk is likely to dominate over the course of the year”.

Bank of England will 'have to walk a tightrope' on further rate cuts

08:23 , Holly EvansOn Wednesday, a survey of companies in the service sector, which includes everything from shops and pubs to finance firms and lawyers, found that cost inflation in the industry nudged up in January.

Most economists think these signs of rising inflation are unlikely to put policymakers off cutting rates on Thursday, but it could lead them to be more cautious at future meetings in March and May.

Chris Arcari, an analyst at finance firm Hymans Robertson, said the Bank will have to “walk a tightrope” when it comes to more rate cuts later this year.

He said that while the economy currently leaves space for a “modest reduction”, the Bank will likely “adopt cautious messaging” about the future.

UK interest rate cut a ‘sure bet’ amid faltering economic growth

07:54 , Holly EvansThe cost of borrowing is expected to fall to its lowest point in more than 18 months this week.

Senior economists at the Bank of England will meet to decide whether to cut the UK’s base interest rate in the coming days, which currently sits at 4.75%.

Most experts predict they will announce a quarter point reduction to 4.5% at their announcement on Thursday February 6, continuing a series of cuts which started last summer.

Read the full article here:

UK interest rate cut a ‘sure bet’ amid faltering economic growth, say experts

Services job cuts rise as stagflation takes ‘a firmer hold’ of sector

07:24 , Holly EvansTim Moore, economics director at S&P Global Market Intelligence, said: “January data highlighted a challenging business environment for UK service providers as stagflation conditions appeared to take a firmer hold at the start of the year.

“Output levels increased only marginally while input cost inflation accelerated for the fifth month in a row to its highest since April 2024.

“Businesses widely noted sharply rising salary payments and many also felt the impact of suppliers passing on forthcoming increases in employers’ national insurance contributions.”

He added: “A range of growth headwinds at home and abroad were cited by survey respondents, including elevated interest rates, geopolitical uncertainty and a post-Budget slide in domestic business confidence.

“The twin perils of shrinking workloads and rising payroll costs meant that many service providers put the brakes on recruitment in January.”

Growing proportion of first-time buyers ‘think now is a good time’ to purchase

07:01 , Athena StavrouThe proportion of first-time buyers who believe now is a good time to purchase a property has doubled over the past year, according to research for a body representing building societies.

A third (33%) of first-time buyers think now is a good time, compared with 16% in December 2023, the Building Societies Association (BSA) said.

Could rates go up?

05:01 , Athena StavrouSome recent announcements have indicated that inflation could be on the way back up, albeit more gradually, posing a potential problem for the Bank.

On Wednesday, a survey of companies in the service sector, which includes everything from shops and pubs to finance firms and lawyers, found that cost inflation in the industry nudged up in January.

Most economists think these signs of rising inflation are unlikely to put policymakers off cutting rates on Thursday, but it could lead them to be more cautious at future meetings in March and May.

When will we know if rates have dropped?

03:47 , Athena StavrouThe Bank of England is expected to announce its interest rate decision from the monetary policy committee at midday on Thursday.

The announcement will be followed at 12: 30pm by a press conference at the bank, with Governor Andrew Bailey.

Why do interest rates change?

02:32 , Athena StavrouThe Bank typically raises interest rates when inflation is high to discourage people from spending money, thereby slowing the rate of price rises.

Now, inflation – which measures how fast prices are rising across the economy – is much lower than the highs of recent years, at 2.5% per year.

And economic growth is stagnating across the UK, leading to predictions of another rate cut, which would encourage more spending and stimulate the economy.

Full story: UK interest rates set to fall at Bank of England meeting on Thursday

01:06 , Athena StavrouThe cost of borrowing is expected to fall to its lowest point in more than 18 months on Thursday.

Senior economists at the Bank of England will announce whether they are cutting the UK’s base interest rate, which currently sits at 4.75%.

Most experts predict a quarter point reduction to 4.5%, continuing a series of cuts which started last summer.

The base rate helps dictate how expensive it is to take out a mortgage or a loan, while it also influences the interest rates offered by banks on savings accounts.

Read the full story here:

UK interest rates set to fall at Bank of England meeting on Thursday

Growing proportion of first-time buyers ‘think now is a good time’ to purchase

00:03 , Athena StavrouThe proportion of first-time buyers who believe now is a good time to purchase a property has doubled over the past year, according to research for a body representing building societies.

A third (33%) of first-time buyers think now is a good time, compared with 16% in December 2023, the Building Societies Association (BSA) said.

Stamp duty costs are set to become more expensive for some buyers from April, when the “nil rate” band for first-time buyers will shrink from £425,000 to £300,000. Stamp duty applies in England and Northern Ireland.

The BSA’s research indicated that a fifth (22%) of people generally think stamp duty costs are an obstacle to buying a new home, falling to 16% among first-time buyers.

The affordability of monthly mortgage payments and raising a deposit are generally seen as bigger barriers to home-ownership, the survey indicated.

How does the rate impact mortgages?

Wednesday 5 February 2025 22:49 , Athena StavrouThe base rate helps dictate how expensive it is to take out a mortgage or a loan, while it also influences the interest rates offered by banks on savings accounts.

Hikes in recent years, designed to combat skyrocketing inflation, have left mortgage rates much higher than was normal for most of the last decade.

The base rate rose as high as 5.25% in late 2023, but the Bank’s policymakers cut it to 4.75% over the course of several months last year.

When will we know if rates have dropped?

Wednesday 5 February 2025 21:32 , Athena StavrouThe Bank of England is expected to announce its interest rate decision from the monetary policy committee at midday on Thursday.

The announcement will be followed at 12: 30pm by a press conference at the bank, with Governor Andrew Bailey.

Why does the bank change interest rates?

Wednesday 5 February 2025 20:11 , Athena StavrouThe Bank typically raises interest rates when inflation is high to discourage people from spending money, thereby slowing the rate of price rises.

Now, inflation – which measures how fast prices are rising across the economy – is much lower than the highs of recent years, at 2.5% per year.

And economic growth is stagnating across the UK, leading to predictions of another rate cut, which would encourage more spending and stimulate the economy.

Could rates go up?

Wednesday 5 February 2025 19:03 , Athena StavrouSome recent announcements have indicated that inflation could be on the way back up, albeit more gradually, posing a potential problem for the Bank.

On Wednesday, a survey of companies in the service sector, which includes everything from shops and pubs to finance firms and lawyers, found that cost inflation in the industry nudged up in January.

Most economists think these signs of rising inflation are unlikely to put policymakers off cutting rates on Thursday, but it could lead them to be more cautious at future meetings in March and May.

Full story: UK interest rates set to fall at Bank of England meeting on Thursday

Wednesday 5 February 2025 18:00 , Athena StavrouThe cost of borrowing is expected to fall to its lowest point in more than 18 months on Thursday.

Senior economists at the Bank of England will announce whether they are cutting the UK’s base interest rate, which currently sits at 4.75%.

Most experts predict a quarter point reduction to 4.5%, continuing a series of cuts which started last summer.

The base rate helps dictate how expensive it is to take out a mortgage or a loan, while it also influences the interest rates offered by banks on savings accounts.

Read the full story here:

UK interest rates set to fall at Bank of England meeting on Thursday

Interest rates expected to fall

Wednesday 5 February 2025 16:34 , Athena StavrouThe UK’s base interest rate is expected to fall to its lowest point in more than 18 months, providing a welcome boost for mortgage holders.

Analysts believe senior economists at the Bank of England will cut the interest rate from 4.75 per cent to 4.5 per cent in its monthly announcement on Thursday morning.

The base rate helps dictate the cost of borrowing such as taking out mortgage with some products, known as tracker mortgages, following it.

The figure also impacts rates paid by individuals and businesses to take out loans.