/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

Intel (INTC) stock jumped 16.1% on Tuesday, Feb. 18 fueled by speculation that the company may be splitting its business. Investors are abuzz with speculation after The Wall Street Journal revealed that semiconductor giants Taiwan Semiconductor Manufacturing (TSM) and Broadcom (AVGO) are exploring deals that could divide the chip maker into separate entities.

Broadcom is considering acquiring Intel’s chip design and marketing division, but only if it can find a partner to take over the company’s manufacturing operations. Meanwhile, TSMC is reportedly interested in Intel’s chip plants, but rather than going solo, the company would likely pursue the acquisition as part of a larger investment group or consortium.

Adding to the drama, Bloomberg recently reported that Silver Lake Management is in exclusive talks to buy a majority stake in Intel’s programmable chip unit, Altera. These chips play a crucial role in telecommunications networks, and Silver Lake’s interest signals confidence in Intel’s ability to restructure and unlock value. While discussions are advanced, there’s still uncertainty around the final stake size, and negotiations could face delays or fall through. Notably, during Intel’s recent fourth-quarter earnings call, management acknowledged the ongoing stake sale of Altera and even hinted at a potential IPO for it in the future.

What This Means for Investors

While media reports debate whether a Taiwan Semiconductor and Broadcom-backed separation of Intel is realistic, significant hurdles remain. Political concerns could be a major roadblock. President Donald Trump’s administration will likely oppose allowing Intel’s U.S. chip factories to fall under foreign control. This could limit Taiwan Semiconductor’s ability to take a leading role in the deal.

That said, the move could be a game-changer if Intel successfully executes some form of transaction or strategic separation. A well-structured split could unlock significant value, giving the company a much-needed boost. The key lies in Intel’s management ensuring that any restructuring generates a breakup value at a considerable premium.

Is Intel a Comeback Story in the Making?

Intel has been navigating rough waters, facing tough competition, shrinking revenues, and declining market share. Profit margins have been under pressure, and the company has struggled to tap into the artificial intelligence (AI)-driven growth that has propelled some of its rivals forward. As a result, its stock has taken a hit, and questions have emerged about whether the tech giant might need to split its business to regain momentum.

Nonetheless, Intel is showing signs of improvement. The company delivered back-to-back better-than-expected quarterly performances, including an impressive fourth-quarter results that exceeded analyst forecasts. This suggests that its strategic adjustments might be starting to pay off.

Intel’s future product lineup could play a crucial role in revitalizing its business. Upcoming AI-powered PCs are expected to strengthen its presence in high-performance computing. Meanwhile, the highly anticipated Panther Lake CPU could further solidify Intel’s competitive position.

Beyond product innovation, Intel focuses on improving efficiency and expanding its Foundry business. Management remains optimistic about the division’s growth potential, particularly as AI fuels demand for advanced silicon chips.

The company is also aggressively cutting costs and refining operations, aiming for its Foundry division to break even by the end of 2027. If Intel executes its plan effectively, it could be positioning itself for a strong resurgence.

Should You Buy Intel Stock?

For investors, the recent developments present both risks and opportunities. If Intel successfully restructures to strengthen its core businesses, the stock could see even more upside. However, regulatory and strategic challenges could complicate any deal and lead to a pullback.

Intel’s turnaround story is still unfolding, and investors looking for a quick rebound might be disappointed. The stock continues to face headwinds and could remain volatile.

Key issues like cyclical downturns in the semiconductor industry and excess inventory in the client computing segment could further weigh on its financial performance. Meanwhile, demand remains sluggish, and rival chipmakers are rapidly advancing, making it more challenging for Intel to reclaim its lost ground.

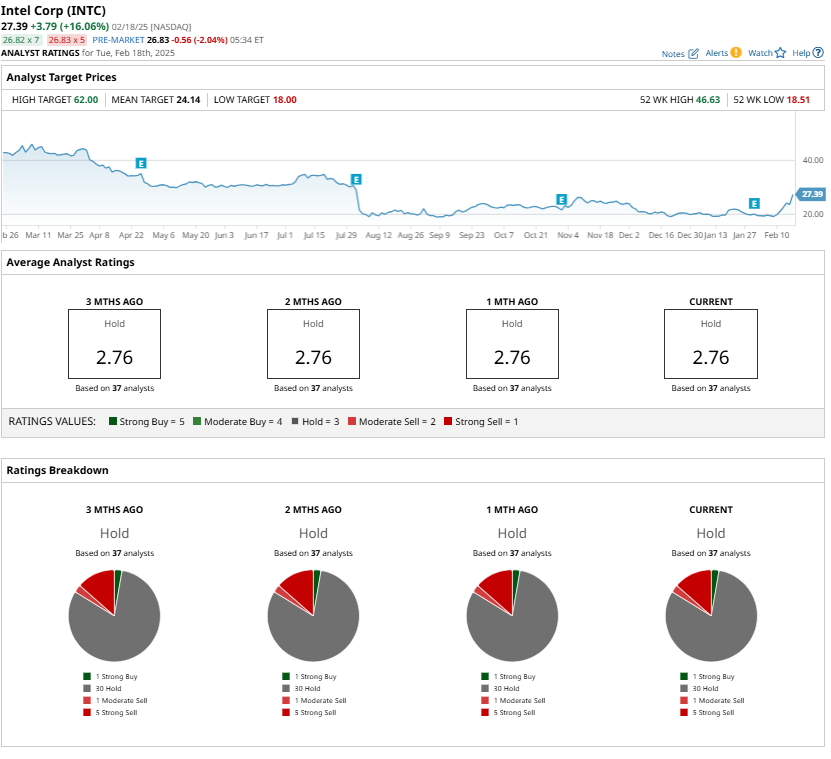

Given these challenges, Wall Street remains cautious, with a consensus “Hold” rating on the stock.