Intel (INTC) stock is getting smacked as the reality for its business is more glum than investors had been expecting.

Intel has lagged Advanced Micro Devices (AMD), Nvidia (NVDA) and others for a while now, but few were expecting the company’s situation to be this pessimistic.

The chipmaker's shares are down about 8% and were down almost 11% at the low. That's as the company reported a top- and bottom-line miss. Revenue dropped more than 28% year over year.

As for the outlook, management expects first-quarter revenue between $10.5 billion and $11.5 billion, missing expectations for just over $14 billion. Further, management expects a loss of 15 cents a share vs. estimates calling for a profit of 25 cents a share.

After a report like this, down less than 10% actually seems pretty good. It makes one think that even if a company reports a bad quarter, Wall Street may be willing to look the other way. At least for now, investors seem to be forgiving mediocre results and guidance.

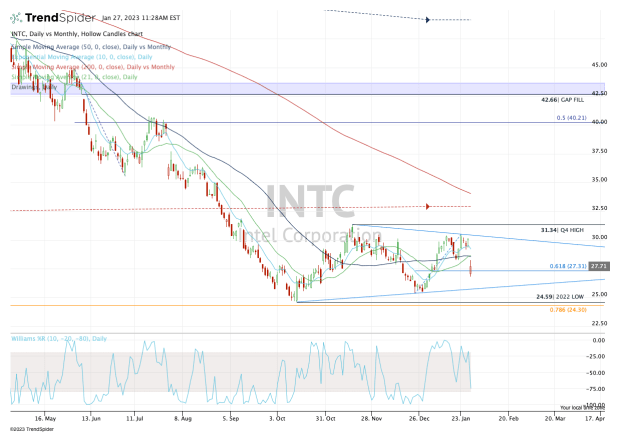

Let’s look at the chart.

Trading Intel Stock on Earnings

Chart courtesy of TrendSpider.com

Coming into the print, Intel shares were up almost 20% from the December low and up 22.5% from the 2022 low.

The stock was also above all its short- and intermediate-term moving averages (like the 10-day, 21-day and 50-day).

In the short term, in my view, the 61.8% retracement is the line in the sand at $27.31.

Below that figure and the post-earnings low of $26.78 is vulnerable. A break of that level — and especially a close below it — puts the December low back in play near $25.50, followed by the 2022 low near $24.50.

After today’s report, I’m actually surprised these levels aren’t in play as we speak. But that’s why we let the price action do the talking.

If Intel stock can hold up over $27.31, it keeps the 10-day, 21-day and 50-day moving averages in play near $28.50 to $29. If it can clear these measures, the gap-fill sits up at $29.33, which is followed by downtrend resistance.

Note: Regardless of how Intel trades from here, many traders will avoid Intel stock — and rightfully so — because of the earnings report.

Those same traders will likely stick to stocks like Nvidia and AMD, which are showing much better relative strength at the moment.