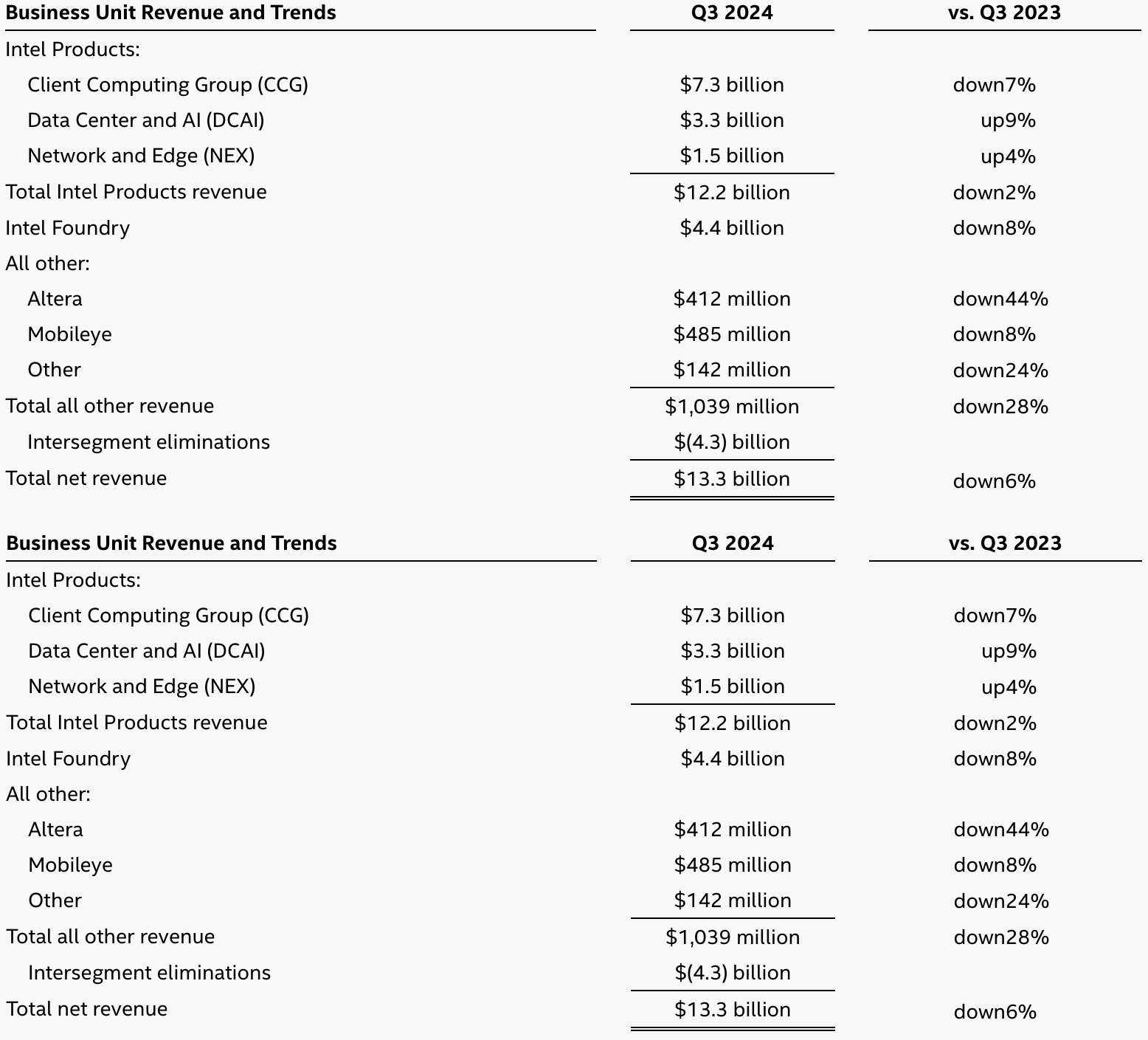

Intel unveiled its financial results for the third quarter of 2024 on Thursday. While the company's revenue beat expectations and totaled $13.3 billion, Intel took massive impairment and restructuring charges and reported a huge $16.6 billion loss. Surprisingly, the company's stock initially jumped up to 12% on the news, though that was closer to an 7% gain at press time.

Intel's revenue reached $13.3 billion, down 6% year-over-year but up $0.5 billion from the previous quarter. The company's net loss totaled an unprecedented $16.6 billion due to massive impairment and restructuring charges and substantial losses by the manufacturing unit. Intel's gross margin dropped to 15%, a historical minimum for the company.

Intel's products group reported profits and generated revenues of around $12.997 billion. The company's Foundry unit earned $4.4 billion, up slightly from $4.3 billion in the previous quarter but down from $4.7 billion from the same quarter a year ago. However, the chip production unit lost a whopping $5.8 billion.

"Our Q3 results underscore the solid progress we are making against the plan we outlined last quarter to reduce costs, simplify our portfolio and improve organizational efficiency," said Pat Gelsinger, Intel CEO. "We delivered revenue above the midpoint of our guidance, and are acting with urgency to position the business for sustainable value creation moving forward. The momentum we are building across our product portfolio to maximize the value of our x86 franchise, combined with the strong interest Intel 18A is attracting from foundry customers, reflects the impact of our actions and the opportunities ahead."

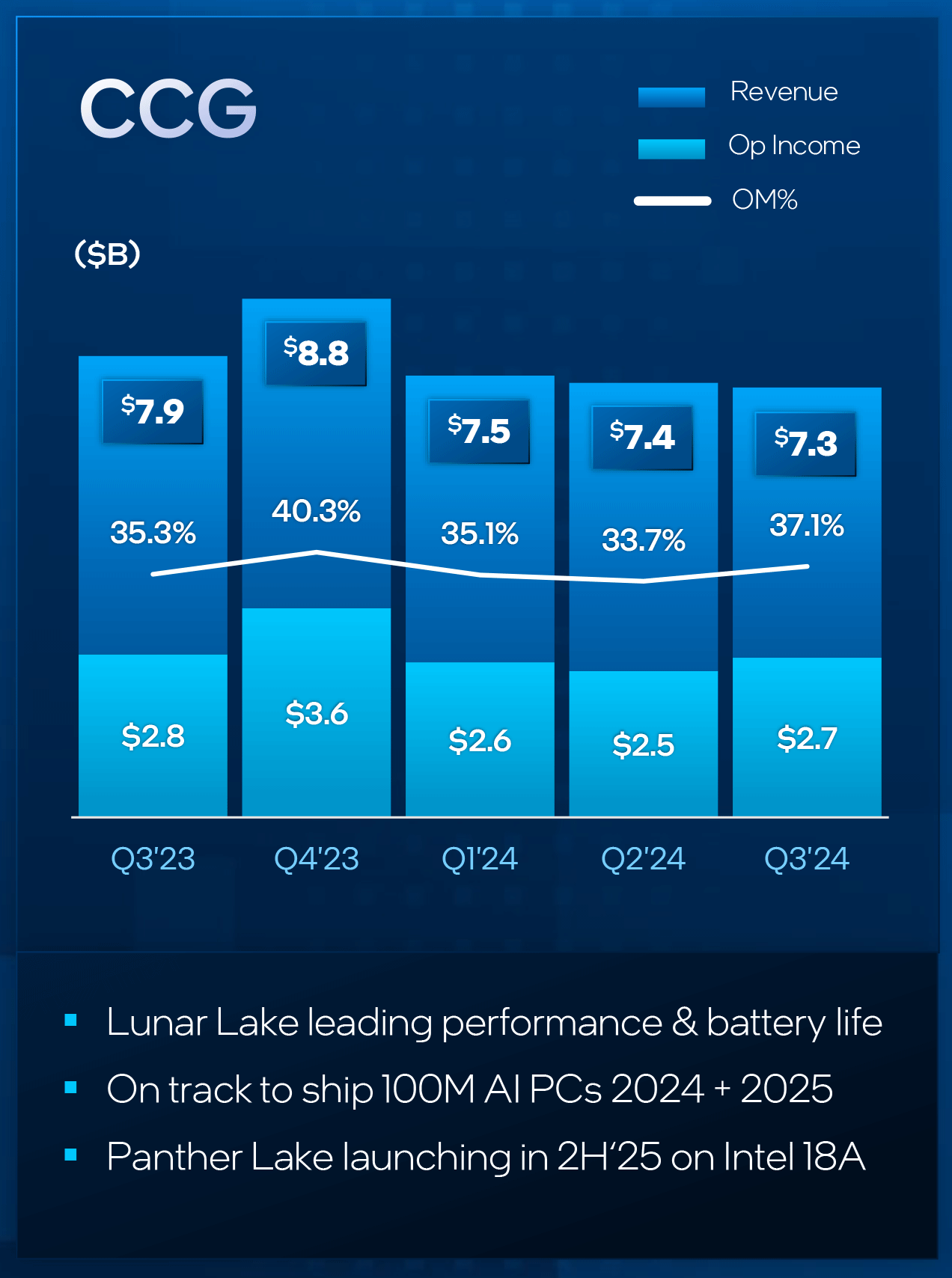

Intel's Client Computing Group: A slight sequential increase

Intel's Client Computing Group remains the top-performing division within the company, generating $7.3 billion in revenue during the third quarter. This marks a decrease from $7.9 billion in the same period last year, and it is also a slight $100 million decrease compared to the second quarter of 2024. The group achieved an operating margin of 37.1%, resulting in an operating profit of $2.7 billion.

During the quarter, Intel began shipments of its Arrow Lake-S processors for enthusiasts and Lunar Lake CPUs for compact laptops. Apparently, these new products have yet to impact Intel's CCG sales.

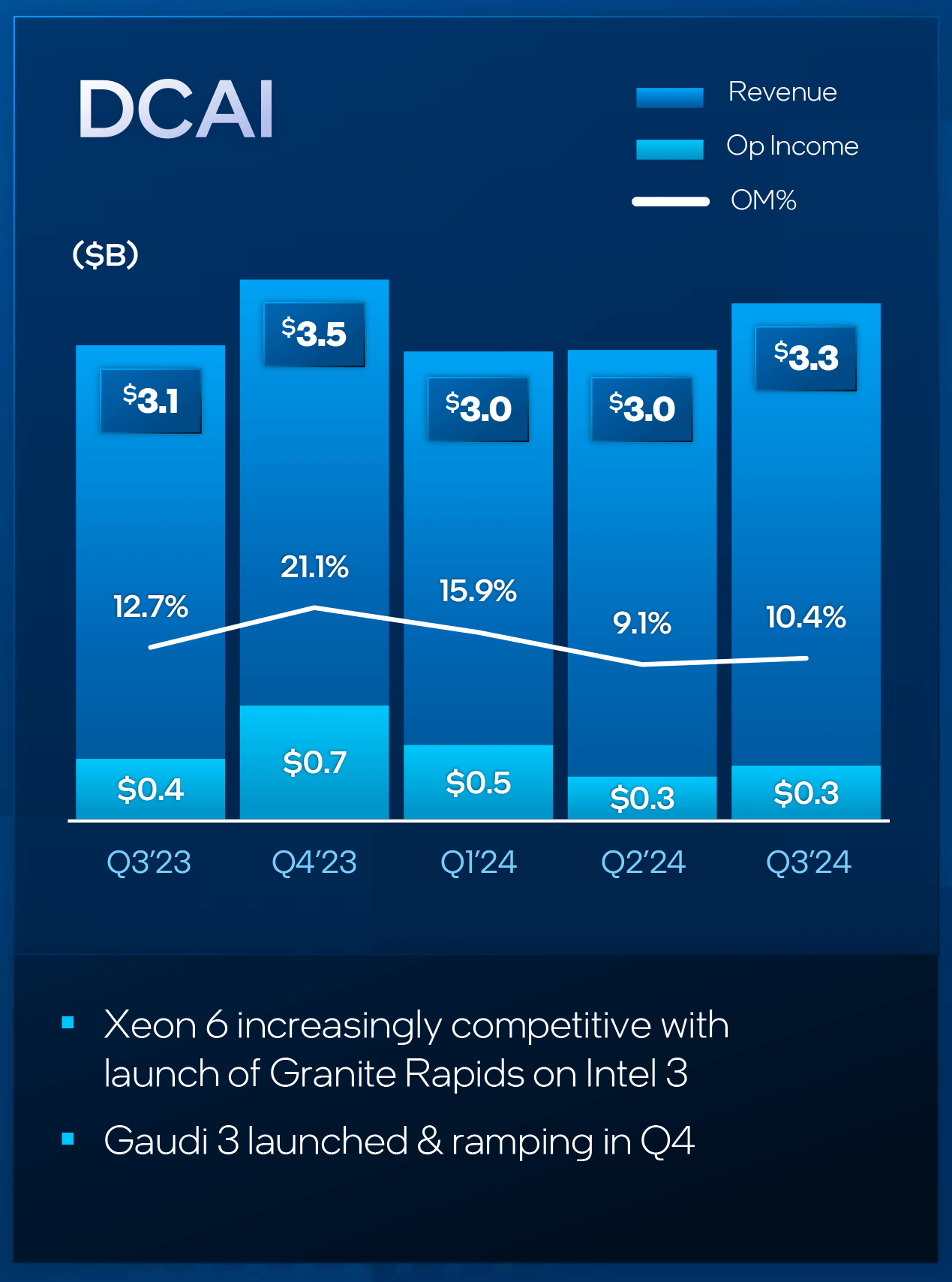

Intel's Datacenter and AI Group: Finally, going up

Intel's Data Center and AI Group (DCAI) earned $3.3 billion in revenue, up both sequentially and year-over-year, which is much-needed good news for the company. The unit's operating margin rose to 10.4%, but its operating profit remained at just $0.3 billion, which is surprising as the company began to ship its high-margin Xeon 6 data center CPUs.

Perhaps the volumes of Xeon 6 were too low to have a greater impact on DCAI's performance, which wouldn't be entirely surprising given that the company is early in the ramping process.

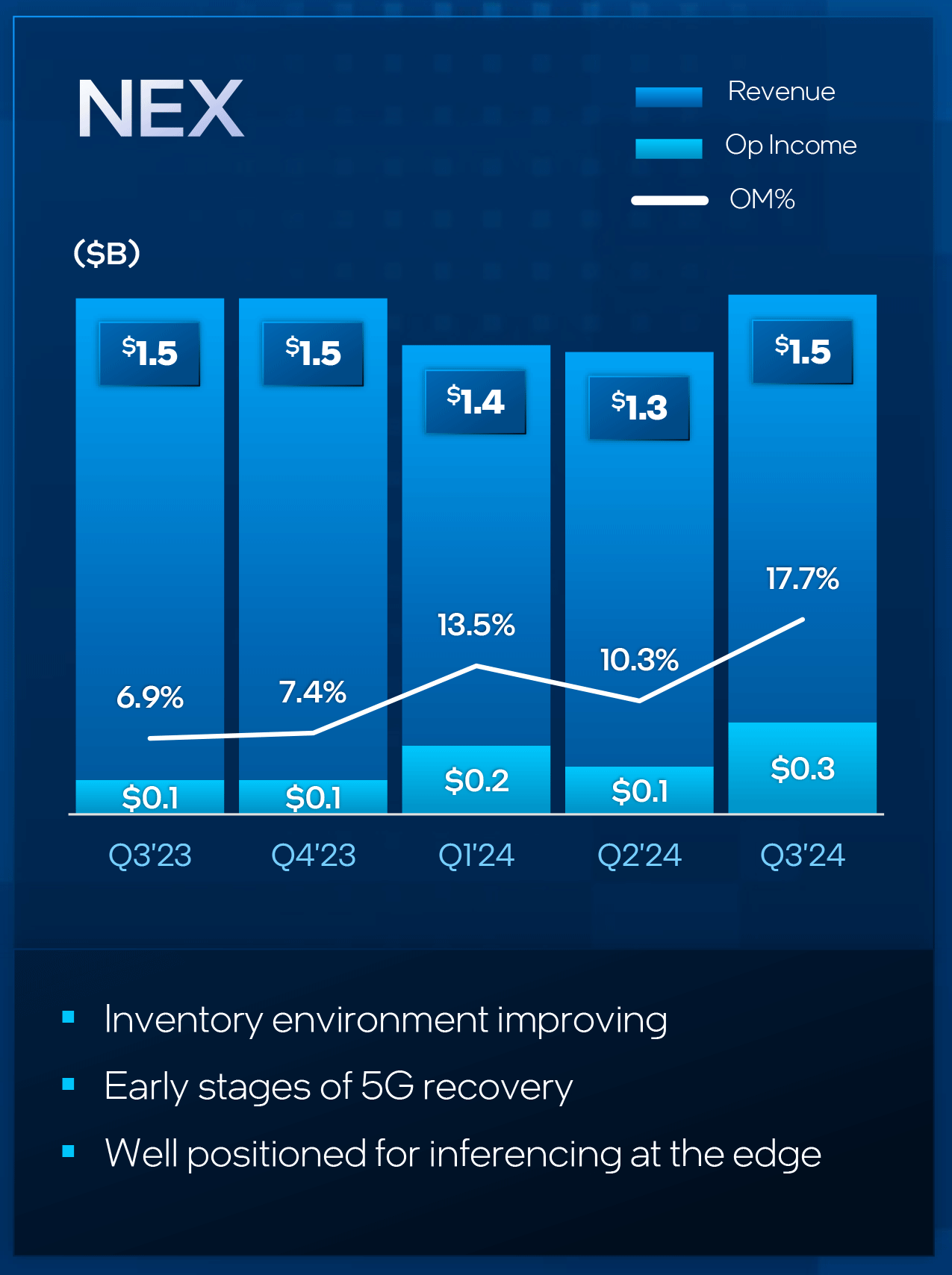

Altera, Edge, Network, and Mobileye: Mixed results

Intel's NEX division, which develops products for 5G, edge computing, networking, and telecommunications, recorded $1.5 billion in revenue, flat year over year and $200 million up quarter over quarter. Along with higher earnings, the business unit also increased its operating profit to $300 million.

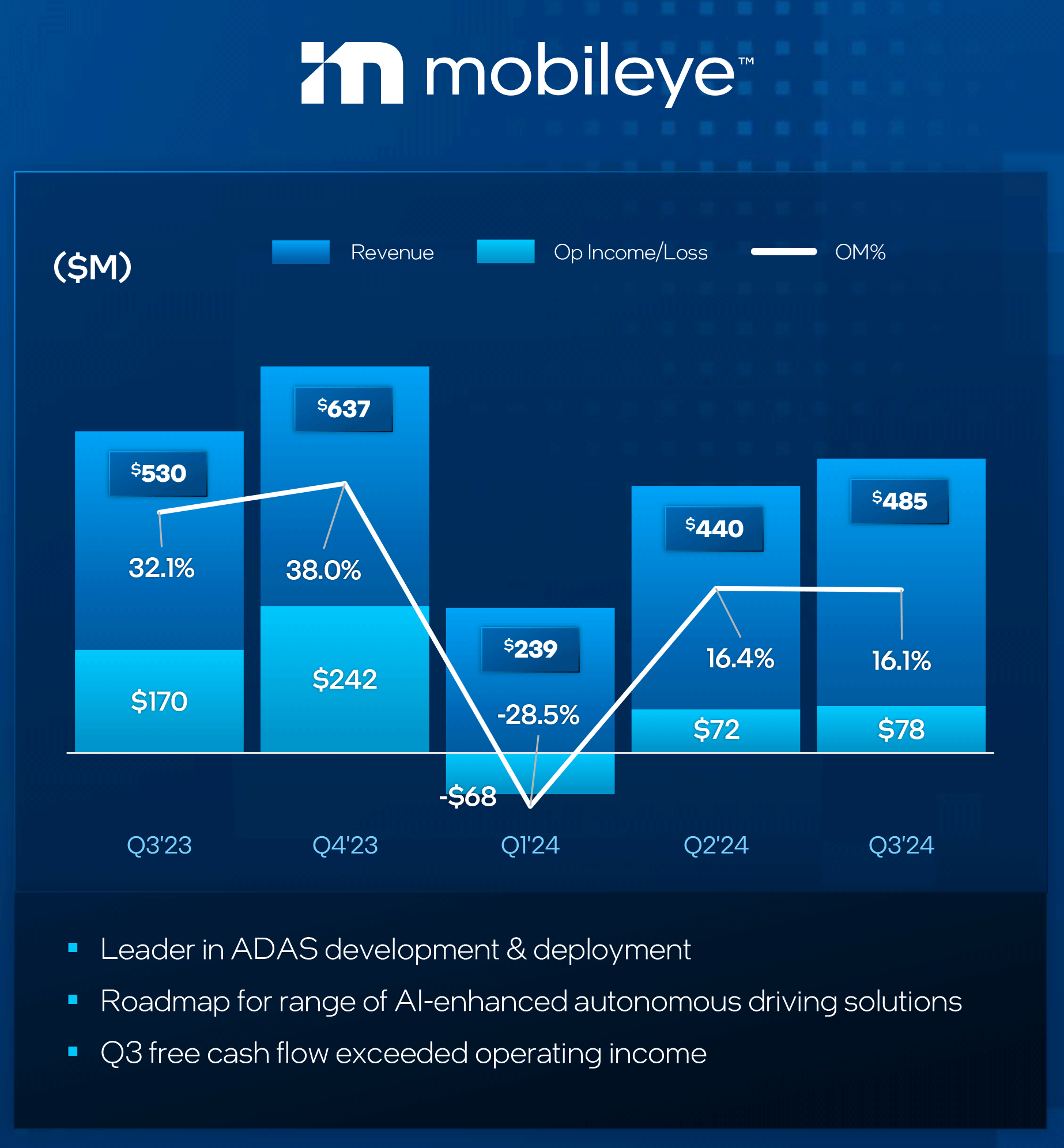

Mobileye saw another surge in revenue, reaching $485 million in Q3 2024, up from $440 million in Q2, but stilly below $530 million reported in Q3 last year. The segment posted $78 million in operating income, a decrease from $170 million in Q3 2023 and flat with the prior quarter.

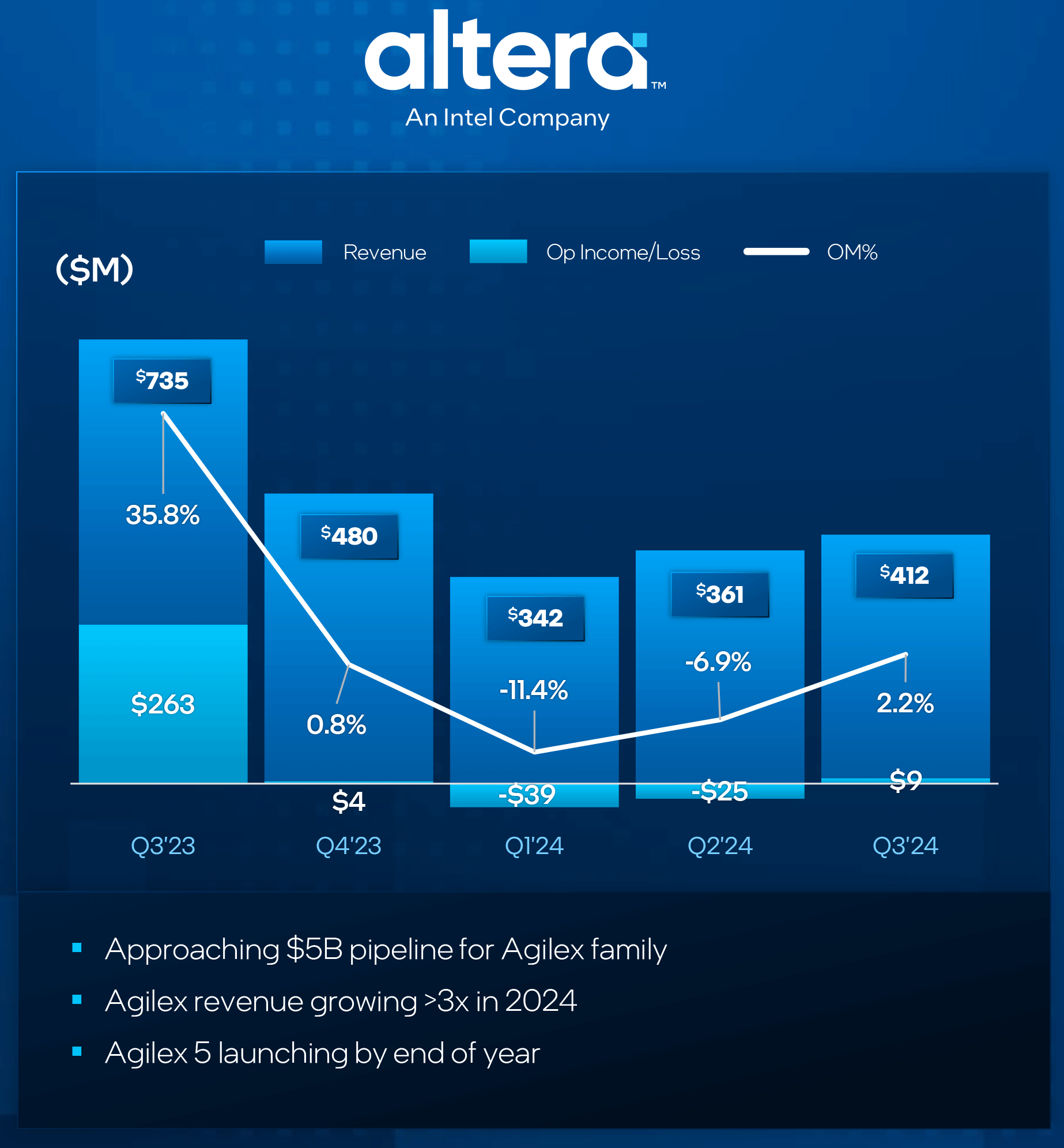

Altera, on the other hand, again experienced a challenging quarter, with revenue reaching $412 million, up significantly from $361 million in the prior quarter, but still down significantly from $735 million in the third quarter of 2023. The unit posted a $9 million profit, a steep drop from the $263 million profit it achieved in the same period last year, but at least up from $25 million loss in Q2 2024.

Modest outlook

Intel forecasts revenue between $13.3 billion and $14.3 billion for the fourth quarter of 2024, down from $15.4 billion reported in the same quarter last year, despite the company's updated product lineup. Additionally, Intel anticipates its GAAP gross margin to fall to increase to 36.5%, reflecting the impact of more competitive products and lack of charges.