What you need to know

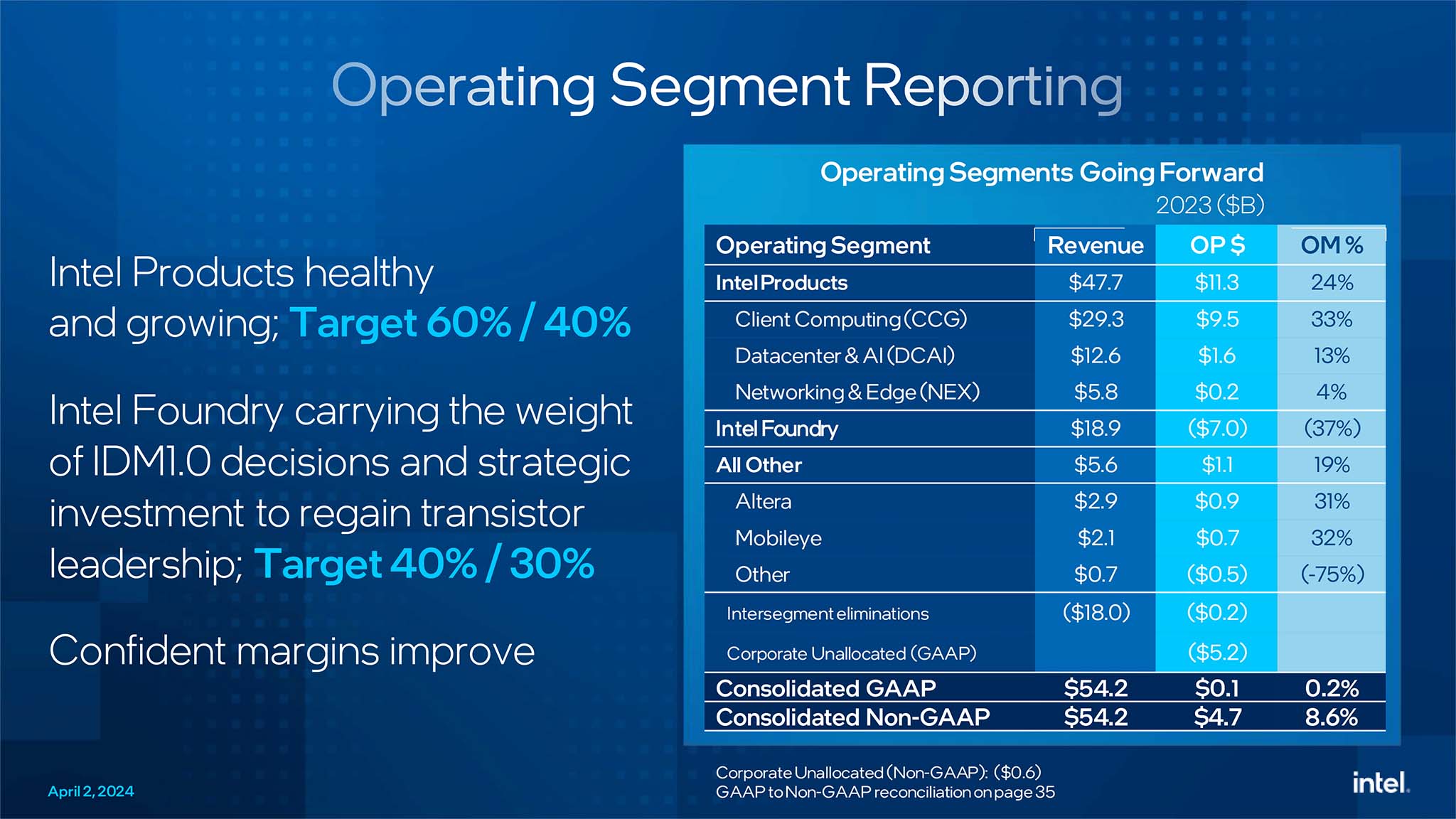

- Intel foundry saw a loss of $7 billion in 2023. Intel revenue was also down 31% year-over-year.

- Share prices for the chip manufacturer dropped by over 4% following this news.

- These 2023 reports do not see Intel foundry as a separate unit, so they don't fully represent Intel foundry's performance.

- Due to some mistakes over the last few years, 30% of Intel's wafer production has had to be outsourced to other foundaries.

- Intel's CEO says the company will be adopting a new operating model starting Q1 2024, but that he doesn't expect to see the company operating basis break even until 2027.

It's been a rough few years in the tech industry and Intel is not immune. As seen in Intel filing and reports, Intel foundry recently recorded a $7 billion loss in 2023, which partially stems from the fact that the company has had to outsource wafer manufacturing to other foundry partners (and rivals) such as TSMC (thank you Tom's Hardware). Overall, Intel revenue was also reported to be down 31% year-over-year. In response to this news, shares predictably have fallen by over 4%.

To be clear, these reports do not show the Intel foundry unit as a separate unit, so it's hard to gauge from these numbers how well the Intel foundry unit itself has been operating. In a webinar, Intel CEO Pat Gelsinger explained that these losses are partially due to the fact that the company failed to switch to more cost-effective ASML EUV (extreme ultraviolet) manufacturing machines. The switch would have been costly up front, but could potentially have helped the company overall.

According to Gelsinger, "It is in the order of 30% of our wafers today that we bring in externally, will be in-sourcing some level." So it seems that 30% are being outsourced to Intel partners. He went on to say that the company expects Intel outsourcing to get "down below 20%" in the time period between now and 2030. Until then, Intel will continue to rely on outsourcing partners.

• Best Intel CPUs

• Best AMD CPUs

• Best AMD GPUs

• Best NVIDIA GPUs

• Best computer monitors

• Best small gaming PCs

Gelsinger further explained to investors that the company doesn't expect to break even until 2027 or thereabouts. However, a new operating plan will be put in place in Q1 2024. After that, Intel foundry and Intel products reports will be recorded separately going forward.

While $7 billion in losses is a massive number to the average person, it's important to remember that this doesn't mean Intel is in a downward spiral. In terms of business, it's very possible that the chip manufacturer will be able to steady itself in the coming years. Of course, being able to manufacture more of its own products rather than relying on partners which also happen to be industry rivals will definitely help matters. We at Windows Central will continue to report on Intel as time goes on, so return for more information.