Workday (NASDAQ:WDAY) is gearing up to announce its quarterly earnings on Tuesday, 2024-11-26. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Workday will report an earnings per share (EPS) of $1.72.

The market awaits Workday's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

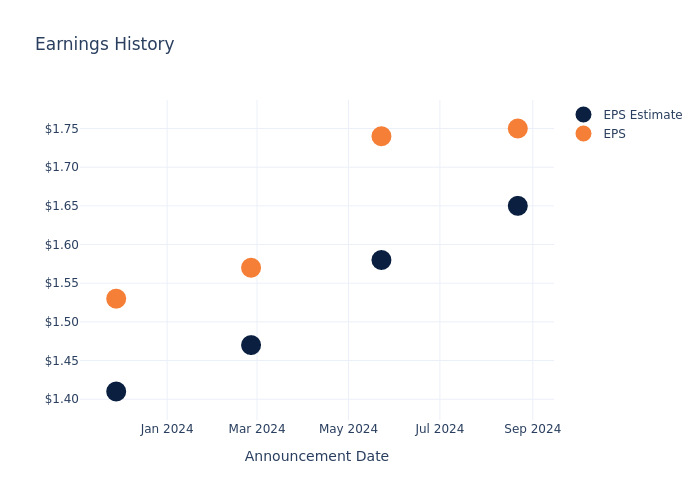

Earnings Track Record

During the last quarter, the company reported an EPS beat by $0.10, leading to a 12.49% increase in the share price on the subsequent day.

Here's a look at Workday's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.65 | 1.58 | 1.47 | 1.41 |

| EPS Actual | 1.75 | 1.74 | 1.57 | 1.53 |

| Price Change % | 12.0% | -15.0% | -4.0% | 11.0% |

Stock Performance

Shares of Workday were trading at $267.75 as of November 22. Over the last 52-week period, shares are up 14.59%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Take on Workday

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Workday.

The consensus rating for Workday is Buy, derived from 10 analyst ratings. An average one-year price target of $298.5 implies a potential 11.48% upside.

Comparing Ratings with Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of Autodesk, Atlassian and Roper Techs, three key industry players, offering insights into their relative performance expectations and market positioning.

- For Autodesk, analysts project an Outperform trajectory, with an average 1-year price target of $316.65, indicating a potential 18.26% upside.

- The consensus among analysts is an Outperform trajectory for Atlassian, with an average 1-year price target of $242.58, indicating a potential 9.4% downside.

- As per analysts' assessments, Roper Techs is favoring an Buy trajectory, with an average 1-year price target of $641.6, suggesting a potential 139.63% upside.

Overview of Peer Analysis

In the peer analysis summary, key metrics for Autodesk, Atlassian and Roper Techs are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Workday | Buy | 16.68% | $1.57B | 1.60% |

| Autodesk | Outperform | 11.90% | $1.36B | 12.17% |

| Atlassian | Outperform | 21.48% | $970.16M | -12.01% |

| Roper Techs | Buy | 12.87% | $1.22B | 2.01% |

Key Takeaway:

Workday ranks at the top for Revenue Growth among its peers. It is at the bottom for Gross Profit. Workday is at the bottom for Return on Equity.

All You Need to Know About Workday

Workday is a software company that offers human capital management, or HCM, financial management, and business planning solutions. Known for being a cloud-only software provider, Workday is headquartered in Pleasanton, California. Founded in 2005, Workday now employs over 18,000 employees.

Workday: Delving into Financials

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Workday's revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 16.68%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Net Margin: Workday's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 6.33%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 1.6%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Workday's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.82%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.4.

To track all earnings releases for Workday visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.