Ollie's Bargain Outlet (NASDAQ:OLLI) is gearing up to announce its quarterly earnings on Tuesday, 2024-12-10. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Ollie's Bargain Outlet will report an earnings per share (EPS) of $0.57.

Anticipation surrounds Ollie's Bargain Outlet's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

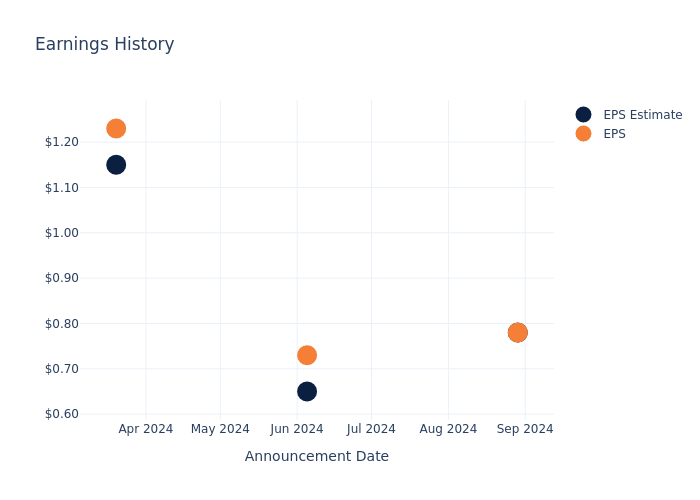

Earnings History Snapshot

The company's EPS missed by $0.00 in the last quarter, leading to a 3.06% increase in the share price on the following day.

Here's a look at Ollie's Bargain Outlet's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.78 | 0.65 | 1.15 | 0.44 |

| EPS Actual | 0.78 | 0.73 | 1.23 | 0.51 |

| Price Change % | 3.0% | -6.0% | 4.0% | -4.0% |

Ollie's Bargain Outlet Share Price Analysis

Shares of Ollie's Bargain Outlet were trading at $101.54 as of December 06. Over the last 52-week period, shares are up 39.44%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Take on Ollie's Bargain Outlet

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Ollie's Bargain Outlet.

The consensus rating for Ollie's Bargain Outlet is Buy, derived from 5 analyst ratings. An average one-year price target of $106.6 implies a potential 4.98% upside.

Analyzing Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of and Dillard's, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Neutral trajectory for Dillard's, with an average 1-year price target of $324.0, indicating a potential 219.09% upside.

Key Findings: Peer Analysis Summary

The peer analysis summary outlines pivotal metrics for and Dillard's, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ollie's Bargain Outlet | Buy | 12.41% | $219.03M | 3.14% |

| Dillard's | Neutral | -4.19% | $584.32M | 6.37% |

Key Takeaway:

Ollie's Bargain Outlet ranks higher than its peers in revenue growth and gross profit, indicating strong performance in these areas. However, it lags behind in return on equity compared to its peers.

Unveiling the Story Behind Ollie's Bargain Outlet

Ollie's Bargain Outlet Holdings Inc is a retailer of brand-name merchandise at drastically reduced prices. It offers customers a selection of brand-name products, including housewares, food, books and stationery, bed and bath, floor coverings, toys, and hardware. It operates stores across the Eastern half of the United States. Its differentiated go-to-market plan is characterized by a fun, and engaging treasure hunt shopping experience, compelling customer value proposition, and witty, humorous in-store signage and advertising campaigns. These attributes have driven rapid growth and consistent store performance for the company.

Ollie's Bargain Outlet's Financial Performance

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Ollie's Bargain Outlet's remarkable performance in 3 months is evident. As of 31 July, 2024, the company achieved an impressive revenue growth rate of 12.41%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Ollie's Bargain Outlet's net margin excels beyond industry benchmarks, reaching 8.47%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 3.14%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Ollie's Bargain Outlet's ROA stands out, surpassing industry averages. With an impressive ROA of 2.09%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.31.

To track all earnings releases for Ollie's Bargain Outlet visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.