MongoDB (NASDAQ:MDB) will release its quarterly earnings report on Monday, 2024-12-09. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate MongoDB to report an earnings per share (EPS) of $0.68.

Anticipation surrounds MongoDB's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

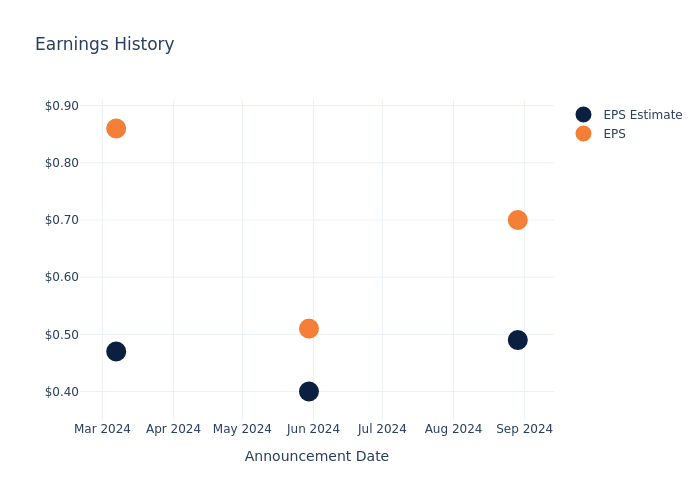

Earnings History Snapshot

Last quarter the company beat EPS by $0.21, which was followed by a 18.34% increase in the share price the next day.

Here's a look at MongoDB's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.49 | 0.40 | 0.47 | 0.50 |

| EPS Actual | 0.70 | 0.51 | 0.86 | 0.96 |

| Price Change % | 18.0% | -24.0% | -7.000000000000001% | -11.0% |

Tracking MongoDB's Stock Performance

Shares of MongoDB were trading at $334.31 as of December 05. Over the last 52-week period, shares are down 15.45%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Insights Shared by Analysts on MongoDB

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding MongoDB.

MongoDB has received a total of 6 ratings from analysts, with the consensus rating as Outperform. With an average one-year price target of $377.5, the consensus suggests a potential 12.92% upside.

Understanding Analyst Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of GoDaddy, Twilio and Akamai Techs, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- GoDaddy received a Outperform consensus from analysts, with an average 1-year price target of $194.14, implying a potential 41.93% downside.

- For Twilio, analysts project an Neutral trajectory, with an average 1-year price target of $91.3, indicating a potential 72.69% downside.

- As per analysts' assessments, Akamai Techs is favoring an Outperform trajectory, with an average 1-year price target of $115.67, suggesting a potential 65.4% downside.

Peer Metrics Summary

The peer analysis summary offers a detailed examination of key metrics for GoDaddy, Twilio and Akamai Techs, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| MongoDB | Outperform | 12.82% | $349.86M | -4.14% |

| GoDaddy | Outperform | 7.28% | $740.20M | 74.17% |

| Twilio | Neutral | 9.67% | $578.63M | -0.11% |

| Akamai Techs | Outperform | 4.06% | $595.87M | 1.21% |

Key Takeaway:

MongoDB is positioned at the top for Revenue Growth among its peers. It ranks at the bottom for Gross Profit and Return on Equity. The Consensus rating for MongoDB is Outperform.

Get to Know MongoDB Better

Founded in 2007, MongoDB is a document-oriented database with nearly 33,000 paying customers and well past 1.5 million free users. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB's database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

Breaking Down MongoDB's Financial Performance

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Positive Revenue Trend: Examining MongoDB's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 12.82% as of 31 July, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: MongoDB's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -11.41% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): MongoDB's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -4.14%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): MongoDB's ROA excels beyond industry benchmarks, reaching -1.77%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.87, MongoDB adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for MongoDB visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.