Once a sleepy fishing village on the banks of the Camel estuary, Rock has become one of Cornwall’s most sought-after destinations – and it’s not hard to see why.

With its dune-backed sandy beaches, luxury homes and world-renowned restaurants, Rock’s popularity has exploded over the past 20 years, and so has demand for properties, with the wealthy snapping up second homes to cater for relaxing getaways from the city.

Take a glimpse in the window of the local estate agent, and you’ll be forgiven for believing that last week’s downgrading of UK growth was a dream.

The cheapest property, priced at £350,000, is a nondescript two-bedroom lodge marketed as an ideal holiday home. At the other end of the scale, five of 18 homes up for sale have asking prices above £1m.

No wonder the village is often dubbed Cornwall’s Saint-Tropez or Kensington-on-Sea.

Further confirmation is found at a high-street deli called Fee’s, where smartly dressed men discuss financial markets while smart saloon cars are parked outside. Inside, sourdough bread costs £5, a latte £3.60.

Yet more than a quarter of people in Cornwall earn under the real living wage, while around 40 per cent of jobs are part time, according to research by the Cornwall Community Foundation. More than one in five of the working population is “economically inactive”, reports the Office for National Statistics.

And herein lies the problem.

“To buy or rent here, you got to be joking haven’t you,” says local Adrian Rickard, who has recently returned to the village to live with his 76-year-old mother. The father-of-two cannot afford to go to many of the pubs and restaurants in the area – the exception being the Rock and District Social Club, where a pint cost members £3.50.

“The second home ownership thing was increasing, but then Gordon Ramsay bought his £4m home [in Rock] and it went crazy,” he adds. “In the summer this place is so busy you can’t move.”

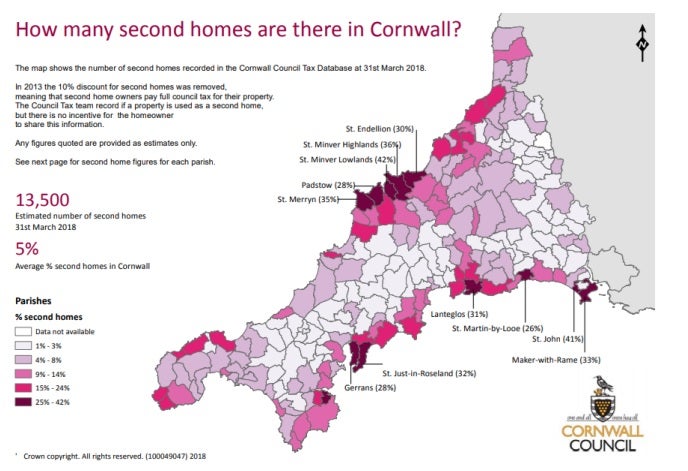

At the last official count, Cornwall Council estimated that 42 per cent of properties in Rock’s parish of St Minver Lowlands were second homes. The biggest reason for owning a second home, the authority said, was to have a holiday home or a weekend cottage, followed by long-term investment or income.

Critics claim such figures show second home ownership is turning once-thriving villages into ghost towns while forcing locals away through a lack of affordable homes.

But from Tuesday (1 April), second home owners in Cornwall will see their council tax increase by 100 per cent under a government-supported move that it is hoped will release more properties and ease the area’s housing crisis. The county has the highest number of second homes in the country – around 13,000, according to the council.

The strategy, however, does not go far enough for many.

“I just don’t see it making a difference,” says Rickard. “If they [second home owners] have got the money to buy a second home, they will have the cash to spend a couple of thousand more on council tax each year. What is needed here is more affordable homes.”

His fears are shared by fellow lifelong villager Frankie Weatherlong. “I’ve lived here 75 years, but now [the problem of second home ownership] is really getting bad,” he says. The 78-year-old has two sons living abroad, aged 38 and 42, whom he would love to see return to the village, but he says they can’t afford it.

“The prices are terrible,” says the retired taxi driver. “The governments have done sod all, and now we’re in this situation – it’s too little, too late.”

Inside the newsagent, worker Irene Buckley says she’s been on a village housing waiting list for months, while living 11 miles away in Delabole.

Any designer homes sold by second home owners will never be within her price bracket, she says.

Her friend Helen Richards, who rents in the village with her son, says the answer is to allocate affordable housing in new developments for local people, while lifelong resident Jake Walton says the balance toward second homes has gone too far.

But not everyone in Rock agrees – and there are those who support preserving the village’s dynamic, at least in part.

There are also signs of a fairly typical village community, despite the concerns of some locals. Noticeboards highlight a pub quiz night, a digital history group meeting, pallets or firewood wanted, and an electric tricycle for sale.

Of course, there’s also a flyer for a seaside cottage to let with a “brand new state-of-the-art gym”, as well as a four-bedroom holiday home with a sauna.

Donna Caswell is painting the walls to the outside terrace of her restaurant, The Dining Room. A native of the village, Caswell opened the smart diner with her husband, cook Fred Beedles, 15 years ago.

It is open four nights a week, and is set to increase to six in the summer, serving up a three-course meal of local ingredients for £70. But Caswell is worried about the impact of the council tax premium.

“Someone who has been coming here for years came in the other day,” she explains. “They always have a pre-drink, a three-course meal with a bottle of wine, and a liquor after. They said ‘We must be careful what we are spending now, because from next month we will be paying double the council tax.’ It made me worry what impact it could have on small businesses that rely on second home owners.”

Outside Fee’s, two women dismiss the second home levy, claiming that politicians are missing the point. One of the women, aged 66, who did not want to be named, owns a second home near Rock. She says local traders depend on holiday lets and second home owners for business, and is quick to point out that properties have been improved through second ownership.

She also highlights the “low drain” on council services, such as schools, from second home owners, and claims that some villages in the area aren’t suitable for residents to live in all year round because of the poor state of roads and a lack of parking.

But are second home owners selling up as a result of the additional tax?

It’s not that clear cut, says Josephine Ashby, managing director of John Bray Estate Agents. She says there are several factors, including the economy and the lifecycle of second home ownership, behind an increase in the number of second homes on the market.

“Not for all, but for some who are in two minds, [the council tax increase] is maybe a tick for them to go ‘Let’s get it on [the market] now’, but it depends who they are and what bracket they are in; it might not be as significant [for some] as it is for others.”

Ashby adds that there is still significant interest in buying second homes, despite the situation.

Amid concerns that the rise in tax will not be enough to restore the balance in Rock, there are some who still welcome the move.

Kim Conchie, a former chief executive of Cornwall Chamber of Commerce, says the current ratio of second homes in some villages is having a “devastating impact”, with recently built “hideaways” not forming part of the village community.

“I think it is a realistic approach to ensuring communities get at least some financial benefit from owners,” he says.

Local elections 2025: Guide to locations, timings and key numbers

The UK’s best coastal spots for a spring swim revealed

How much will bills go up next week? From energy to council tax

Children put at ‘unnecessary risk’ under proposals to overhaul mental health law

Downing Street admits Britain will be hit by Trump’s tariffs on Wednesday

Sentencing guidelines delayed after row over claims of ‘two-tier justice’