NEW DELHI: The year 2022 posed severe challenges for the economy since the beginning. With cases of Covid-19 receding after 2 years of mayhem, this year was being watched as a good opportunity for the economies to recover completely from the pandemic slump.

Little did anyone know that an unprecedented global crisis was waiting to happen, one that had the potential to derail all economies alike.

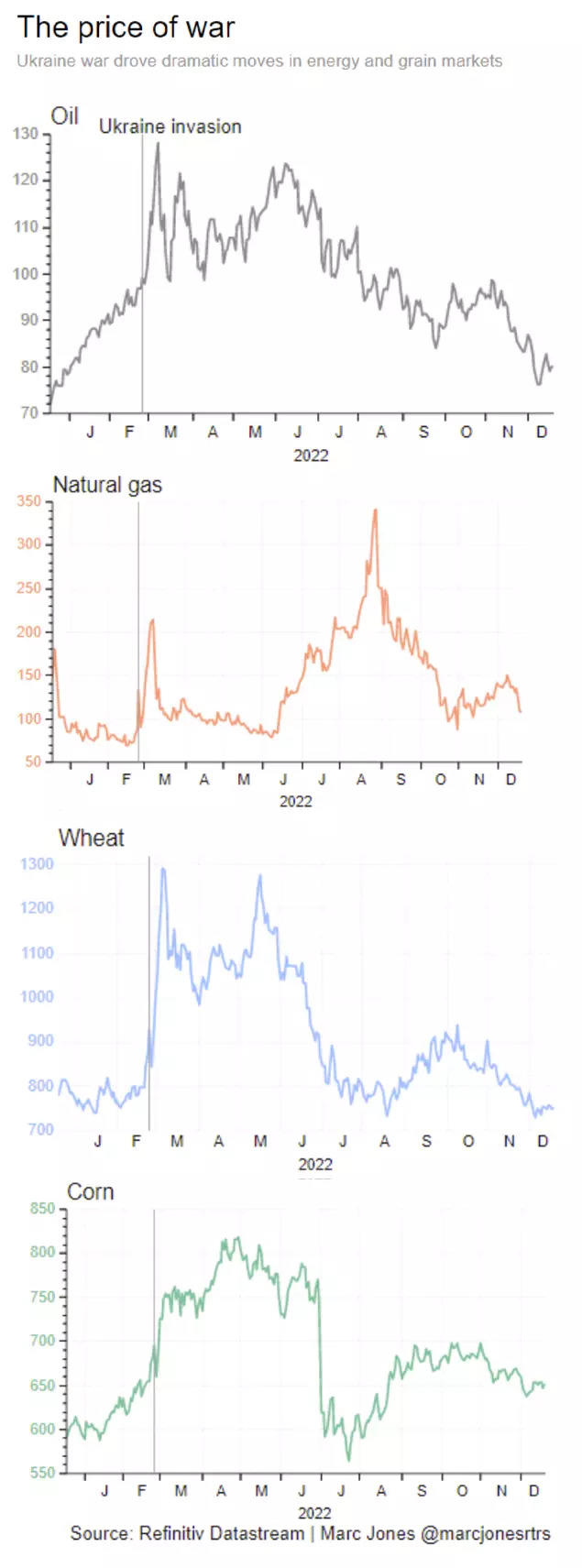

As Russia invaded Ukraine in February, the entire world found itself fighting to secure basic amenities. Disruption to 2 major trade routes, Russia and Ukraine, along with subsequent sanctions imposed on Russia by different economies, had a major impact on global supply chains.

As a result, oil prices surged to record highs, which in turn pushed up inflation. The spillover effect fell upon India as well. In line with global cues, stock markets tumbled, inflation soared to record high, rupee plunged and forex reserves took a hit.

The government and Reserve Bank of India (RBI) faced twin challenges of whether to opt for measures to boost economic growth or soothe the rapidly rising inflation in the country. Eventually, it decided to focus on bringing prices under control.

The policy measures undertaken this year are sure to have a bearing in the coming year as well, as the government prepares itself to announce the Union Budget for financial year 2023-24. Growth will of course be a key objective for the Centre. But, policies or measures do not mean that the trouble is over.

India continues to face headwinds from external factors as geopolitical challenges remain. Besides, two of the world’s biggest economies – the United States and China – are facing risks of a slowdown and if that happens the impact on India is inevitable.

With just few days left for the new year 2023, let’s have a look at 10 economic trends to look forward to:

* India to be fastest growing economy

At a time when the world economy is projected to experience a slowdown and speculations about the onset of a global recession are rife, India is expected to emerge as a bright spot.

Many economists, brokerage firms and agencies like the International Monetary Fund (IMF) and World Bank have in their latest reports stated that Indian economy will be fastest growing among major economies in financial year 2022-23.

Even though existing global challenges like tightening monetary policy cycle, slowing growth and elevated commodity prices may lead to a lower growth than previous financial year, still India's growth will be robust due to strong domestic demand.

At present, global economy is navigating through incredibly rough waters attributed mainly to global uncertainties, unfolding of conflict in Ukraine, the reaction of financial and commodity markets to the changing scenarios, tight monetary policy and more.

However, despite these hurdles, the World Bank in its latest India development update said that India showed higher resilience to global shocks and better than expected quarterly growth numbers.

India's economy grew at 6.3% in September quarter 2022-23 as compared to 13.5% in the preceding June quarter, mainly on account of contraction in output of manufacturing and mining sectors.

Economists at State Bank of India (SBI) estimated that India will be third largest economy by 2029. They projected India to grow by 6.7% to 7.7% in FY23. Meanwhile, the RBI slashed India's GDP estimate in its December policy meet to 6.8% from 7% earlier citing accentuated headwinds from geopolitical tensions.

Further, a report by Morgan Stanley in August had stated that India is likely to be the fastest growing Asian economy in FY23 as it expects GDP to grow at an average of 7% during the period -- strongest among largest economies.

* Inflation remains a concern

One of the biggest and most common impacts of the war in Ukraine was the struggle to contain domestic prices of key commodities, thereby widening the demand-supply imbalances.

In fact, global inflation has been surging since 2021. An event like the war only flared up a crisis that was waiting to happen in future. The economic consequences, visible in the commodity market, trade, and financial linkages are retarding growth and escalating inflation further, a report by ICRIER had showed.

Fueled by erratic rainfall and supply shocks from Russia's invasion of Ukraine, prices of daily consumables like cereals and vegetables which form the largest category in the inflation basket have climbed over the past two years.

Already reeling from Covid-19 pandemic-induced economic shocks, consumers were further hit by the increase in prices as they spent a large chunk of income on food, amid the festive season in the country.

The government also introduced certain measures to calm domestic prices, including some export restrictions on rice to temper inflation. But consumer prices have remained defiant and stayed above the RBI's upper tolerance limit this year.

The RBI has been tasked by the government to keep inflation within 2-4% range with a margin of 2% on each side. However, India's annual inflation numbers stayed above the 6% tolerance band for 10-straight months this year. In November, the CPI figure came within RBI's target range mainly on account of slower rise in food prices.

However, a cool down doesn't mean that India is out of doldrums. Let's not forget that external headwinds still remain and India has been time and again cautioned by various experts to safeguard itself.

A few days back, the IMF cautioned India to be careful with interest rate hikes in future. Even though it praised India's shift towards an "appropriate policy tightening", the fund said that additional tightening should be done carefully in a calibrated manner.

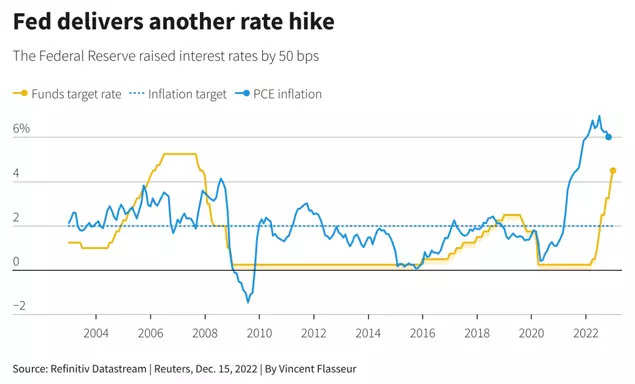

* More rate hikes to come

Till now the RBI has raised its key policy rate by 225 basis points, starting from May 2022. The repo rate is now at its highest level in over 3 years.

Consistent rate hikes have led to a consequent increase in EMIs being paid by loan takers, thereby adding to the financial burden of people amid already high inflation.

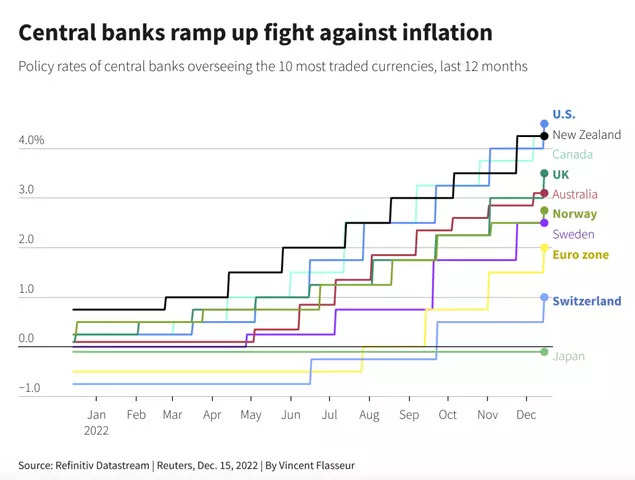

The rate hikes are not expected to stop anytime soon, not just in terms of India but also for all major central banks of the world.

In RBI's latest monetary policy minutes, governor Shaktikanta Das said that a premature pause in rate hike at this juncture could be a costly policy error as the battle against inflation is not over yet.

Similar views were presented by US Fed chair Jerome Powell as well. In its recent meet a few days back, the US Federal Reserve said that it will deliver more rate hikes next year even as the US economy slips towards a possible recession. The Fed is raising borrowing costs to bring down inflation by trying to reduce demand across the economy, relieving what has been intense competition for everything from workers to goods and homes. How this affects the economy is what needs to be seen in the coming year.

The rate hikes are not just confined to India and the US, but other major central banks also ramped up interest rates at the fastest pace and biggest scale in at least two decades in 2022 as policy makers went all out in the battle to contain surging inflation.

The US Federal Reserve, the European Central Bank, the Bank of England, the Reserve Bank of Australia, Norway's Norges Bank, the Bank of Canada and the Swiss National Bank all raised their benchmarks by a cumulative of 300 basis points. This compares to the monthly peak of 550 bps in September, though not all central banks meet on a monthly basis.

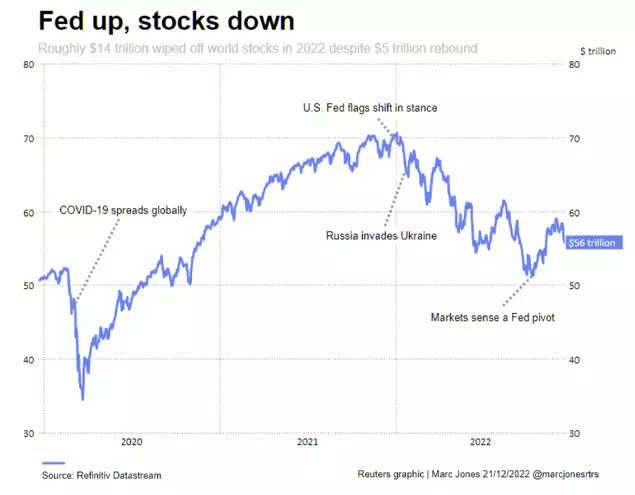

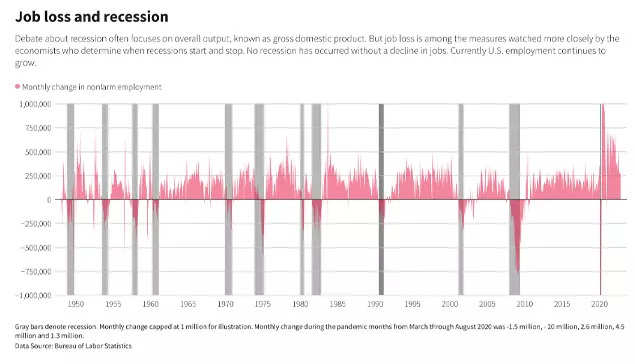

* US recession

Much has been said and speculated about the world's biggest economy inching towards recession in the coming year. The stock markets in US already had a rough year and investors are now bracing themselves up for an expected recession in 2023, a report by Reuters said.

It all started with inflation surging to 40-year highs in the country and the consequent multiple rate hikes by the Fed -- something that was stalled ever since Covid pandemic happened.

Not just investors, recession worries are now also filtering into asset prices while the Treasury yield curve has been inverted since early 2022, a signal that has preceded past downturns.

In new economic projections last week, Fed chair Jerom Powell did not explicitly jump into the recession camp, and said he feels the country can maintain "modest" growth and sees only a "modest" increase in unemployment even as the Fed deliberately tries to slow things down to cool inflation.

Recessions in the United States have come in many flavors - deep or shallow, short or long. The last two have spanned extremes. On the plus side is jobs. There has never been a recession declared without an outright decline in employment. So far that keeps growing.

However, if at all a recession is in pipeline, it is high time that economies start bracing themselves as spillover effects are bound to pose fresh challenges.

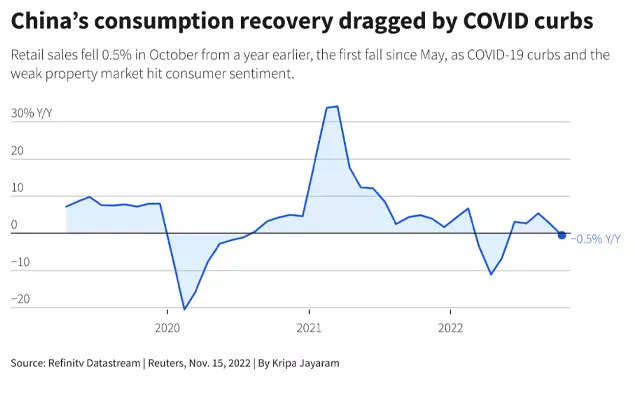

* China slowdown

The world's second-largest economy has been facing a series of headwinds right from protracted Covid curbs, global recession risks and a property downturn.

At present, the unprecedented surge in Covid cases has kept China at its toes as hospitals and crematoriums across the country continue to be overwhelmed by the influx of cases.

Other countries have also expressed concerns about the potential for new variants to emerge as China battles the world's biggest surge in infections. If this new variant of Covid spreads like earlier, countries will be forced to impose certain restrictions at a time when global economy is facing towards a downturn.

In terms of its economy, profits at China's industrial firms contracted further in the January-November period as strict Covid-related curbs disrupted factory activity and supply chains. However, many analysts are of the view that a U-turn in their zero-Covid policy can help improve prospects beginning next year.

JP Morgan analysts said China's domestic reopening, which came earlier and faster than expected, would mean a shorter period of transitional pain in the first quarter of 2023, followed by an above-trend sustained recovery from the second quarter.

Earlier this month, they trimmed their forecast for China's year-on-year GDP growth rate for the current quarter, to 2.2% from 2.7%, but raised their full-year growth forecast for next year, to 4.3% from 4%.

However, China's property market continues to be a dud. According a Reuters report, property investments in the country fell 16% in October -- its biggest drop since January-February 2020.

China's property sector has slowed sharply as the government has sought to restrict excessive borrowing. Chinese financial regulator said in a notice it will allow property developers to access some pre-sale housing funds, in the latest move to relieve the liquidity crunch.

Real estate has been China's traditional growth engine and it accounts for a fifth of the country's GDP. The danger is that the crisis will spill over into the financial sector, torpedoing investment.

In addition, exports -- which was the last reliable pillar for China -- struggled as softer overseas markets forced them to shed workers, shift to lower-value goods and even rent out their factories.

A slowdown in one of major manufacturing hubs of the world is sure to cause spillover effects in other economies as well.

Analysts quoted by Reuters have said that China is on track to miss its annual growth target of around 5.5%.

* Turmoil in South Asia

India's neighbours have seen a tough year, marred with elevated inflation, political and economic turmoil, balance of payment pressures and more. These renewed challenges came in addition to the scars from Covid pandemic which continues to weigh down on the economic recovery.

The unprecedented combination of shocks being faced by Sri Lanka, Pakistan, Bangladesh and China is dampening growth of the region.

In its report on South Asia, the World Bank estimated the region to average 5.8% this year -- a downward revision of 1 percentage point from its earlier forecast made in June.

The report noted that in Sri Lanka people suffered from shortages of essential items; floods in Pakistan have wreaked havoc on millions of people that lost their homes; soaring food prices

across the region have adverse impacts on households’ ability to obtain sufficient food; people in Afghanistan suffer from double-digit declines in income and reduced access to core services; and the lives of migrant workers, upended during Covid lockdowns, face uncertainty and possible scarring effects from the pandemic.

In May, Sri Lanka defaulted on its overseas debt. Amid political upheaval and human suffering, the Indian Ocean island is still awaiting a $2.9 billion rescue by the IMF. Lacking resources to buy even essentials like fuel, the economy is falling into an ever-deepening abyss. The poverty rate has doubled in one year; output has cratered and inflation soared.

Pakistan witnessed political instability this year after Pakistan Tehreek-e-Insaf (PTI) chairman Imran Khan was ousted from power through a no-confidence motion. The country faced economic slowdown and its foreign exchange reserves depleted. As a result, Pakistan had to tap IMF to secure financial aid.

Similarly, Bangladesh was also in talks with IMF to prevent further decline in its forex reserves.

"The growth path diverges among South Asian countries: The more services-led economies (India, Nepal, and Maldives) are expected to maintain a reasonable recovery trend despite

headwinds, while Afghanistan, Sri Lanka and Pakistan are in more precarious shapes and will see poverty increase in 2022 amid severe domestic crises," the World Bank said in its report.

India has long been concerned about China's clout in its neighbourhood, including Nepal, Bangladesh and Sri Lanka.

* Stock markets volatility

Domestic equity indices emerged as the best performer among Asian stock markets, strengthening hopes for a better 2023.

A structural shift in supply chains from pandemic-hit China, forecasts of fastest economic growth and post-pandemic retail boom, helped Indian stock markets to double its weight in MSCI's emerging markets index to 16% from 2019.

According to a Reuters report, next year's optimism for India is driven by strong corporate earnings, a post-pandemic retail boom and an economy set to grow by 6% in the next fiscal year - which will make it the world's fastest-growing major economy in 2023.

The credit for this relative outperformance goes largely to the domestic retail and institutional investors, who kept the faith despite the steady drumbeat of negative headlines and absorbed the record selloff by foreign funds.

Interestingly, like most stock markets, both sensex and Nifty experienced a lacklustre spell for most part of the year, especially after the Ukraine war broke out in February. Sensex started picking up momentum as the festive season approached. It closed at its all-time high of 63,284 on December 1.

The sensex is up just 4.44% in 2022, but is still the world's best-performing large market index.

In fact, none of the major global indices have managed to muster gains in this brutal year, including the Dow Jones (down 9.24% in 2022 so far), FTSE 100 (dipped 0.43%), Nikkei (shed 10.47%), Hang Seng (lost 15.82%) and the Shanghai Composite Index (dropped 16.15%).

While, NSE Nifty 50 Index up above 7%, compared to an 18% slump in global stocks, it remains the most expensive in Asia.

However, foreign investors seemed to have missed out on making most of the surge in Indian markets. After 3 years of infusing huge funds, foreign portfolio investors retreated from the Indian equity markets in a big way in 2022 with the highest-ever yearly net outflow of nearly Rs 1.21 lakh crore.

According to experts, inflows from FPIs might see a revival in the coming year. But, the quantum of investments might be lower than before.

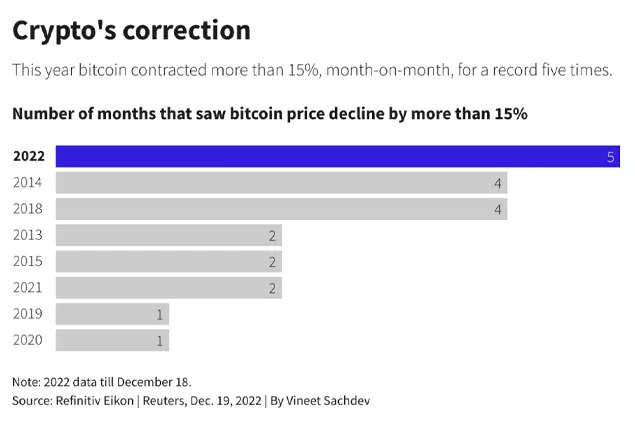

* Crypto market

The cryptocurrency market has been very chaotic this year.

The pre-eminent cryptocurrency has lost 60% of its value, while the wider crypto market has shrunk by $1.4 trillion, squashed by the collapse of Sam Bankman-Fried's FTX empire, Celsius and supposed 'stablecoins' terraUSD and Luna.

The most popular cryptocurrency Bitcoin touched $69,000 peak in November 2021. From that level, the value of bitcoin has now dropped about three-quarters.

However, RBI governor Shaktikanta Das has time and again cautioned investors against buying cryptocurrencies. At a recent event, the RBI governor reiterated his warning against unregulated cryptos and said that the next financial crisis will come from cryptos itself if such private digital coins are allowed to grow unchecked. He again expressed his view of banning cryptos.

To combat the popularity of cryptos, the RBI recently introduced pilots of its own digital currency, the digital rupee or central bank digital currency.

The CBDCs can boost innovation in cross-border payments, making these transactions instantaneous and help overcome key challenges relating to time zone, exchange rate differences as well as legal and regulatory requirements across jurisdictions.

With the onset of digital rupee, Indian investors are now eyeing its proper launch.

The CBDCs can boost innovation in cross-border payments, making these transactions instantaneous and help overcome key challenges relating to time zone, exchange rate differences as well as legal and regulatory requirements across jurisdictions.

* Freebies & the OPS v/s NPS debate

The debate over old pension scheme (OPS) and new pension scheme (NPS) has been trending since past few months. The issue came into limelight after reversal of positions on the old pension scheme by Rajasthan and Chhattisgarh.

In a report, RBI had said that reverting to old pension scheme is bound to increase the current expenditure of state governments. Even though the old pay-as-you-g0 (PAYG) scheme was always an attractive dispensation for political parties as the current aged people can benefit, even though they may not have contributed directly to the pension kitty. However, the report clearly stated that the scheme is not sustainable for state's finances and has always been a fiscal burden.

Another debate which has been in public eye since the past 4-5 months is that on freebies. Especially, with 9 states heading for elections next year, the matter over freebies will be of interest to people.

The Supreme Court has already raised questions about the freebie culture causing a significant impact on the economy. It has proposed to constitute an apex body for suggestions on how to control freebies by political parties during election campaigns.

Few months back, Prime Minister Narendra Modi also expressed concern over giving free government schemes to the public on behalf of states. Even the RBI in its annual report had cautioned that rising subsidy burdens have stretched state government finances. The states were already reeling under pressure created by the Covid pandemic since 2020.

Last week, finance minister Nirmala Sitharaman said that freebies and subsidies should be contextualised and no one will have objection if there are budgetary provisions with compliance to fiscal rules for any such promises.

* Union Budget

Boosting economic growth and ensuring fiscal consolidation will be one of the prime objectives of the Centre when it announces the Union Budget 2023-24 in February next year.

All eyes will be on finance minister Nirmala Sitharaman as she will present the last full year budget of the Modi 2.0 government. In 2024, this government will present an interim budget as a full year budget will be announced only after completion of general elections.

At a Reuters conference last month, Sitharaman had said that India plans to use government capital spending to sustain strong economic growth. She also forecasted a "very good" economy ahead of the 2024 elections.

The finance minister also said that the government plans to give priority to health and education sectors.

"We would continue to push capital expenditure, and that I’m saying even as I’m preparing for the next budget," Sitharaman told the conference. Capital expenditure, she said, "can guarantee good growth."