6 analysts have shared their evaluations of Redwood Trust (NYSE:RWT) during the recent three months, expressing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 1 | 0 | 0 |

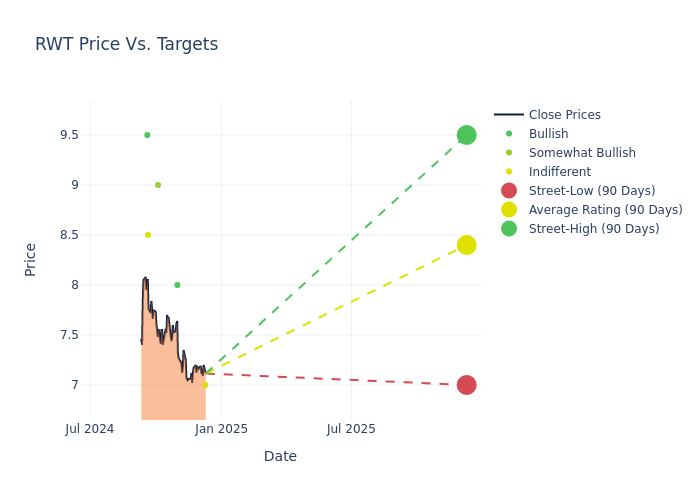

Analysts have recently evaluated Redwood Trust and provided 12-month price targets. The average target is $8.33, accompanied by a high estimate of $9.50 and a low estimate of $7.00. Observing a 5.18% increase, the current average has risen from the previous average price target of $7.92.

Exploring Analyst Ratings: An In-Depth Overview

A comprehensive examination of how financial experts perceive Redwood Trust is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Richard Shane | JP Morgan | Lowers | Neutral | $7.00 | $8.00 |

| Jason Weaver | Jones Trading | Raises | Buy | $8.00 | $7.55 |

| Richard Shane | JP Morgan | Raises | Overweight | $8.00 | $7.50 |

| Trevor Cranston | JMP Securities | Raises | Market Outperform | $9.00 | $8.50 |

| Donald Fandetti | Wells Fargo | Raises | Equal-Weight | $8.50 | $7.50 |

| Stephen Laws | Raymond James | Raises | Strong Buy | $9.50 | $8.50 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Redwood Trust. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Redwood Trust compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Redwood Trust's stock. This analysis reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Redwood Trust's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Redwood Trust analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Redwood Trust

Redwood Trust Inc is a real estate investment trust focused on different areas of housing credit. The company operates in three segments: the Residential Consumer Mortgage Banking segment consists of a mortgage loan conduit that acquires residential loans from third-party originators for subsequent sale to whole loan buyers, securitization through SEMT (Sequoia) private-label securitization program, or transfer into its investment portfolio, Residential Investor Mortgage Banking segment consists of a platform that originates and acquires business purpose lending loans for subsequent securitization, sale, or transfers into its investment portfolio, and Investment Portfolio segment consists of organic investments sourced through residential and business-purpose mortgage banking operations.

Unraveling the Financial Story of Redwood Trust

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Positive Revenue Trend: Examining Redwood Trust's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1053.95% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Financials sector.

Net Margin: Redwood Trust's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 21.72% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Redwood Trust's ROE stands out, surpassing industry averages. With an impressive ROE of 1.13%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Redwood Trust's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.07%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Redwood Trust's debt-to-equity ratio stands notably higher than the industry average, reaching 14.56. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.