MongoDB (NASDAQ:MDB) has been analyzed by 4 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

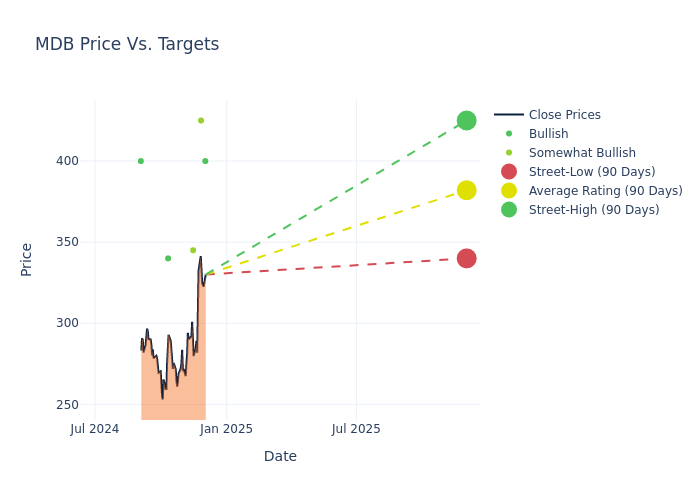

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $377.5, along with a high estimate of $425.00 and a low estimate of $340.00. Observing a 18.9% increase, the current average has risen from the previous average price target of $317.50.

Understanding Analyst Ratings: A Comprehensive Breakdown

The perception of MongoDB by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Yun Kim | Loop Capital | Raises | Buy | $400.00 | $315.00 |

| Brent Bracelin | Piper Sandler | Raises | Overweight | $425.00 | $335.00 |

| Raimo Lenschow | Barclays | Raises | Overweight | $345.00 | $290.00 |

| Rudy Kessinger | DA Davidson | Raises | Buy | $340.00 | $330.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to MongoDB. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of MongoDB compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of MongoDB's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into MongoDB's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on MongoDB analyst ratings.

Get to Know MongoDB Better

Founded in 2007, MongoDB is a document-oriented database with nearly 33,000 paying customers and well past 1.5 million free users. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB's database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

Financial Insights: MongoDB

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: MongoDB's revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 12.82%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -11.41%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): MongoDB's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -4.14%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of -1.77%, the company showcases effective utilization of assets.

Debt Management: MongoDB's debt-to-equity ratio is below the industry average. With a ratio of 0.87, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.