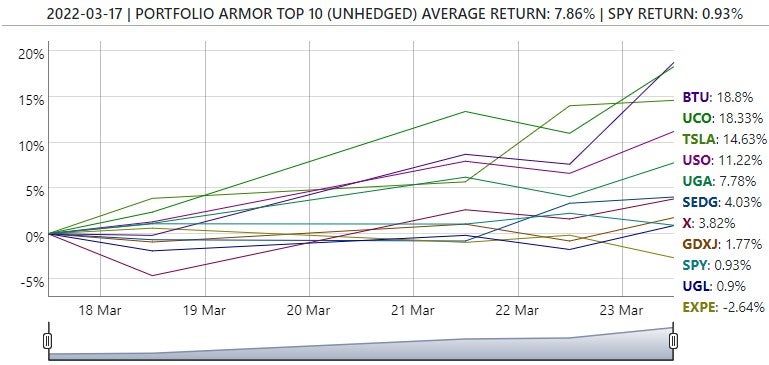

U.S.-led sanctions on Russia in response to its invasion of Ukraine have put upward pressure on steel prices recently, as Russia is one of the world's top steel exporters. United States Steel Corporation (NYSE:X) has been one of our top ten names recently, in our system's daily ranking of securities by its gauges of stock and options market sentiment. For example, it was a top name last Thursday, on March 17th.

Since then, it was up 3.82%, as of Thursday's close, lagging other top names of ours from last week such as Peabody Energy Corporation (NYSE:BTU) and Tesla, Inc. (NASDAQ:TSLA). U.S. Steel was still a top name of ours as of March 23rd, but now Goldman Sachs Group, Inc. (NYSE:GS) has reiterated its sell rating on the stock.

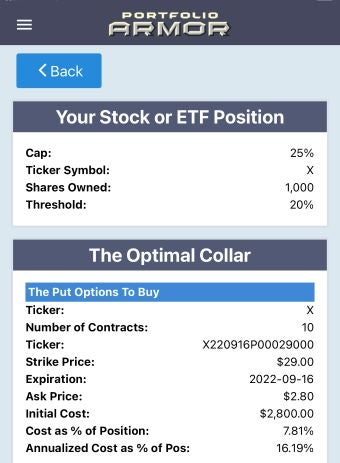

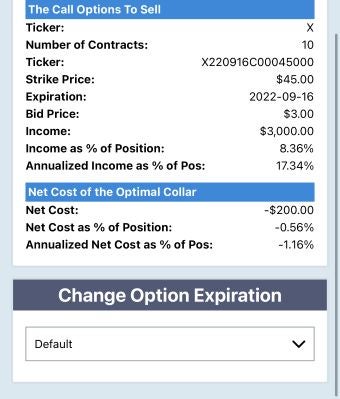

If you share our system's bullishness about U.S. Steel, but want to limit your downside risk in the event Goldman Sachs's bearishness ends up being correct, here is a way to do so. As of Thursday's close, this was the optimal, or least expensive collar to hedge 1,000 shares of U.S. Steel against a greater-than-20% drop over the next several months, while not capping your possible upside at less than 25% over the same time frame.

Screen captures via the Portfolio Armor iPhone app.

As you can see above, the net cost of this collar was negative, meaning you would have collected a net credit of $200 when opening this hedge on Thursday. That cost was calculated conservatively, assuming you bought the puts at the ask and sold the calls at the bid. Since, in practice, you can often buy and sell options at some price between the bid and ask, you likely would have received a bit more than $200 in net credit when opening this collar.