An $11 million budget shortfall has prompted Responsible Wagering Australia to call for the ACT government to immediately slash a controversial tax.

The body, which represents Australia's largest online betting agencies, said the government's attempts to fill their coffers by increasing the betting operations tax had backfired - and the capital was missing out on valuable revenue as a result.

Government budget papers revealed Treasury estimated the tax, commonly referred to as the point-of-consumption tax, would bring in $32.1 million for 2023-24.

But it only resulted in $21.7 million going into general revenue - almost $11 million less.

It was also less than the $22.3 million they received from it the previous year.

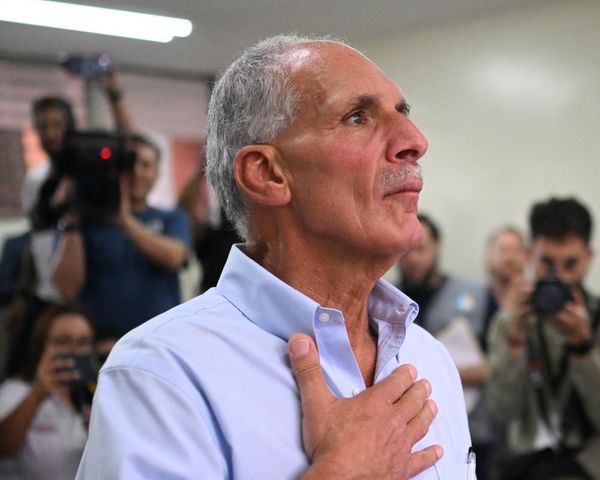

RWA chief executive Kai Cantwell put it down to the tax being increased from 20 to 25 per cent last year - without warning or consultation with the betting industry.

It's the second year in a row the tax has come in short with the government also increasing the tax by 5 per cent the previous financial year.

For the 2023-24 budget it was forecast at $26.6 million - $4 million more than received.

The government declined to comment, but they weren't planning to change the PoC tax.

They've put it simply down to forecasts varying - some years they're higher, some years lower and other years on the money.

Government forecasts predict the PoC will return to rising for the next four years - from $27.8 million this year up to $44.4 million in '27-28.

Revenue was $1.4 million higher than forecast in 2022-23 and slightly lower in 2021-22, respectively, when the PoC was stable at 15 per cent.

"The ACT government's attempt to fill their own coffers has backfired, resulting in a significant loss of tax revenue that could have been invested into areas that are important to the local Canberra community," Cantwell told The Canberra Times.

"RWA warned the government that increasing the betting operations tax by so much would lead to negative outcomes, but they chose to proceed without bothering to consult or even give a heads up to the impacted industries."

The ACT has the highest PoC tax in Australia, with Queensland the only other state that has it above 15 per cent.

It's a tax designed to tax gamblers where they reside - rather than letting betting companies simply get taxed where they're based.

In every other state part of the revenue raised was used to fund the racing industry - except in the ACT where it's part of general revenue.

As a result of last year's unexpected increase, which betting companies found out about when it kicked in, Sportsbet cancelled its popular "bet with mates" function and also bonus bets for people living in the ACT.

Other betting companies were yet to follow suit.

"RWA and our members are always willing to work with the ACT government to develop a sustainable funding model that benefits the ACT community and supports a prosperous racing industry, which sustains hundreds of Canberrans' livelihoods," he said.

"We urge the government to immediately revert the tax rate to 20 per cent and engage with the ACT racing and wagering industries to better support the workers who significantly contribute to the Canberra community and economy."