/Apple%20logo%20-%20by%20Pexels%20via%20Pixabay.jpg)

Apple (AAPL) has come under fire for delays in its AI projects, causing its stock price to decrease by 14.2% in 2025. However, the selloff might be overdone, according to analysts who see a buying opportunity in the stock.

This is because the company continues to have strong fundamentals and to report robust revenue growth across its product and services sergments. This can offset near-term concerns about AI setbacks.

Apple is also expanding its artificial intelligence (AI) capabilities with a deal planned with Alibaba (BABA) in China, which could bring in $10 billion in new annual revenue by the year 2027, as per the analysts. Apple also intends to release a foldable iPhone in late 2026, a move that could resuscitate growth on the back of innovation.

Apple’s services division, including iCloud, Apple Music, and the App Store, continues to be a growth driver, bringing in nearly $100 billion annually. Consumer hardware sales are slowing, but Apple is focusing on software and services, which bring higher-margin revenue and recurring payments. This change in direction has the potential to mitigate the impact of the cycles in the hardware business and ensure long-term profitability.

Another area where Apple is making inroads is augmented reality and virtual reality. Apple’s Vision Pro headset, targeted at enthusiasts, has the potential to be a mainstream item by the year 2026 as software platforms develop. The possibilities for AR-based apps in gaming, productivity, and social networking could make Apple the metaverse market leader.

About Apple Stock

Apple (AAPL) is a top technology firm that manufactures the legendary iPhone, Mac, and iPads. It also has an iconic services segment which comprises the App Store, Apple Music, and iCloud. Headquartered in Cupertino, California, Apple has a market capitalization of approximately $3.19 trillion.

AAPL stock has been volatile, ranging from $164.07 to $260.10 over the last 52 weeks. Apple has still recorded a 21.7% rise over the last year, outperforming the S&P 500 Index ($SPX).

AAPL’s valuation remains elevated with a trailing price-earnings ratio of 30.7x and forward price-earnings ratio of 29.5x. The price-sales ratio stands at 8.2x, which is a premium valuation relative to its industry. The price-book ratio of the company at 48.2x also indicates that investors are willing to pay a premium for the strength of the Apple brand and its cash generation ability.

Apple rewards its shareholders with a regular dividend. Apple pays a dividend of $1 per year for each share, with a dividend yield of 0.47%.

Apple Stock Beat on Q1 2025 Earnings

Apple reported diluted earnings per share of $2.40 for the first quarter of its fiscal 2025, far surpassing Wall Street expectations. This demonstrates the firm’s strong execution and continued leadership in the consumer electronics and services segments.

Looking ahead, analysts are calling for EPS of $1.61 in the current quarter, up 5% year-over-year. For the full fiscal 2025, analysts are guiding for earnings of $7.26, up 7.6% year-over-year. EPS growth is expected to accelerate to 12% for fiscal 2026.

Its future AI integration and potential new developments in hardware could be major drivers in the future. Supply chain problems and regulation problems are the current hurdles, but the company’s underlying strengths and ecosystem are the drivers for its long-term growth prospects.

What Do Analysts Expect for Apple Stock?

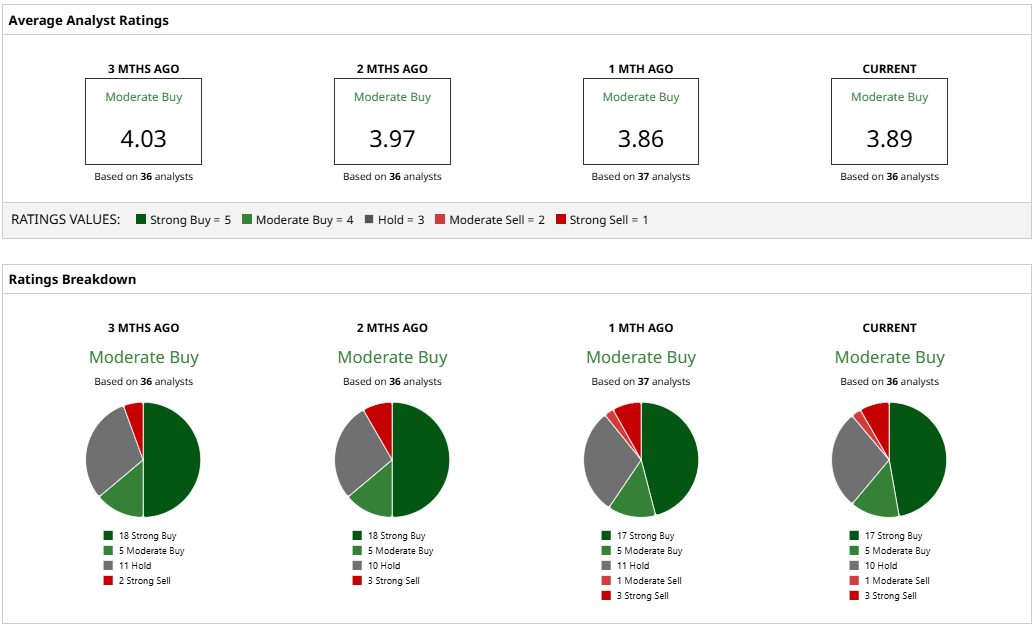

Apple has a “Moderate Buy” consensus based on the opinions of 36 analysts. The average price target stands at $250.83, which reflects a potential increase of 15.7% over current prices. The highest price target stands at $325, and the lowest price target stands at $184, showing a wide range in the opinions regarding Apple’s valuation.

Apple’s high institutional holding of 67.73% indicates that major investors are confident in the company. Despite ongoing short-term headwinds, the outlook for Apple to overcome obstacles and continue as the market leader remains upbeat.