Humana (NYSE:HUM) has outperformed the market over the past 10 years by 5.66% on an annualized basis.

Buying $100 In HUM: 10 years ago, an investor could have purchased 1.17 shares of Humana at the time with $100. This investment in HUM would have produced an average annual return of 17.86%. Currently, Humana has a market capitalization of $55.85 billion.

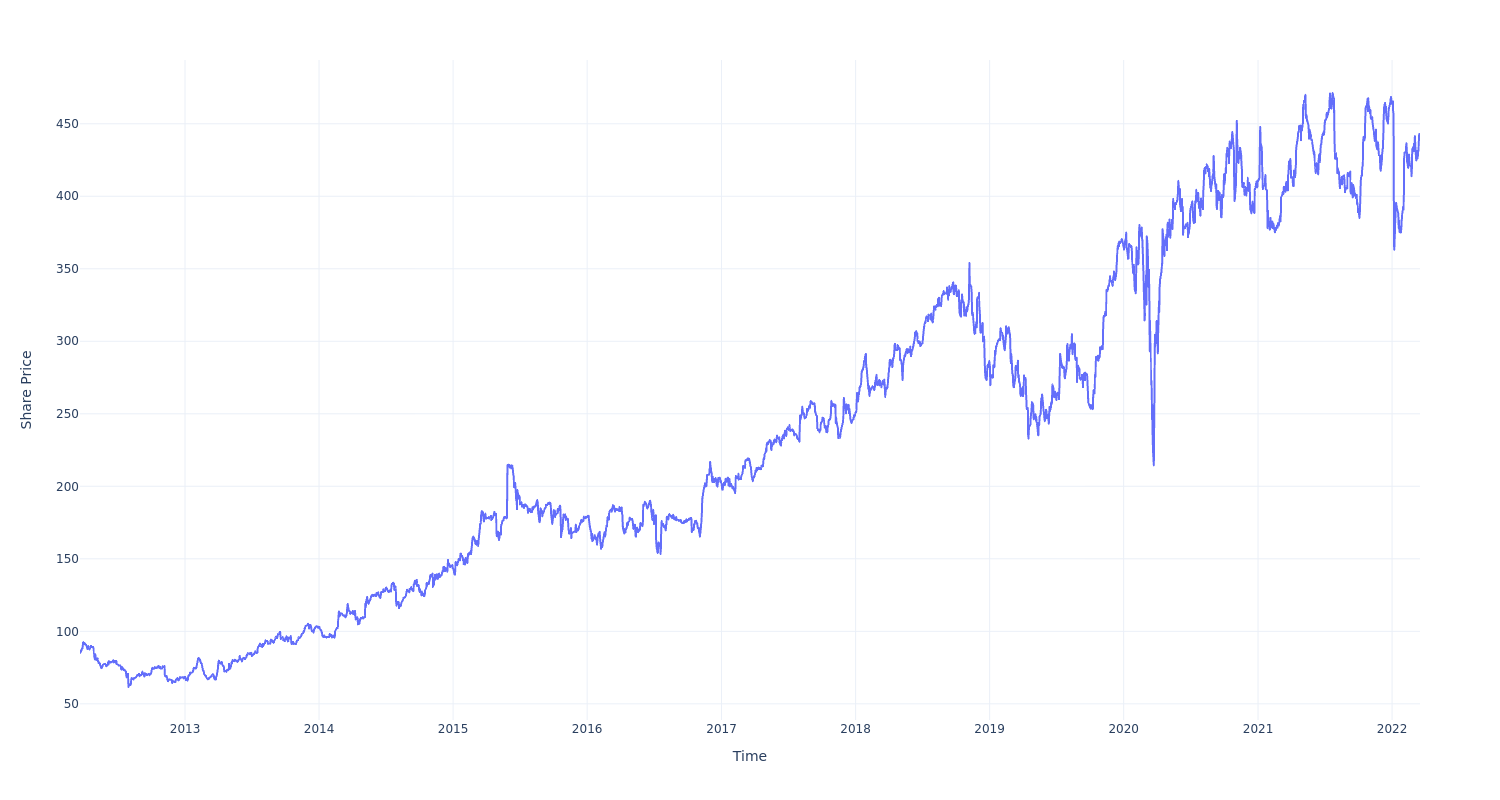

Humana's Share Price Over Last 10 Years

If you had invested $100 in Humana you would have approximately $517.05 today.

Finally -- what's the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga's automated content engine and reviewed by an editor.