When it comes to blue chip stocks that pay dividends and play defense, Walmart's (WMT) reputation is pretty tough to beat.

Indeed, Walmart is indisputably one of the best dividend stocks for dependable dividend growth.

This member of the S&P 500 Dividend Aristocrats has increased its payout annually for more than half a century. For those reasons and more, Walmart ranks as one of analysts' top-ranked Dow Jones stocks.

Walmart's defensive characteristics certainly came in handy in 2022, as you can see in the chart below.

The S&P 500 generated a total return (price change plus dividends) of -18.1%, a historically bad result.

On the other hand, Walmart's total return came to -0.5% – or essentially flat – to beat the broader market by more than 17 percentage points.

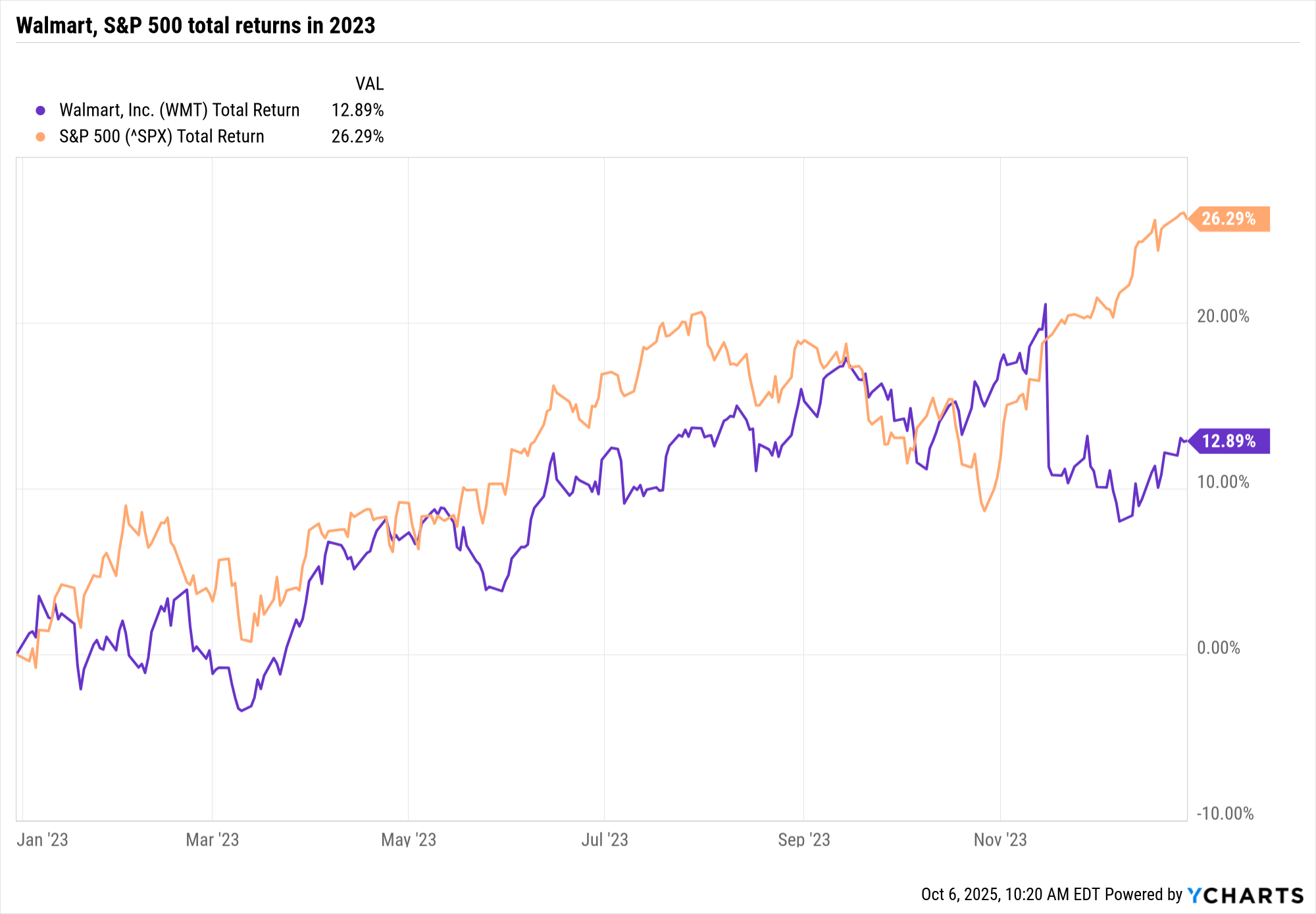

The other side of WMT's defensive coin can be seen in its performance during 2023's remarkable rally. While the S&P 500 returned more than 26%, Walmart returned less than 13%.

As for 2024, WMT beat the broader market by nearly 50 percentage points, helped by resiliency in the labor market and consumer spending.

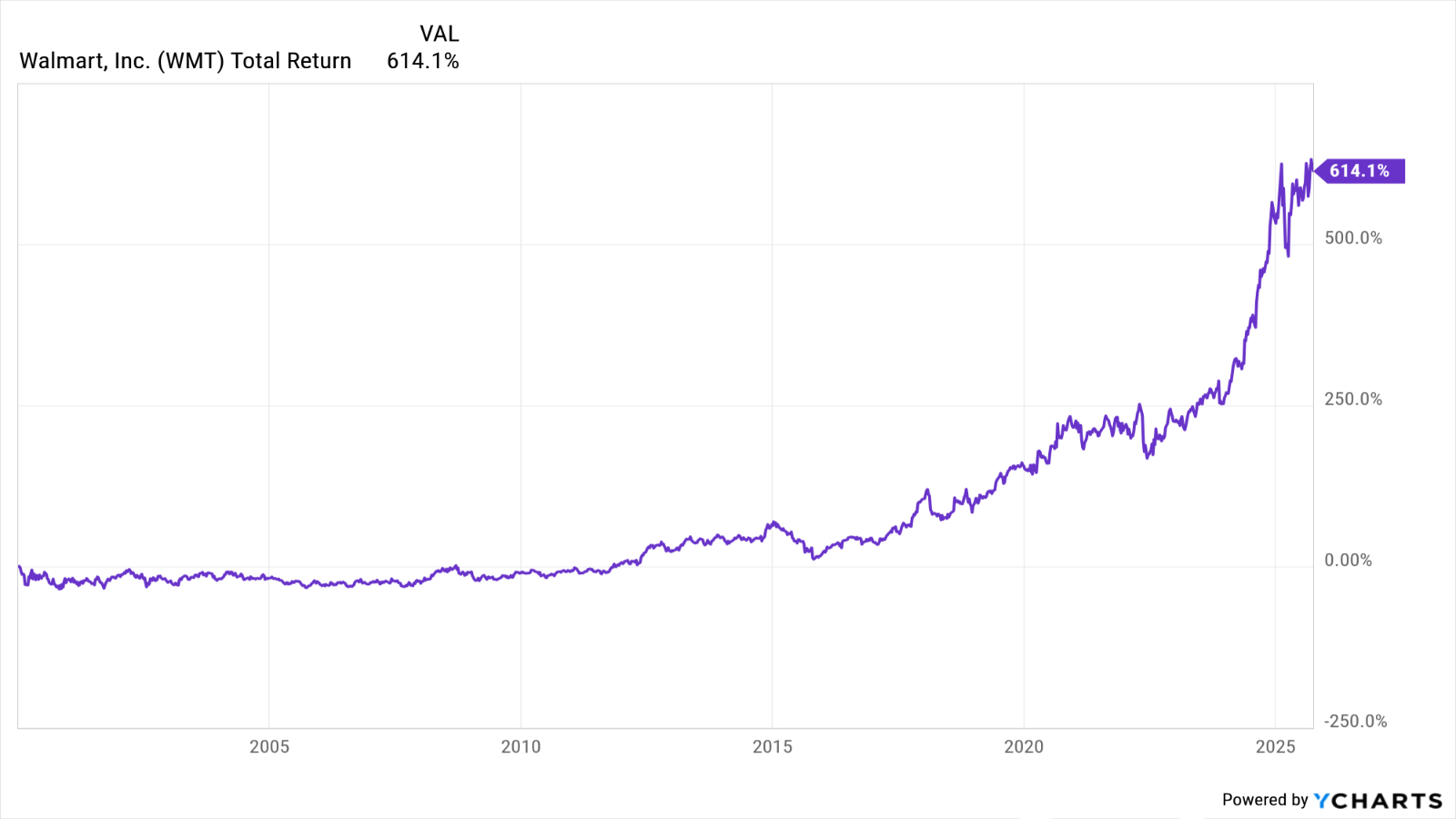

Happily for long-term shareholders, WMT stock's outperformance over the past 52 weeks has helped it turn in market-beating returns on a 20-year basis.

That's a change in fortune. WMT stock was a long-time laggard following a torrid run in the 1990s, hurt by the market's preference for growth over value, as well as worries about the future of bricks-and-mortar retail.

The bottom line on Walmart stock

Walmart stock was actually one of the best stocks of the 30 years between 1990 and 2020, but as you can see in the chart below, WMT basically traded sideways for the first decade-plus of the 21st century.

Walmart shares went nowhere for a long time, but then that's not necessarily unusual given how far and fast they appreciated during the bubblicious 90s.

Between the beginning of 1997 and the end of 1999, WMT gained more than 500% on a price basis. The broader market didn't quite double over the same span.

Also weighing on WMT during the first decade of the new century was the threat from e-commerce.

Walmart responded by becoming the second-largest e-commerce retailer in the U.S. after Amazon.com (AMZN) – albeit a distant second. Walmart got serious about its digital strategy sometime around 2006, but it took a while for what was regarded as "show-me" story to ultimately prove successful.

Whatever the causes, that lost decade on Walmart's stock chart really hurts its long-term results. Over the past 20 years, WMT stock has generated an annualized total return of 12.5% vs 11% for the S&P 500.

And even then, that one percentage point of outperformance emerged only recently. To get a sense of what this sort of ride looks like on a stock chart, see the image below.

The chart illustrates the fact that if you invested $1,000 in Walmart stock 20 years ago, today it would be worth about $10,500. The same thousand bucks invested in an S&P 500 ETF would be worth about $8,000 today.

For its entire history as a publicly traded company, WMT's annualized total return beats the broader market by 2.5 percentage points.