Apple (AAPL) stock has taken a bruising to start 2025, but then past drawdowns have proven to be a good time to pick up this long-time market-beater on sale.

Just ask buy-and-hold Apple investors who have been through this before. They'll tell you they have enjoyed incomparable returns over the past few decades – all by just sitting on their hands.

From January 1990 through December 2020, AAPL stock created $2.67 trillion in shareholder wealth, or an annualized dollar weighted return of 23.5%, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

Indeed, per Bessembinder's findings, which account for a stock's increase in market cap adjusted for cash flows in and out of the business and other adjustments, Apple was the best stock in the world over those 30 years.

True, AAPL stock traded sideways for the first few years of the 21st century, but an explosion of innovation soon put an end to that. Under the visionary leadership of the late Steve Jobs, Apple essentially reinvented itself for the mobile age, launching revolutionary gadgets such as the iPod, MacBook and iPad.

But what really set Apple on its course to becoming the world's second largest publicly traded company – and one of hedge funds' favorite blue chip stocks – was the 2007 debut of the iPhone.

Today, Apple isn't just a purveyor of gadgets; it sells an entire ecosystem of personal consumer electronics and related services. And it's a sticky ecosystem at that.

No less an eminence than Warren Buffett has called the iPhone maker Berkshire Hathaway's (BRK.B) "third business," noting Apple fans' fantastic brand loyalty as one reason for being all-in on the stock. (Apple accounts for nearly 30% of the value of the Berkshire Hathaway equity portfolio.)

True, Berkshire Hathaway cut its Apple stake sharply last year, but that was because the holding company believes that corporate taxes are likely to rise at some point in the future. Bulls needn't worry about Berkshire losing its taste for the stock. Warren Buffett adores Apple as much as ever.

Little wonder the iconic tech firm was tapped to become one of the elite 30 Dow Jones stocks. In 2015, Apple replaced AT&T (T) in the Dow Jones Industrial Average.

The bottom line on Apple stock?

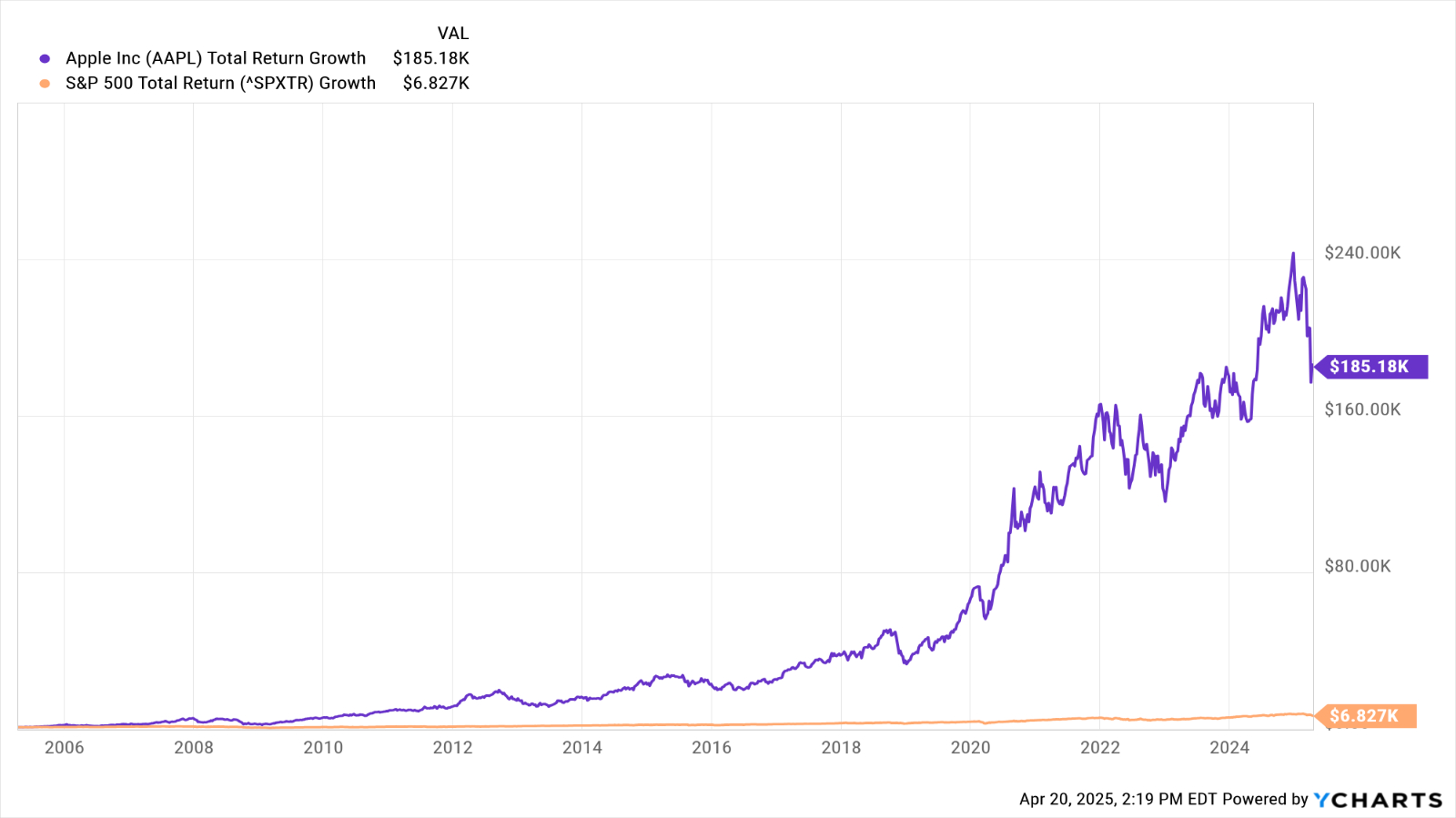

Over the past 20 years Apple stock generated an annualized total return (price change plus dividends) of 29.8%. By comparison, the S&P 500 delivered an annualized total return of 10.1% over the same span.

What does that look like on a brokerage statement? Check out the above chart and you'll see that if you invested $1,000 in Apple stock 20 years ago, it would today be worth about $185,000. The same $1,000 invested in the S&P 500 would theoretically have turned into about $6,800 over the same period.

For those wondering if Apple stock is a buy at current levels, Wall Street mostly thinks so. Of the 46 analysts covering AAPL surveyed by S&P Global Market Intelligence, 21 rate it at Strong Buy, seven say Buy, 16 have it at Hold, one says it's a Sell and one has it at Strong Sell.

That works out to a consensus recommendation of Buy, albeit with somewhat mixed conviction.