IDC has revised its expectations for the personal computer market, lowering its forecast for 2025 and beyond due to U.S. tariffs on China-made goods and reduced consumer demand. But the PC industry has tailwinds as well as headwinds, so sales of PCs will increase in 2025 compared to the prior year.

Global PC shipments are now projected to reach 273 million next year, growing 3.7% from 2024 — slightly less than previously estimated by IDC. PC growth is expected to slow further, remaining under 1% annually through 2029. On the other hand, workstations are expected to maintain steady demand. PC makers pin their hopes on AI-powered PCs, yet the category has struggled to gain traction so far; IDC expects to see stronger adoption by 2026 as the technology matures and the ecosystem around them improves.

Sales of tablets are projected to struggle, with shipments predicted to drop 0.8% in 2025 to 143.3 million and gradually decline to 141.6 million by the end of the decade mainly due to market saturation among consumers.

"Price hikes stemming from tariffs in the US combined with subdued demand are leading to a negative impact within the largest market for PCs," said Jitesh Ubrani, research manager with IDC's Worldwide Mobile Device Trackers. "However, the weakness amongst consumer demand is universal as macro issues persist. There are still some silver linings though: workstation volume should remain healthy, along with near-term tablet demand in China boosted by consumer subsidies."

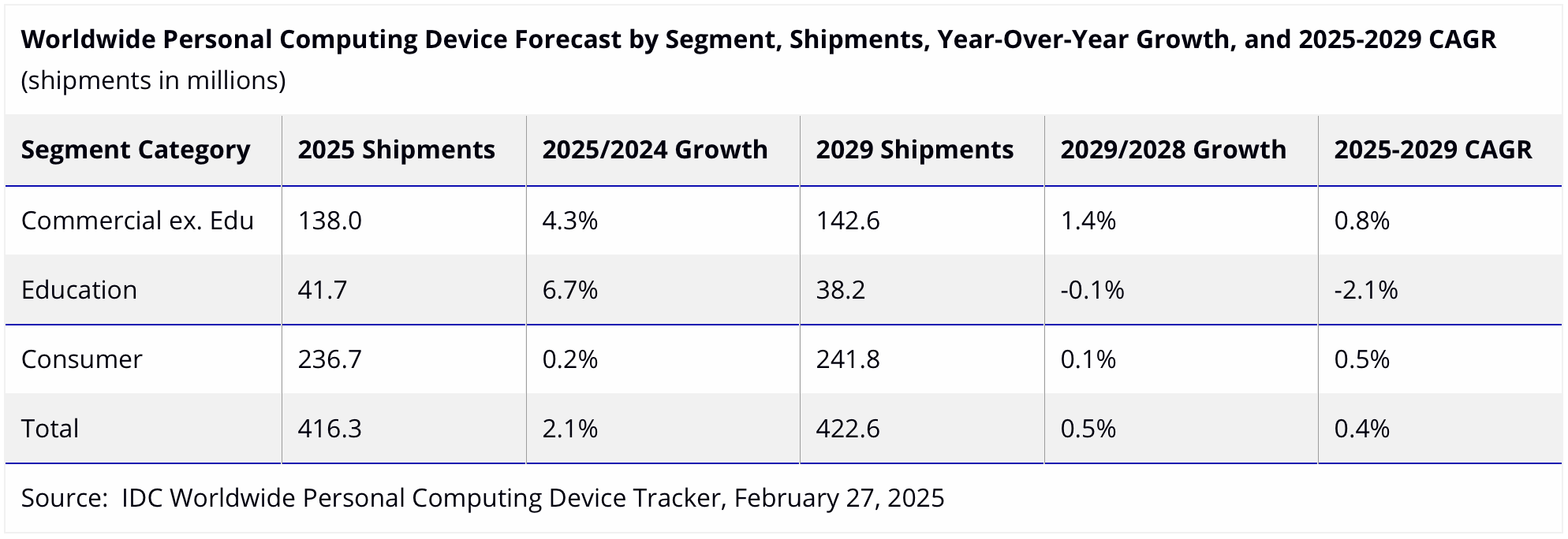

Consumer PC and tablets shipments are set to rise slightly by 0.2% in 2025, totaling 236.7 million units, but demand remains weak due to price hikes in the U.S. linked to tariffs as well as economic conditions in the rest of the world.

Meanwhile, the commercial sector — excluding education — will expand to 138 million PC and tablet units, or by 4.3%, in 2025 (possibly driven by the end of Windows 10 support) and maintain modest long-term growth at 0.8% annually. IDC notes that while the transition to Windows 11 is influencing purchasing decisions, budget constraints may push some businesses to rely on extended Windows 10 support instead.

The education segment, which will initially grow to 41.7 million PCs and tablets this year, or by 6.7%, is expected to shrink in the long run, with a compound annual decline of 2.1%.

Japan stands out as one of the few regions experiencing strong growth, as companies and smaller businesses are quickly replacing older systems before Windows 10 support ends in October. While expansion is set to slow after this surge, an ongoing education-sector initiative is expected to provide continued support for the market, according to IDC.

"In light of so many challenges around the world, Japan is a much-needed source of double-digit growth this year. Enterprises there as well as SMBs have been quickly replacing PCs in advance of the Windows 10 End Of Service in October," says Bryan Ma, vice president of Devices Research. "Growth rates naturally come down next year, but at least there is still a large education project to absorb some of the landing."