International Business Machines (IBM) stock has been acting much better in 2022.

That assertion may surprise some investors, given how poorly this stock has performed over the years.

For instance, the tech giant's shares are down 17% over the past five years and 31% over the past 10 years. But this year IBM stock is down just 4%, outperforming the roughly 22% skid in the S&P 500.

Thursday’s performance helps, as the shares are up roughly 5% after the company beat on earnings and revenue estimates for the third quarter.

Sales grew 6.4% year over year to $14.1 billion and beat expectations by $550 million. Despite currency headwinds, management also provided an upbeat revenue outlook.

That’s key for a tech stock. Investors love revenue growth -- even though the current climate forces us to take a closer look at profit. In that regard, IBM pays a dividend yield in excess of 5% and trades at just 13.5 times this year’s earnings expectations.

Withal, the charts have a lot of overhead areas to monitor.

Trading IBM Stock on Earnings

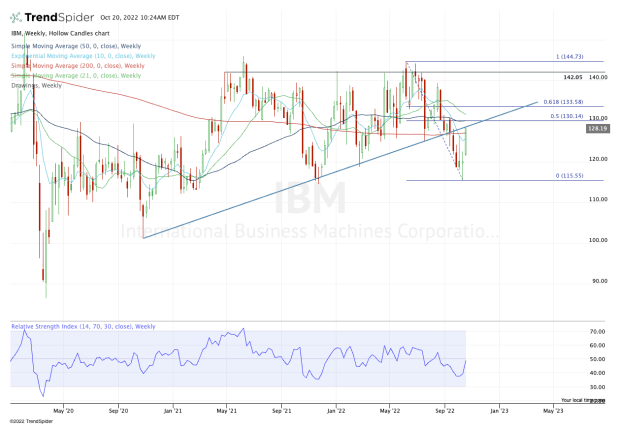

Chart courtesy of TrendSpider.com

I want to be more bullish on IBM because of the above attributes (including last night’s earnings report), but the technicals flash some caution.

That’s what happens when we’re in a bear market, as there is layer after layer of potential resistance to push through.

For IBM stock's part, it’s doing a good job pushing through the 200-week moving average -- but it’s running into the underside of prior uptrend support (blue line).

The bulls need to see this level reclaimed if they want a more sustainable rally to play out.

If IBM does reclaim this measure, it faces two rather significant measures: the 50% retracement near $130, as well as the 50-week and 200-day moving averages.

It would be reasonable to pair all these levels together and say simply that the $128.50 to $130 zone is critical.

If the stock can clear the zone, the door opens to the 61.8% retracement near $133.50, then potentially the $140 to $142 zone, which has been stout resistance this year.

On the downside, let’s keep an eye on today’s low at $125.18. Below that and IBM stock may go on to fill the post-earnings gap at $123.94.

Below $121 is where I become more cautious, as it could open the door down to the 2022 low near $115.50.