In IBD's Screen of the Day, we look at the stocks that investment funds are buying. Record profits, high growth and a hedge against inflation have led many fund managers to continue to be bullish on energy stocks. Here are some of the top stocks that funds are buying, based on IBD's fund buying screen.

It has been a summer of sunlight for IBD's solar industry group, which has moved to the top rank out of IBD's 197 industries. Fund favorite Canadian Solar has been hot after reporting strong second-quarter results on Thursday.

Earnings came in at $1.07 per share on revenue of $2.31 billion. This trounced analyst earnings estimates of 48 cents on revenue of $2.23 billion. Strong demand and a positive outlook also allowed Canadian Solar to increase its revenue guidance for the year. The company now expects 2022 revenue in the range of $7.5 billion to $8 billion.

Positive developments in the sector should spur this continued growth, with the Biden administration signing the Inflation Reduction Act last week. In the bill, there are numerous green tax credits as well as funding for clean-energy projects.

Strong results sent shares of Canadian Solar skyrocketing 15% briefly, passing a 43.25 buy point before retracing below that level. The stock was back above that entry Monday afternoon.

Strong Demand Continues To Drive These Energy Stocks

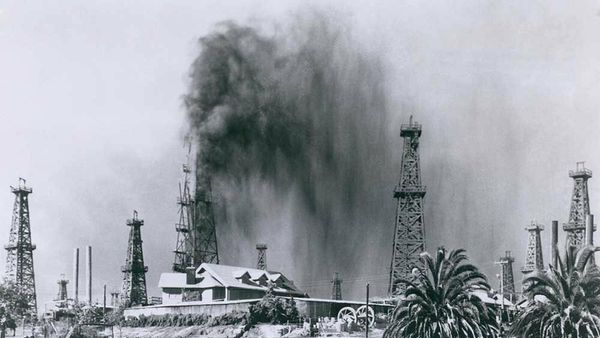

Funds accumulating oil and gas stocks have been rewarded, and it looks like many institutions are betting on continued strength in the industry.

Shares of Silverbow Resources have been outperforming, with a top Relative Strength Rating of 99 as shares break out of a cup with handle past a 46.55 buy point in today's trading. Funds owning the stock rose from 91 in September 2021 to 189 in June, according to MarketSmith.

Silverbow Resources operates oil and gas production in the Eagle Ford Basin in Texas. The company has been looking to expand quickly to meet high energy demand. During the second quarter, it successfully closed two acquisitions in addition to starting new well developments. This will allow Silverbow to grow production by an estimated 30% per year in both 2022 and 2023.

Swiss offshore driller Noble is also a fund favorite. The stock ranks first in IBD's oil and gas drilling group. The number of funds owning Noble climbed from 126 in September 2021 to 258 in June.

After losing 96 cents per share last year, strong energy demand is boosting earnings to an estimated $1.59 and $4.52 per share in 2022 and 2023, respectively. Shares are currently trading in a cup and handle with a 33.32 buy point.