Money can be a touchy topic in relationships—according to Royal London, nearly two-thirds (62%) of people who argue with their partner say they fight over finances.

This woman, unfortunately, was no exception. After her partner insisted they buy a new house together, she’s been working hard to pay it off. She’s already spent thousands on repairs, and now they’re clashing over how much she should be saving.

Exhausted and unsure how to handle it all, she turned to Mumsnet for advice.

Read on for her story, and be sure to catch our conversation with financial influencer Megan Micklewright about building better money habits.

More info: Instagram | TikTok | Linktree

After her partner insisted they buy a new house together, the woman has been working hard to pay it off

But now that thousands have gone into repairs, with no end in sight, it’s becoming too much to handle

How to be smarter about money with your partner

Image credits: wirestock/Envato (not the actual photo)

Whether it’s serious financial hardships, like those in OP’s story, or everyday spending habits, money issues can be a real deal breaker for couples if not managed wisely. For tips on keeping finances under control, Bored Panda spoke with award-winning influencer Megan Micklewright, known online as The Savvy Spender.

Many disagreements arise simply because people don’t talk to their partners about money concerns until it’s too late—so start the conversation.

“Make sure you’re on the same page! Have regular financial check-ins,” says Micklewright. “Money date nights we like to call them. Talk about any money worries or struggles you have. Discuss expenses, current outgoings, savings, and your financial goals. This builds transparency and trust.”

“You can also go one step further and designate financial roles so everyone knows what’s expected of them,” she adds. “Decide who will handle specific financial tasks, such as managing the budget, tracking expenses, and paying bills.”

To stay motivated, set individual and joint financial goals. “This could be things like saving for a home, a holiday, or a car. It gives you both something to work toward,” Micklewright explains.

Of course, bringing up these topics might not be easy at first, but remember they’re important for your future. Practice mutual respect, Micklewright reminds. “You may have different views and outlooks on certain financial points. Find a compromise that works for you both.”

Don’t rush expensive purchases

Image credits: insidecreativehouse/Envato (not the actual photo)

When you’re ready to make big purchases, take a step back and gauge their impact on your finances. “Make sure you know where your financial health is at,” says Micklewright. “Evaluate your income, savings, expenses, and overall financial situation to ensure you can comfortably afford something like a new home.”

“Budget for additional costs, whether it’s a new home or a car—things like these come with hidden expenses, so make sure you’re aware of them,” she notes.

Avoid rushing the decision. Weigh your options and consider what’s best for you. Nearly 40% of recent car buyers and 93% of home buyers report some form of regret about the choices they’ve settled on, so it’s in your best interest to think things through.

Learn to say no to excessive spending

Image credits: stockasso/Envato (not the actual photo)

Saying no to purchases you can’t afford—or simply don’t want—can be tough. But there are ways to approach it more comfortably.

“Set a personal budget for spontaneous spending,” suggests Micklewright. “I like to have a sinking fund called ‘fun money.’ This is money I can spend on anything I like, but once it’s gone, it’s gone. It lets you enjoy spending without dipping into funds you can’t afford to lose.”

You can always say no without actually saying it. “If a friend invites you for coffee but you can’t afford it, an alternative could be: ‘Why don’t we go for a walk and bring some homemade coffee?’” says Micklewright. “Or, instead of going out for an expensive meal, you can invite someone over for dinner at home.”

“Being honest about your financial situation manages people’s expectations of you,” she adds. “Let people know your goals and what you’re saving for—it can make others more understanding when you need to say no to plans and outings. You can simply say, ‘I’m focusing on saving right now.’ Anyone important to you should respect that!”

In the replies, the woman shared they had been planning to get married, but the situation with the house made her rethink their future

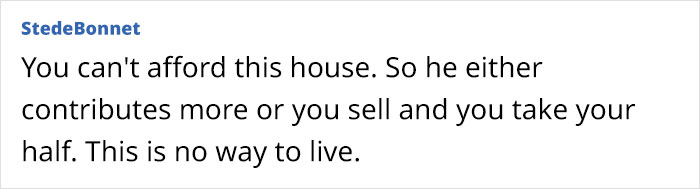

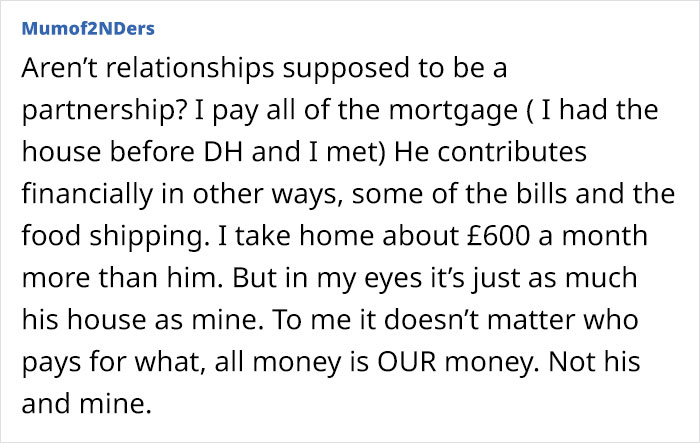

Commenters offered advice on what she could do, with many saying her partner was financially manipulating her

In a follow-up, the woman shared that she’s doing much better and finding her way forward