KEY POINTS

- Ayesha Ofori handled over £500 million in client money at Goldman Sachs

- Ofori said she began questioning the absence of women in investing.

- She founded a platform which has various investment options, such as funds from Vanguard, Blackrock, and HSBC.

Ayesha Ofori spent over six years as a wealth adviser at Goldman Sachs, managing more than £500 million for high-net-worth clients. Despite her success, she grew disillusioned with her role, realising she was primarily enriching wealthy men and not addressing the financial challenges faced by women. Disturbed by the UK's £567 billion gender investment gap, Ofori quit Goldman in 2018 to found Propelle, an investment platform focused on empowering women to take control of their financial futures.

The Gender Wealth Gap: A Persistent Issue

The gender wealth gap in the UK is alarming, with men holding significantly more wealth in investments than women. According to Boring Money, the gap currently stands at £567 billion, with men having £1.01 trillion invested while women hold only £450 billion. Additionally, the gender pensions gap is even wider, standing at 37.9%—double the gender pay gap of 14.9%.

Ofori was shocked by these statistics, particularly given that women tend to live longer than men and, therefore, require more substantial financial reserves for retirement. Yet, the lack of female participation in investment markets continues to contribute to their economic disadvantage.

A New Mission: Empowering Women Through Propelle

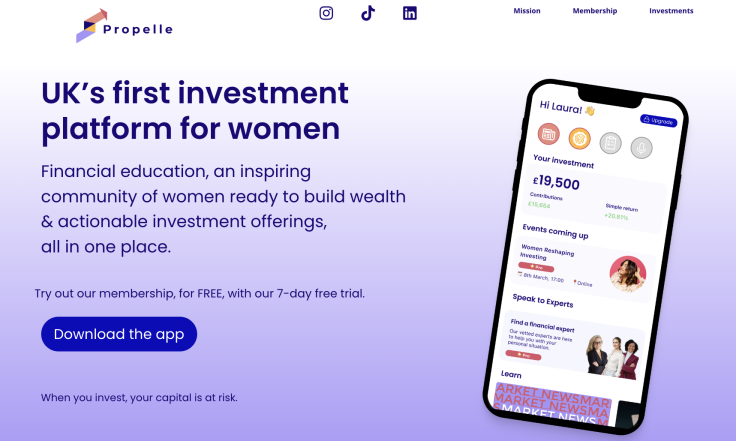

After realising the depth of the issue, Ofori decided to leave her high-profile role at Goldman Sachs and create Propelle, a platform dedicated to helping women build wealth through investment. Launched in 2024, Propelle has already raised £1.2 million in pre-seed funding, including investments from Google and prominent figures in the financial world, such as former Goldman executive Stefan Bollinger and Lucy Demery, managing director of fintech investments at Barclays.

Propelle aims to close the gender investment gap by offering tailored investment opportunities from well-known firms like Vanguard, BlackRock, and HSBC. The platform is designed to cater to women's unique financial goals, values, and risk tolerances, with a range of easy-to-understand and accessible investing options.

Breaking Down Barriers: The Struggles Women Face in Investing

Ofori's mission is deeply rooted in her understanding of women's barriers to investing. Many women mistakenly equate saving with investing, often placing their money in cash Individual Savings Accounts (ISAs) rather than investment accounts. While ISAs offer tax-free savings, they do not provide the same growth potential as stocks, bonds, or funds investments.

"Saving and investing are not the same thing," Ofori emphasised. "Women naturally default to saving, but saving alone is not enough to achieve long-term financial goals."

Research from BNY Mellon in 2022 revealed that nearly half of women globally find investing too risky, and only 28% feel confident about investing their money. Ofori's experience aligns with this data—many women she spoke to admitted they didn't know where to start with investing and found the process too overwhelming.

This hesitation and a lack of confidence contribute to the persistent gender wealth gap. Ofori identified two critical reasons for this: time and confidence. Women, particularly those juggling work and family life, often feel they don't have the time to dedicate to learning about investing. Additionally, they lack the confidence to make informed investment decisions, fearing they might make mistakes.

From Goldman Sachs to Female Empowerment

Ofori's journey from a Goldman Sachs executive director to the founder of a female-focused investment platform was driven by her desire to make a meaningful impact. During her time at Goldman, she constantly reflected on her role in making wealthy men even richer while so many women remained excluded from the world of investment.

"I realised that I was making rich men richer," Ofori said. "I wanted to make a difference by helping women build their wealth."

To address this disparity, she began hosting events for women in London, sharing her knowledge and experience in building wealth. The response was overwhelming—within a few months, 2,000 women signed up to attend her workshops. This validation led to Propelle, a platform designed to cater to women's financial needs and empower them to take control of their financial futures.

Propelle's Features: Investment for Every Woman

Propelle distinguishes itself from traditional investment platforms by offering features tailored specifically for women. The platform includes a risk assessment tool that explains the risks involved in different investments and helps users understand their personal risk tolerance. It also offers a smart goal-setting feature, which allows women to invest in funds with varying risk levels based on their short-term or long-term goals.

Furthermore, Propelle provides investing options aligned with personal values, including sustainable and Shariah-compliant funds. The platform plans to expand into alternative investments, such as fractionalised real estate, startup investments, and wine and art.

"I didn't want to build a platform where women were just investing in things just because they're available. It had to be personalised and effective," Ofori explained. "Women deserve access to asset classes that have been dominated by the wealthy for years. We're breaking down those barriers."

The Road Ahead: A Future of Financial Empowerment

Ofori's goal with Propelle is to reshape the investment landscape for women in the UK and beyond. By providing a platform that is accessible, easy to use, and tailored to women's needs, she hopes to inspire more women to take control of their financial futures.

"I know that my purpose is to help women build wealth," Ofori said. "It's time for women to realise that they can achieve financial independence and security, just like men have been doing for years."

As Propelle grows, Ofori's vision for closing the gender wealth gap remains clear. With the backing of prominent investors and the support of women across the country, she is confident that Propelle will help bridge the divide and create a more equal financial future for women.