Saving money is a priority for many of us, and as a busy mom shopping for my family of five, finding ways to stretch my budget is always top of mind. Recently, I discovered a new way to make smarter shopping decisions using ChatGPT.

By uploading my grocery receipts into ChatGPT, I managed to categorize my purchases, analyze my spending habits, and even find alternative retailers with better prices.

I started last month by uploading my Target receipts into ChatGPT and now do the same thing at other local grocery stores. Here’s how I did it and the surprising savings it uncovered.

Organizing my receipts

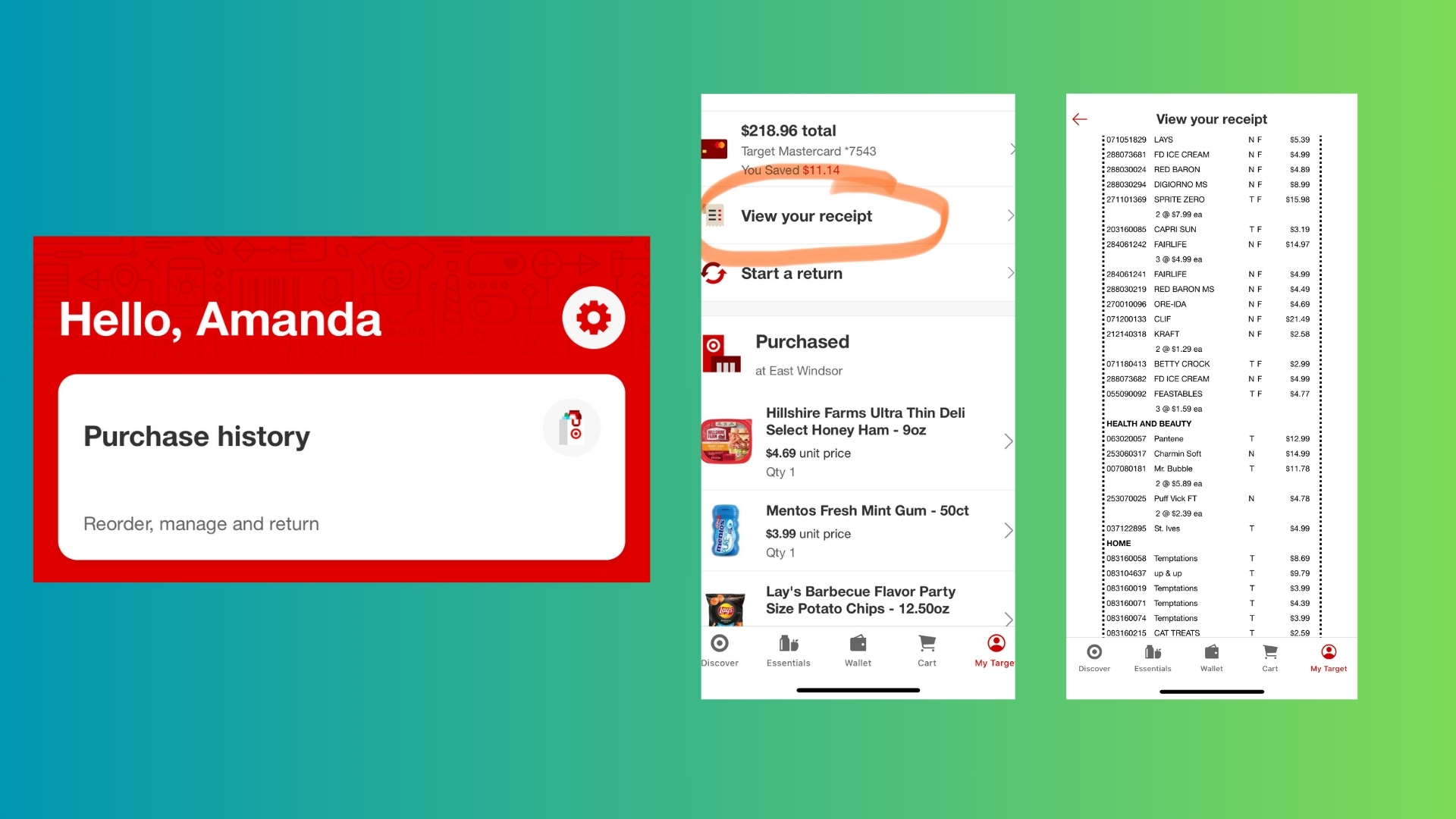

The first step was to gather all my Target receipts from the past month. Although I don’t save my physical receipts, this did not take long because I have the Target app, which stores all of my receipts. If you shop regularly at stores like Target, Walmart, Amazon, Best Buy and others, you can easily track down those receipts.

Whether you save physical receipts or choose to download them digitally, you don’t need to type anything into ChatGPT manually — simply snap a photo and upload it, or upload the digital version.

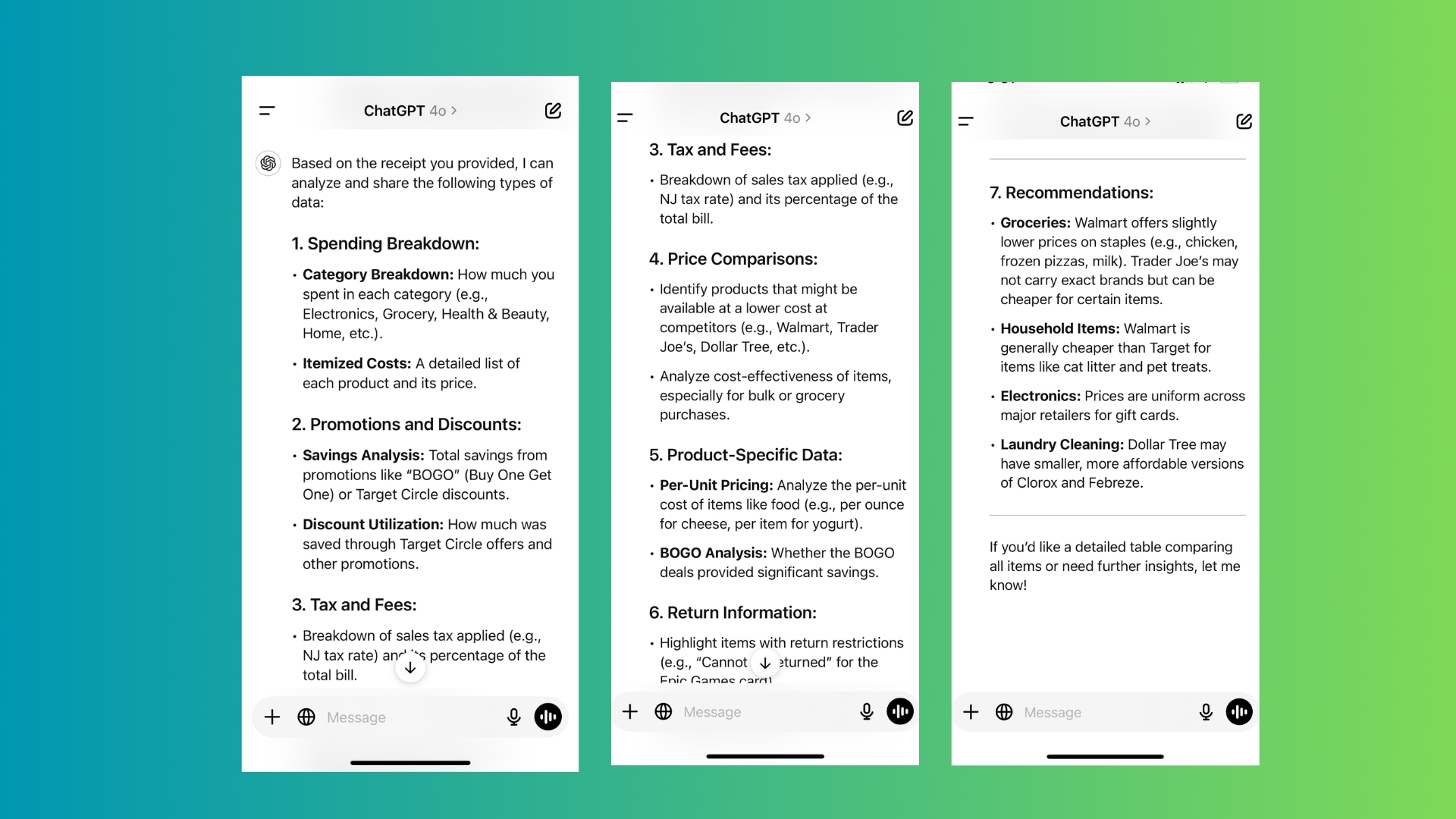

Once I uploaded this data into ChatGPT, I asked it to sort my purchases into categories like groceries, household essentials, personal care, and kids’ items. This simple act of organization immediately helped me see where my money was going. For example, I noticed that a significant chunk of my spending was on food and household supplies—something I assumed, but ChatGPT verified.

Identifying spending patterns

After categorizing my purchases, I asked ChatGPT to analyze my spending habits and identify areas where I might be overspending. ChatGPT pointed out trends, such as buying branded products instead of generics, frequent impulse purchases, and stocking up on items I didn’t need immediately.

The AI even highlighted specific categories where I could cut costs. For instance, it suggested swapping out my usual cleaning supplies for less expensive yet equally effective alternatives. For snacks, it proposed bulk purchases from warehouse stores to reduce costs per unit.

With all this data, I created a more strategic shopping plan. For items that were consistently cheaper at other stores, I adjusted my buying habits. I decided to make a bi-weekly trip to Costco for bulk purchases and reserved smaller, more specific needs for Target or Amazon.

ChatGPT also helped me set up a system to track my recurring purchases and identify when I was running low on essentials. This proactive approach prevented me from making last-minute, often expensive, purchases.

Finding cheaper alternatives

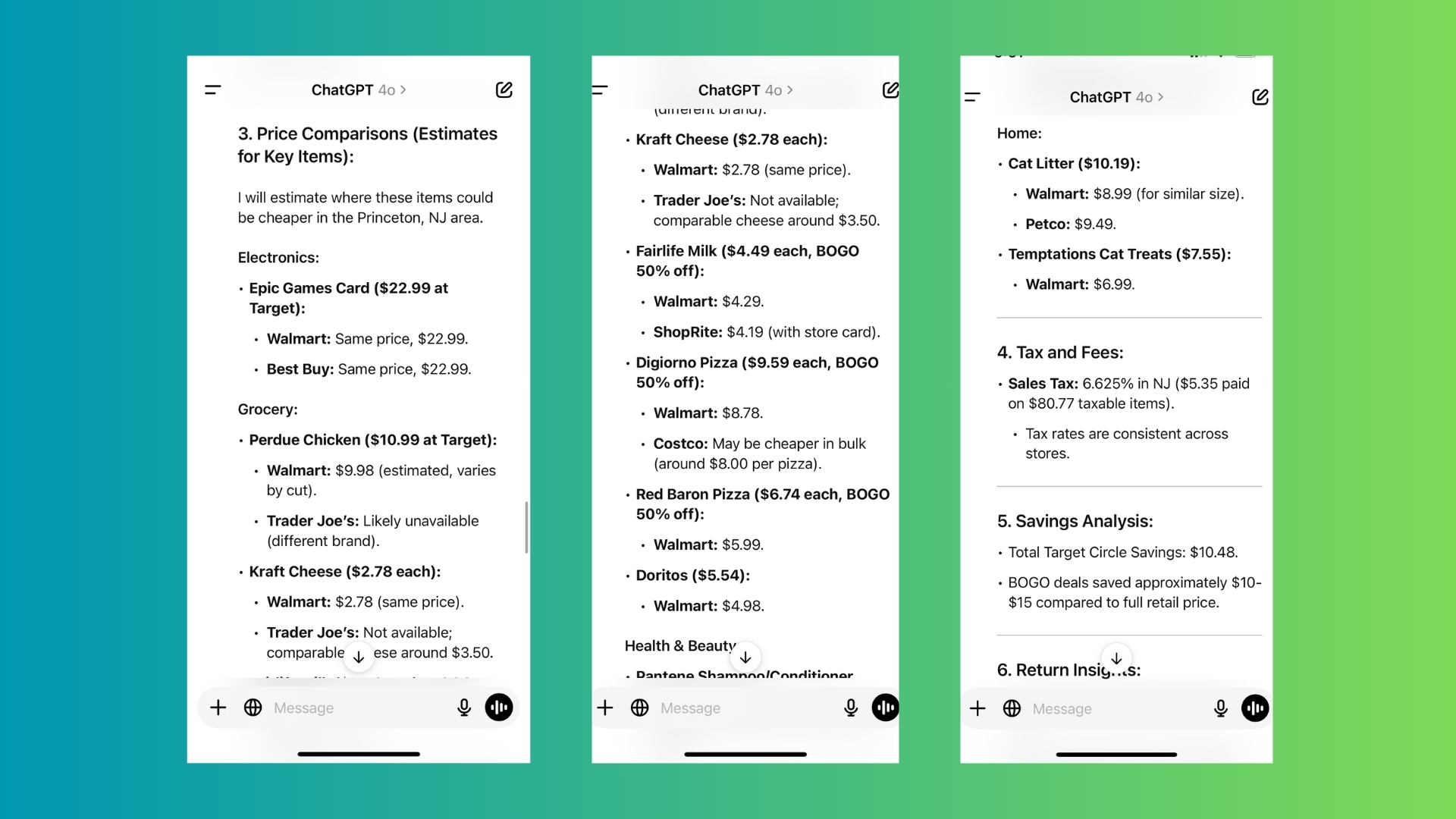

This is where ChatGPT truly made a difference. I asked it to compare the prices of items on my receipt with those from other retailers like Walmart, Costco, and even online platforms like Amazon. ChatGPT identified potential savings by finding products at lower prices elsewhere. For example:

A cleaning spray I regularly purchased at Target for $4.99 was available in a similar size at Walmart for $3.49. My kids’ favorite granola bars were nearly 20% cheaper when bought in bulk from Costco. An everyday moisturizer I used was on sale on Amazon, saving me $5 compared to the Target price.

ChatGPT also alerted me to deals and discounts that I hadn’t noticed, such as Target’s own Cartwheel offers or promotions available at competing stores.

How ChatGPT can help you save money

In just one month, these small changes added up. By following ChatGPT’s suggestions, I saved over $100—money that I redirected toward activities with my kids and other priorities. The most surprising part? The process was super easy because all I had to do was upload my receipts saved from the app. I didn't have to leave the couch and everything was done on my phone.

Watching ChatGPT crunch numbers and provide actionable insights felt like having a personal financial assistant, but without the hefty cost. Once you have uploaded your receipts ask ChatGPT to categorize items, identify spending trends and suggest alternative shopping strategies based on hypothetical scenarios or actual infromation you want to share (e.g. "for a family of five," "on a budge of $200 per week," etc.).

- Organize data. ChatGPT can categorize items if you provide structured data (like a receipt with item names, prices, and categories).

- Analyze spending patterns: ChatGPT can identify trends and suggest areas to save if prompted with sufficient information. For example, if you provide a list of expenses, it can help spot where you spend the most and suggest adjustments.

- Find cheaper alternatives: ChatGPT can suggest alternative retailers or products. Because ChatGPT can search the web in real time, you are able to see price comparisons that are on the web. If you shop for groceries at a very local store or farmer's market, this might not be an option.

- Strategic planning: It can help create shopping plans, track recurring expenses, or suggest smarter budgeting techniques based on the data you share.

Takeaways and next steps

This experiment showed me that AI tools like ChatGPT are not just for answering questions or brainstorming ideas—they can have a tangible impact on your finances. With a little effort upfront, I turned my receipts into a goldmine of data that helped me shop smarter, save money, and take control of my budget.

For anyone looking to make similar changes, the process is straightforward and customizable. Whether you’re managing a household budget, running a small business, or just looking to cut unnecessary spending, tools like ChatGPT can help you gain insights and make better decisions.

Moving forward, I plan to make this a monthly habit. I’ll continue uploading my receipts, tracking my purchases, and refining my shopping habits. As AI tools like ChatGPT become more advanced, I’m excited about the additional ways they might help me save money and simplify my life.

If you’re looking for an easy way to optimize your spending, give this method a try. You might be surprised by how much money—and time—you can save. This is not in any way financial advice, just a different way to use AI tools for real-world uses.