Saving money is not something I’m good at. Often I’ll find myself staring at my banking apps in bewilderment in the last two weeks of every month wondering where all my money has gone, and how could I not have anything saved up. I don’t exactly lead a lavish lifestyle here folks, I am just a girl who likes a cheeky little treat now and then, and who is too scared to break down my finances to gain control of it.

I found for a long time that whenever I did try and set money aside and create specific savings goals I would always end up taking money out of that small savings pot and using it anyway every month - taking me back to zero constantly. However, as we all tighten purse strings and try to make our money last as long as possible, I decided to try something I never normally would: a smart money app that uses artificial intelligence to tell me how much to save and do it for me.

This is part of a regular series of articles exploring the apps that we couldn't live without. Read them all here.

I discovered Plum while digging through financial advice forums on Reddit and downloaded the app on a whim. The app uses automated smart technology that combs through your linked banking apps and breaks down exactly what you pay for bills, where those bills are going, and how much you have left over each month. Once that is done you are then prompted to set up rules for the artificial ‘brain’ to follow that offer fun but sensible criteria to set your money aside. Ever since I downloaded the app I’ve been talking about it to all my friends nonstop - so I’m here to share it with you!

How Plum works

Some of these rules that you can enable and adjust include the rainy day deposit you can set to take a small amount of money or even change from your regular account and put it into a Plum savings account every time it rains! This is incredibly effective if you live in particularly wet climates.

This is all done automatically, which means I don’t even have to open the app for the app to do so - it registers through my phone weather app that it has rained a certain amount of times during the week, so it makes a transfer into my savings account to reflect that.

I also have a rule set up where every time I order Deliveroo or Just Eat it adds an extra $10/£10 to my takeaway bill and sets it aside, which forces me to think about how much I not only want that takeaway but if I can actually afford it with that rule in place.

The automated rules mean I can set them, save money, and not actively have to think about it - which means money that would otherwise be left idle or spent on non-essential things is now building up in a savings account for me to access whenever I need it.

Sounds intimidating, I know. But trust me, it works

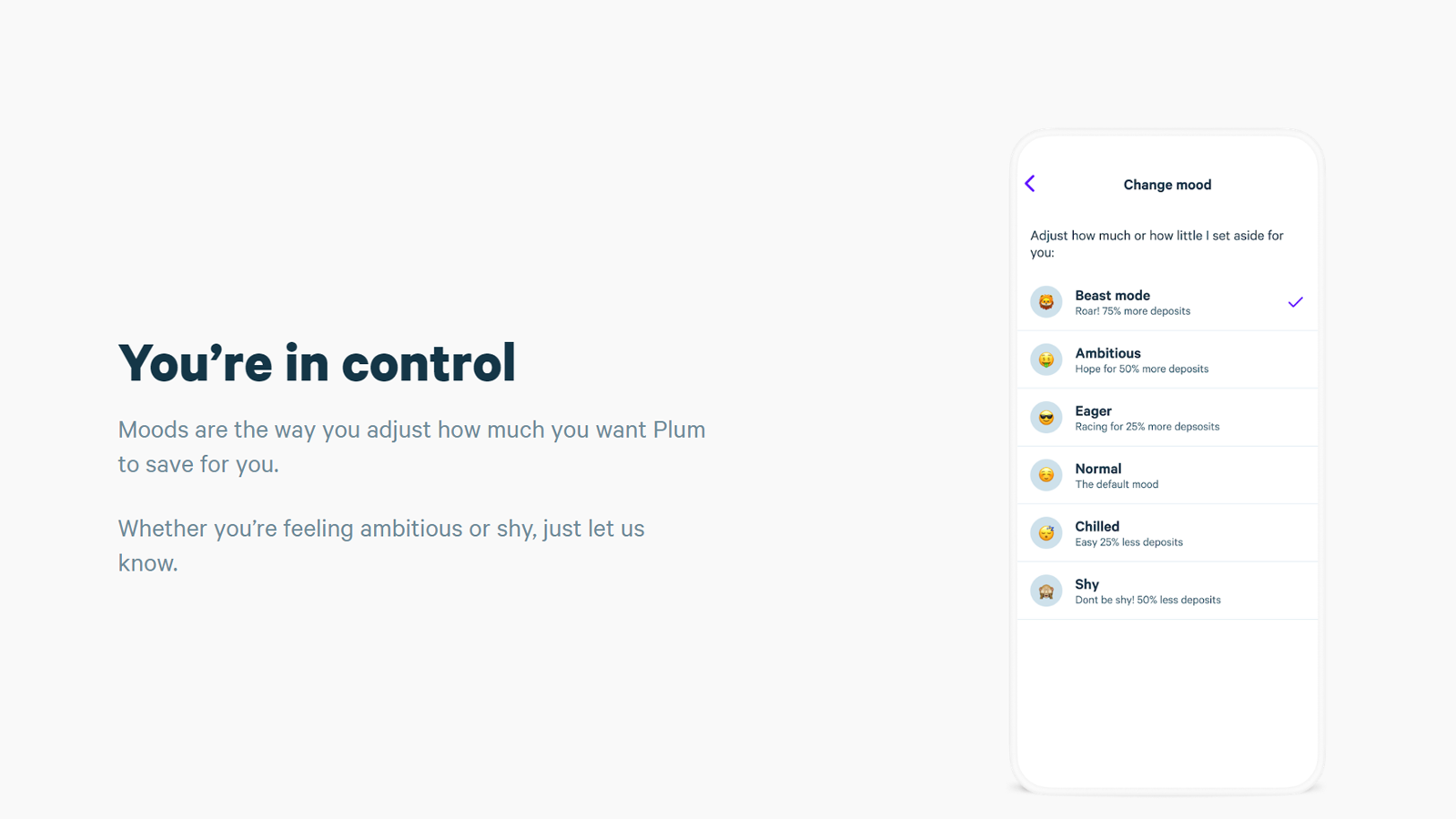

If this sounds a bit too intense for you - don’t worry. I found that whenever I am in a spot that makes it more difficult for me to regularly set aside money, even with the automated rules, I can adjust the intensity of the ‘brain's’ saving strategy and either completely turn off weekly deposits for that month or change it so each active rule is taking away less money.

So, normally I have each of the rules I have set to take out about $10/£10 each time, but when money is a lot tighter I normally change the intensity and drop it down to $5/£5 or even $2/£2, so I’m still saving, even if it's just a little bit.

I have three savings pots that my money is split into on the Plum app - Rainy Day savings, House deposit, and my Plum card (more on this later!). You can set the AI brain to split the amount of money per week or per month (I usually deposit a lump sum on payday as well) between multiple pots so you don’t have to manage where it goes yourself. I have mine split between the two savings accounts and my Plum card.

Separation is key!

You can take advantage of basically all of Plum's features without having to pay for a subscription of any kind. However, if you are like me and struggle with refraining from a little splurging here and there, you can sign up as a member (membership/sub fees here) and get a Plum Card.

It’s a very basic card that is linked to a dedicated ‘pot’ in the app that you can deposit and withdraw from, which I use as ‘splurging' money. The app dedicated a small percentage of my savings chunk into that account that I can then use to buy my little treats and cover random smaller expenses during the day - for example, a quick cup of coffee on my morning commute, an Uber home when I’m out late, or just a spontaneous meal with friends.

Having this ‘fun money’ has really helped me with my saving goal because I never really feel like I’m going without - I now think about every purchase with a lot more scrutiny and consider how important each spend is, and how it’ll affect my goals. The truly customizable experience lets me tailor everything to my needs and my targets, without feeling like I’m always on a tight edge or a restrive budget.

If you’re really struggling, Plum’s AI can also calculate through your bank records and regular spending habits and give you an ‘allowance’ - it allocates all the money that isn't spent on your bills and regular purchases and gives it to you as kind of ‘this is what you’re left with’ so you can essentially do whatever you want with that fund.

Tackling my finances has never been easier because now, with the Plum app, I’m not doing it alone, and I’m getting some serious help saving for things in a way I never would have before. It’s the app I can check every day to get the morale boost to see how much I’ve saved, but also leave it completely untouched and know it’s working for me behind the scenes whether I’m thinking about it or not.